Excess Flood Application 2012-2026

What is the Excess Flood Application

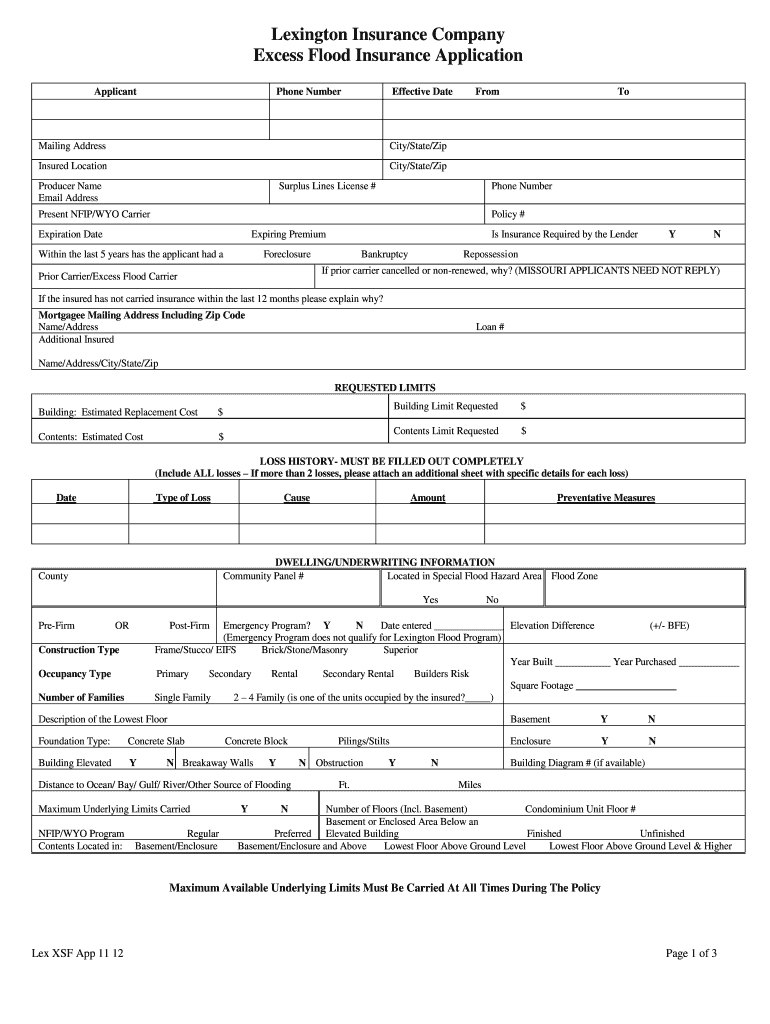

The Excess Flood Application is a crucial document for individuals and businesses seeking additional flood insurance coverage beyond the standard National Flood Insurance Program (NFIP) limits. This application allows policyholders to protect their properties against potential flood damage that exceeds the basic coverage provided by NFIP. Understanding this application is essential for ensuring adequate financial protection in flood-prone areas.

Steps to complete the Excess Flood Application

Completing the Excess Flood Application involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information about the property, including its location, value, and existing insurance coverage. Next, fill out the application form with precise details, ensuring that all required fields are completed. After submitting the application, keep a copy for your records and monitor its status to confirm approval.

Legal use of the Excess Flood Application

The Excess Flood Application must be completed in accordance with applicable laws and regulations to be considered legally valid. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is essential when submitting the application electronically. These laws ensure that electronic signatures and documents hold the same legal weight as traditional paper forms.

Key elements of the Excess Flood Application

Several key elements must be included in the Excess Flood Application to facilitate processing and approval. These elements typically include the applicant's personal information, property details, existing insurance coverage, and the amount of excess coverage requested. Providing accurate and complete information is vital for a smooth application process and to avoid delays in obtaining coverage.

Who Issues the Form

The Excess Flood Application is typically issued by insurance providers that offer excess flood insurance policies. These companies specialize in providing additional coverage options beyond the standard limits set by the NFIP. It is important to choose a reputable insurance provider to ensure that the application is processed efficiently and that the coverage offered meets the specific needs of the property owner.

Required Documents

When completing the Excess Flood Application, several documents may be required to support the application. These documents can include proof of property ownership, existing flood insurance policies, and any relevant financial information that demonstrates the property's value. Having these documents ready can streamline the application process and help ensure that the application is approved without unnecessary delays.

Application Process & Approval Time

The application process for the Excess Flood Application typically involves submitting the completed form along with any required documentation to the insurance provider. After submission, the approval time can vary based on the provider's internal processes and the complexity of the application. Generally, applicants can expect to receive a response within a few weeks, but it is advisable to follow up if there are any concerns about the status of the application.

Quick guide on how to complete excess flood application

Complete Excess Flood Application effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, adjust, and electronically sign your documents swiftly without holdups. Manage Excess Flood Application on any device using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign Excess Flood Application with ease

- Locate Excess Flood Application and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Excess Flood Application and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the excess flood application

The best way to make an eSignature for your PDF file in the online mode

The best way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the lexington insurance app flood and how does it work?

The lexington insurance app flood is a specialized tool designed to manage and process flood insurance policies. It allows users to submit applications, track claims, and stay informed about their coverage. By integrating with existing insurance workflows, it helps streamline operations for both agents and policyholders.

-

How much does the lexington insurance app flood cost?

Pricing for the lexington insurance app flood depends on the specific features and integrations needed by your business. airSlate SignNow offers flexible pricing plans tailored to different business sizes and needs. Contact sales for a detailed quote that matches your requirements.

-

What benefits does the lexington insurance app flood provide?

The lexington insurance app flood enhances efficiency by automating many aspects of flood insurance management. Businesses can benefit from faster application processing, improved accuracy, and reduced operational costs. Users also enjoy easy access to important documents and real-time updates.

-

Can the lexington insurance app flood integrate with other platforms?

Yes, the lexington insurance app flood is designed to integrate seamlessly with a variety of other applications and platforms. Whether you're using CRM systems or accounting software, airSlate SignNow ensures that data flows smoothly between different tools, enhancing overall workflow efficiency.

-

Is the lexington insurance app flood user-friendly?

Absolutely! The lexington insurance app flood is built with a user-friendly interface that ensures a positive experience for all users. The application is designed for ease of use, requiring minimal training, which facilitates quick adoption and effective utilization within your organization.

-

What types of documents can I manage with the lexington insurance app flood?

With the lexington insurance app flood, you can manage a wide range of documents related to flood insurance, including applications, policy documents, and claims forms. The application supports electronic signatures, making it easier to handle all necessary paperwork digitally without delays.

-

How does the lexington insurance app flood improve compliance?

The lexington insurance app flood aids in compliance by ensuring that all necessary documentation is completed and securely stored. The app provides standardized templates and checklists to help users follow regulations accurately, reducing the risk of errors and improving audit readiness.

Get more for Excess Flood Application

- Change of parent polyclinic echs online form

- Pebtf chiropractic precertification form bhomesteadb

- Panel release form providers prestige health choice panel release form

- Vi peel consent form

- Pre registration form please print or type nyack

- All kids application form

- Destruction form

- Concussion symptom score sheet form

Find out other Excess Flood Application

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online