Mutual Death Claim 2019-2026

Understanding the Mutual Death Claim

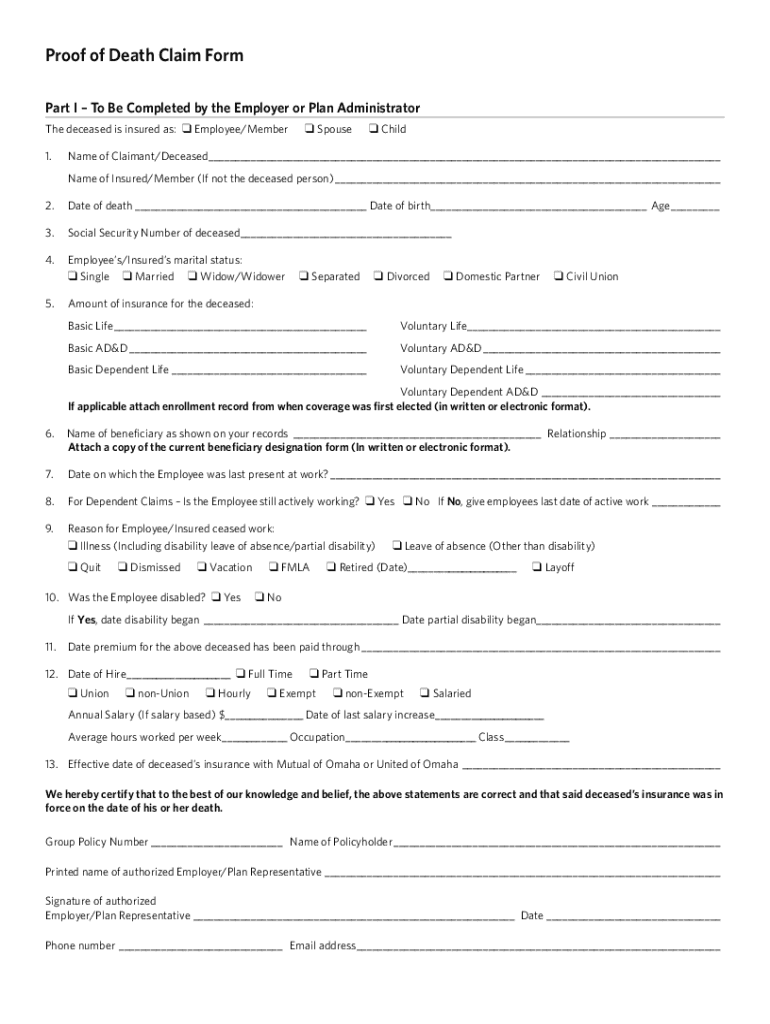

The mutual death claim refers to a formal request made to an insurance provider, specifically in cases where a policyholder has passed away. This claim allows beneficiaries to receive the benefits outlined in the insurance policy. It is essential to understand the specific provisions and requirements associated with the mutual death claim to ensure a smooth process for the beneficiaries. The claim typically involves submitting necessary documentation that verifies the death and the relationship to the deceased, along with the completed mutual omaha claim form.

Steps to Complete the Mutual Death Claim

Completing the mutual death claim involves several important steps to ensure accuracy and compliance with the insurance provider's requirements. The following steps outline the process:

- Gather necessary documents, including the death certificate and any relevant insurance policy information.

- Obtain the mutual omaha claim form, which can usually be downloaded from the insurance provider's website.

- Carefully fill out the form, ensuring all required fields are completed accurately.

- Review the completed form for any errors or missing information.

- Submit the form along with the required documents, either online, by mail, or in person at the insurance office.

Required Documents for the Mutual Death Claim

When filing a mutual death claim, specific documents must be submitted to support the claim. These documents typically include:

- A certified copy of the death certificate.

- The original insurance policy or a copy thereof.

- Identification documents of the claimant, such as a driver's license or Social Security card.

- Any additional forms or information requested by the insurance provider.

Legal Use of the Mutual Death Claim

The mutual death claim is legally binding once all required documentation is submitted and approved by the insurance provider. It is crucial for beneficiaries to understand their rights and obligations under the policy. The claim must be filed within a specific timeframe, and failure to do so may result in denial of benefits. Understanding the legal implications ensures that beneficiaries are prepared and informed throughout the process.

Form Submission Methods

Submitting the mutual omaha claim form can be done through various methods, depending on the preferences of the claimant and the policies of the insurance provider. Common submission methods include:

- Online submission via the insurance provider's website, which may offer a secure portal for document uploads.

- Mailing the completed form and documents to the designated address provided by the insurance company.

- In-person submission at a local insurance office, allowing for direct interaction with representatives.

Eligibility Criteria for the Mutual Death Claim

To qualify for benefits under the mutual death claim, certain eligibility criteria must be met. These typically include:

- The claimant must be a designated beneficiary on the insurance policy.

- The policy must be active and in force at the time of the policyholder's death.

- The claim must be filed within the timeframe specified by the insurance provider.

Quick guide on how to complete mutual death claim

Effortlessly prepare Mutual Death Claim on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Mutual Death Claim on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Mutual Death Claim with ease

- Find Mutual Death Claim and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you want to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Mutual Death Claim and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mutual death claim

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is a mutual omaha claim form?

A mutual omaha claim form is a document used to initiate a claim with Mutual of Omaha insurance. This form captures necessary information related to the claim and facilitates a seamless process for policyholders seeking benefits. Filling it out accurately ensures a quicker response from the insurer.

-

How can airSlate SignNow help with the mutual omaha claim form?

airSlate SignNow streamlines the process of completing and submitting the mutual omaha claim form by allowing users to eSign documents electronically. This feature enhancement speeds up processing times and reduces the likelihood of errors or delays in submission. Plus, it offers a user-friendly interface that simplifies document handling.

-

Is there a cost associated with using airSlate SignNow for the mutual omaha claim form?

Yes, airSlate SignNow operates on a subscription-based pricing model. Users can choose from various plans tailored to their needs, all while offering a cost-effective solution for managing documents like the mutual omaha claim form. Pricing is designed to provide value for businesses seeking an efficient eSigning solution.

-

What features does airSlate SignNow offer for the mutual omaha claim form?

Key features of airSlate SignNow that benefit users dealing with the mutual omaha claim form include advanced eSignature capabilities, document templates, and tracking options. These features ensure that every step of the signature process is secure and well-documented. Additionally, users can integrate helpful tools to automate workflows further.

-

How can I integrate airSlate SignNow with other tools for the mutual omaha claim form?

airSlate SignNow offers seamless integrations with popular tools such as Google Drive, Salesforce, and more. This means you can easily manage the mutual omaha claim form and other documents alongside your existing software ecosystem. The integrations help save time and boost productivity by centralizing document management.

-

What are the benefits of using airSlate SignNow for document management, especially for the mutual omaha claim form?

Using airSlate SignNow for document management enhances efficiency and accuracy, particularly when handling the mutual omaha claim form. It allows users to quickly eSign documents, reducing turnaround times signNowly. Each completed form is securely stored and easily accessible, ensuring peace of mind and compliance with records management standards.

-

Can I track the status of my mutual omaha claim form through airSlate SignNow?

Absolutely! With airSlate SignNow, users can track the status of their mutual omaha claim form in real-time. This feature not only helps you stay informed about the progress of your claim but also enhances communication between all parties involved, ensuring that nothing falls through the cracks during the process.

Get more for Mutual Death Claim

Find out other Mutual Death Claim

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy