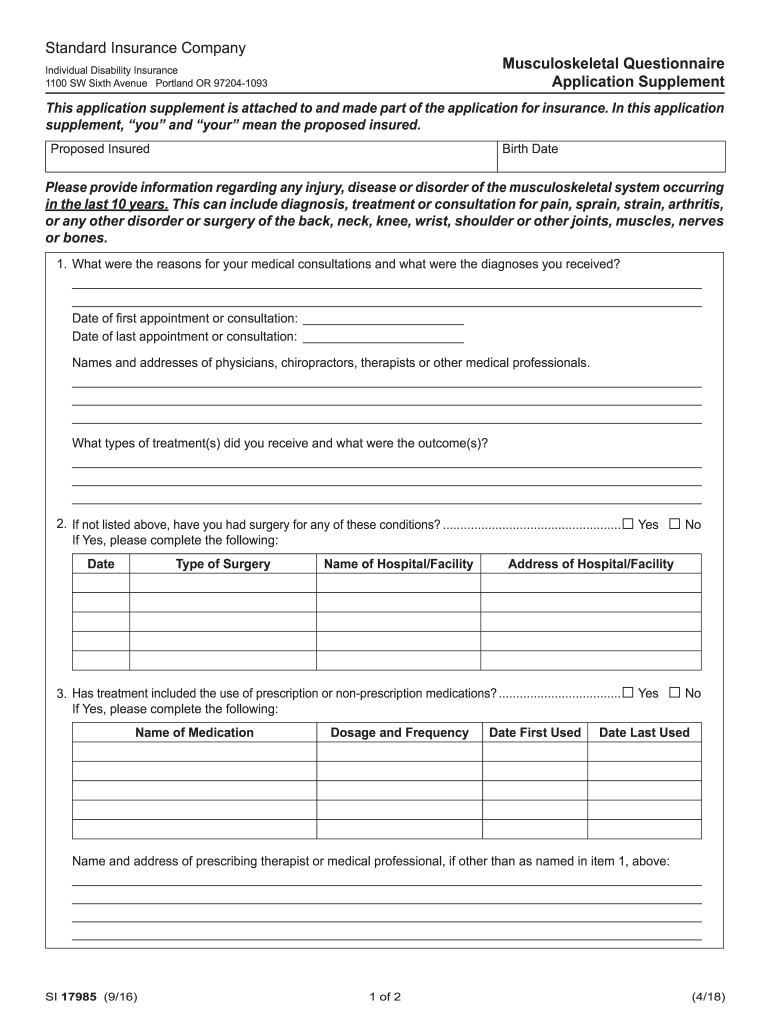

17985a PDF MusculoSkeletal Questionnaire Application Supplement Individual Disability 2018-2026

What is the standard insurance questionnaire?

The standard insurance questionnaire is a document used by insurance companies to gather essential information from applicants. This questionnaire typically includes personal details, medical history, and lifestyle choices that help insurers assess risk and determine policy eligibility. By providing accurate and thorough responses, applicants can facilitate a smoother underwriting process, which may lead to better coverage options and premiums.

Steps to complete the standard insurance questionnaire

Completing the standard insurance questionnaire involves several key steps to ensure accuracy and thoroughness:

- Gather necessary information: Collect personal identification details, including your full name, address, and contact information.

- Review medical history: Be prepared to disclose any past medical conditions, surgeries, or ongoing treatments that may impact your insurance application.

- Consider lifestyle factors: Reflect on habits such as smoking, alcohol consumption, and exercise routines, as these can influence your risk profile.

- Answer questions honestly: Provide truthful and complete answers to all questions to avoid issues during the underwriting process.

- Review your responses: Before submission, double-check your answers for accuracy and completeness.

Legal use of the standard insurance questionnaire

The standard insurance questionnaire is legally binding when filled out accurately and submitted to an insurance provider. It is essential to understand that any misrepresentation or omission of information can lead to penalties, including denial of coverage or policy cancellation. Insurers are required to comply with regulations that govern the handling of personal data, ensuring that your information remains confidential and secure throughout the process.

Required documents for the standard insurance questionnaire

When completing the standard insurance questionnaire, certain documents may be required to support the information provided. Commonly requested documents include:

- Identification proof, such as a driver's license or passport.

- Medical records or summaries from healthcare providers.

- Details of any existing insurance policies.

- Financial documents, if applicable, to assess your income and assets.

Form submission methods for the standard insurance questionnaire

The standard insurance questionnaire can typically be submitted through various methods, depending on the insurer's preferences:

- Online submission: Many insurers offer an online portal where applicants can fill out and submit the questionnaire electronically.

- Mail: Applicants may also choose to print the questionnaire, complete it manually, and send it via postal service.

- In-person: Some insurance agents may provide the option to complete the questionnaire during a face-to-face meeting.

Eligibility criteria for the standard insurance questionnaire

Eligibility to complete the standard insurance questionnaire typically depends on several factors, including:

- Age: Applicants must meet the minimum age requirement set by the insurer.

- Residency: Many insurers require applicants to be residents of the state in which they are applying for coverage.

- Health status: Certain health conditions may affect eligibility or require additional documentation.

Quick guide on how to complete 17985apdf musculoskeletal questionnaire application supplement individual disability

Complete 17985a pdf MusculoSkeletal Questionnaire Application Supplement Individual Disability seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage 17985a pdf MusculoSkeletal Questionnaire Application Supplement Individual Disability on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest method to modify and eSign 17985a pdf MusculoSkeletal Questionnaire Application Supplement Individual Disability effortlessly

- Locate 17985a pdf MusculoSkeletal Questionnaire Application Supplement Individual Disability and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, arduous form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign 17985a pdf MusculoSkeletal Questionnaire Application Supplement Individual Disability and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 17985apdf musculoskeletal questionnaire application supplement individual disability

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is a standard insurance questionnaire?

A standard insurance questionnaire is a document that collects essential data from clients to assess their insurance needs. Using airSlate SignNow, businesses can easily create and send these questionnaires to clients for eSignature, streamlining the insurance process.

-

How can airSlate SignNow help with standard insurance questionnaires?

airSlate SignNow enables businesses to efficiently send, fill out, and eSign standard insurance questionnaires. Our user-friendly platform simplifies document management, making it easy for clients to complete and return their information quickly.

-

What are the pricing options for using airSlate SignNow for insurance questionnaires?

airSlate SignNow offers various pricing plans to accommodate different business sizes and needs. Our cost-effective solutions ensure that you can manage standard insurance questionnaires without breaking the bank, while also providing robust features tailored for the insurance industry.

-

Are there any features specific to handling standard insurance questionnaires with airSlate SignNow?

Yes, airSlate SignNow includes features like customizable templates, automated workflows, and real-time tracking for standard insurance questionnaires. These features help businesses ensure accuracy and efficiency throughout the document collection process.

-

Can I integrate airSlate SignNow with other tools for managing insurance questionnaires?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and insurance management tools, allowing you to streamline the collection and execution of standard insurance questionnaires. This integration enhances productivity by centralizing data management.

-

What benefits does airSlate SignNow offer for completing standard insurance questionnaires?

Using airSlate SignNow for standard insurance questionnaires offers numerous benefits, including improved turnaround times and reduced paperwork. Our platform ensures that your clients can quickly fill out and sign documents, enhancing client satisfaction and increasing retention.

-

Is airSlate SignNow secure for handling standard insurance questionnaires?

Yes, airSlate SignNow prioritizes security and compliance when handling standard insurance questionnaires. We use advanced encryption and authentication measures to protect sensitive information, ensuring that your clients' data remains secure throughout the process.

Get more for 17985a pdf MusculoSkeletal Questionnaire Application Supplement Individual Disability

- Blacks law dictionary definitions of the terms and phrases form

- Alaska form ap 311

- Pg 525 alaska court records state of alaska form

- Tf 303 alaska court records state of alaska form

- Vs 405 form

- Civ 750 stalking protective order packet alaska court records form

- Dr 415 form

- Civ 405 certificate of facts civil forms

Find out other 17985a pdf MusculoSkeletal Questionnaire Application Supplement Individual Disability

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors