Kentucky Annual Surcharge Report Form 2011

What is the Kentucky Annual Surcharge Report Form

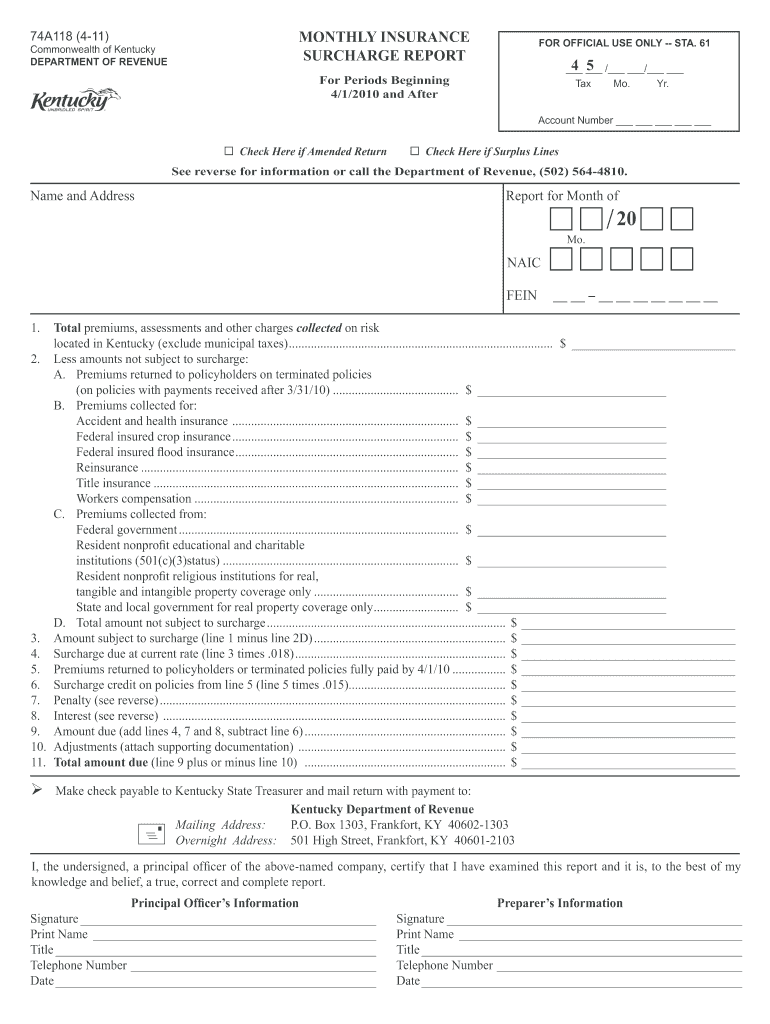

The Kentucky Annual Surcharge Report Form is a critical document required for businesses operating in Kentucky. This form is used to report the annual surcharge owed by certain corporations and limited liability entities. The surcharge is typically based on the gross receipts of the business, and it is essential for compliance with state tax regulations. Completing this form accurately ensures that businesses meet their financial obligations to the state and avoid potential penalties.

How to use the Kentucky Annual Surcharge Report Form

Using the Kentucky Annual Surcharge Report Form involves several straightforward steps. First, gather all necessary financial records, including gross receipts and any applicable deductions. Next, access the form online or obtain a physical copy. Fill out the required sections, ensuring all information is accurate and complete. After completing the form, review it for any errors before submitting it either electronically or by mail, depending on your preference.

Steps to complete the Kentucky Annual Surcharge Report Form

Completing the Kentucky Annual Surcharge Report Form requires careful attention to detail. Follow these steps for successful submission:

- Gather all relevant financial documents, including income statements and receipts.

- Download or print the Kentucky Annual Surcharge Report Form from an official source.

- Fill in your business information, including name, address, and tax identification number.

- Calculate the surcharge based on your gross receipts, using the provided guidelines.

- Double-check all entries for accuracy.

- Sign and date the form, ensuring compliance with eSignature regulations if submitting online.

- Submit the completed form by the deadline, either electronically or via postal mail.

Legal use of the Kentucky Annual Surcharge Report Form

The Kentucky Annual Surcharge Report Form must be used in accordance with state tax laws. It is legally binding, meaning that inaccuracies or omissions can lead to penalties or fines. Businesses are encouraged to maintain accurate records and ensure that the information provided on the form reflects their actual financial status. Consulting with a tax professional can help ensure compliance and proper use of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Kentucky Annual Surcharge Report Form are crucial for businesses to avoid late fees or penalties. Typically, the form must be submitted by a specified date each year, often aligned with the state’s tax calendar. It is advisable to check the Kentucky Department of Revenue's official announcements for any updates on deadlines, as these can vary. Mark your calendar to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

Businesses have multiple options for submitting the Kentucky Annual Surcharge Report Form. The form can be filed online through the Kentucky Department of Revenue’s e-filing system, which offers a convenient and efficient way to submit documents. Alternatively, businesses can mail the completed form to the appropriate address or deliver it in person to a local revenue office. Each submission method has its own processing times and requirements, so it is essential to choose the one that best fits your needs.

Quick guide on how to complete kentucky annual surcharge report 2011 form

Your assistance manual on how to prepare your Kentucky Annual Surcharge Report Form

If you're interested in understanding how to generate and dispatch your Kentucky Annual Surcharge Report Form, here are some straightforward instructions on how to simplify tax submissions.

Firstly, you just need to sign up for your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document management solution that enables you to modify, create, and finalize your income tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and electronic signatures, and return to modify answers as necessary. Streamline your tax administration with enhanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Kentucky Annual Surcharge Report Form in just a few minutes:

- Set up your account and begin working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through variants and schedules.

- Click Obtain form to access your Kentucky Annual Surcharge Report Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to add your legally-recognized electronic signature (if required).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your intended recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper may lead to increased errors and delayed refunds. Of course, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct kentucky annual surcharge report 2011 form

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How long does it take to read an annual report, SEC Form 10-K?

I recommend setting yourself a time limit of one hour for your initial research. Annual reports have a typical length of 100 to 150 pages, though I have seen some as short as 70 pages and some as long as 300 pages. It is unlikely that you will want to read an annual report from front to cover. With a time limit of one hour (no more, no less), you do some justice to the depth and complexity of an annual report, and at the same time the time limit hopefully helps you to avoid going down a rabbit hole (in other words: getting stuck in trivia) without seeing the big picture.If your alarm goes off after an hour, summarize what you have learned about the company so far, and listing the datapoints that you base that answer on. If you decide that you want to allocate more time for your review of the annual report, then define how you are going to “peel the onion”. How are you going to dig in deeper, layer after layer, to uncover what you are looking for in the annual report? Which line items in the income statement, cash flow statement or balance sheet do you want to investigate? Which terminology do you need to understand before you can make sense of the next level of complexity?

-

What tax forms do I need to fill out for reporting bitcoin gains and loses?

IRS1040 and 1099 forms.“For instance, there is no long-term capital gains tax to pay if you are in the lower two tax brackets (less than $36,900 single income or less than $73,800 married income). The capital gains rate is only 15% for other tax brackets (less than $405,100 single income) with 20% for the final bracket.”Reference: Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule DOther References:IRS Virtual Currency Guidance : Virtual Currency Is Treated as Property for U.S. Federal Tax Purposes; General Rules for Property Transactions ApplyHow do I report taxes?Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule Dhttps://www.irs.gov/pub/irs-drop...

-

Can anyone share a link on how to fill out the GST and GST annual return?

The deadline for filing GST Return for the year 17–18 is fast approaching .To file the GST annual return you need to reconcile the data appearing in your returns with the data in your financial books.You can watch the below video to have a basic idea about filing GST annual returnEnglish :Hindi :

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the kentucky annual surcharge report 2011 form

How to generate an electronic signature for your Kentucky Annual Surcharge Report 2011 Form in the online mode

How to create an electronic signature for the Kentucky Annual Surcharge Report 2011 Form in Chrome

How to generate an eSignature for putting it on the Kentucky Annual Surcharge Report 2011 Form in Gmail

How to make an eSignature for the Kentucky Annual Surcharge Report 2011 Form straight from your mobile device

How to generate an eSignature for the Kentucky Annual Surcharge Report 2011 Form on iOS

How to create an electronic signature for the Kentucky Annual Surcharge Report 2011 Form on Android OS

People also ask

-

What is the Kentucky Annual Surcharge Report Form?

The Kentucky Annual Surcharge Report Form is a document required by businesses in Kentucky to report certain surcharges. This form ensures compliance with state regulations and provides transparency in financial reporting. Using airSlate SignNow simplifies the process of generating and submitting this form electronically.

-

How can airSlate SignNow help me with the Kentucky Annual Surcharge Report Form?

airSlate SignNow allows you to easily create, send, and eSign the Kentucky Annual Surcharge Report Form. Our platform offers intuitive tools to streamline the preparation and submission process, making your reporting more efficient and compliant. Plus, you can track the status of your form in real-time.

-

Is airSlate SignNow cost-effective for filing the Kentucky Annual Surcharge Report Form?

Yes, airSlate SignNow provides a cost-effective solution for managing the Kentucky Annual Surcharge Report Form. With our competitive pricing plans, you can choose the best option that fits your business needs. The savings on printing and mailing costs alone make it a financially smart choice.

-

What features does airSlate SignNow offer for the Kentucky Annual Surcharge Report Form?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSignature capabilities for the Kentucky Annual Surcharge Report Form. Our platform also supports document storage and sharing, ensuring that all your forms are easily accessible and organized.

-

Can I integrate airSlate SignNow with other software for managing the Kentucky Annual Surcharge Report Form?

Absolutely! airSlate SignNow offers seamless integrations with various software including popular accounting and project management tools. This allows you to manage your workflow effectively and ensures that the Kentucky Annual Surcharge Report Form is part of your overall business process.

-

What are the benefits of using airSlate SignNow for the Kentucky Annual Surcharge Report Form?

Using airSlate SignNow for the Kentucky Annual Surcharge Report Form grants you quicker submission times, increased document security, and improved regulatory compliance. The electronic signing process is not only faster but also more reliable than traditional methods. This means more time for you to focus on your core business activities.

-

Is it easy to learn how to use airSlate SignNow for the Kentucky Annual Surcharge Report Form?

Yes, airSlate SignNow is designed with user-friendliness in mind. You don’t need any technical expertise to get started on filling out and managing the Kentucky Annual Surcharge Report Form. Our comprehensive resources and customer support are available to assist you whenever you need help.

Get more for Kentucky Annual Surcharge Report Form

- Fw 008 order on court fee waiver after hearing superior court judicial council forms courts ca

- Jv 680 findings and orders for child approaching judicial council forms courts ca

- Jv 060 juvenile court information for parents courts ca

- Jv 446 findings and orders after postpermanency hearing permanent plan other than adoption welf amp inst code 3663 judicial form

- Orders under welfare and institutions code form

- Fl 630 judgment regarding parental obligations 2011 form

- Jv 710 juvenile fitness hearing order welfare and institutions code 707 judicial council forms courts ca

- Jv 365 2012 form

Find out other Kentucky Annual Surcharge Report Form

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now