Kentucky Annual Surcharge Report Form 2015

What is the Kentucky Annual Surcharge Report Form

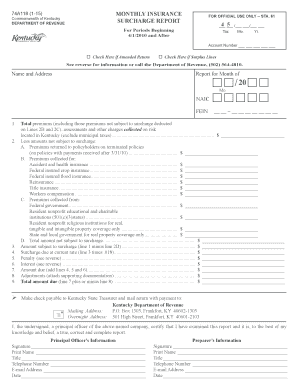

The Kentucky Annual Surcharge Report Form is a tax document used by businesses operating in Kentucky to report and pay the annual surcharge imposed by the state. This form is essential for ensuring compliance with state tax regulations and is typically required for various business entity types, including corporations and limited liability companies (LLCs). The surcharge is calculated based on the gross receipts of the business, making accurate reporting critical for tax obligations.

How to use the Kentucky Annual Surcharge Report Form

Using the Kentucky Annual Surcharge Report Form involves several steps to ensure proper completion and submission. First, gather all necessary financial information, including gross receipts and any applicable deductions. Next, accurately fill out the form with the required details, ensuring that all figures are correct. After completing the form, it can be submitted electronically or via mail, depending on the preferred method of filing. Utilizing digital platforms like signNow can streamline the signing and submission process, ensuring timely compliance.

Steps to complete the Kentucky Annual Surcharge Report Form

Completing the Kentucky Annual Surcharge Report Form requires careful attention to detail. Follow these steps:

- Gather necessary financial documents, including income statements and receipts.

- Access the form online or obtain a physical copy from the appropriate state agency.

- Fill in your business information, including name, address, and entity type.

- Calculate the surcharge based on your gross receipts and enter the amount on the form.

- Review the form for accuracy and completeness before signing.

- Submit the completed form electronically or by mail to the designated state office.

Legal use of the Kentucky Annual Surcharge Report Form

The Kentucky Annual Surcharge Report Form must be completed and submitted in accordance with state laws. It serves as a legal document that reflects a business's financial activity and tax obligations. Failure to file this form accurately and on time can result in penalties and interest charges. Therefore, it is crucial to understand the legal requirements surrounding the form, including any deadlines and regulations set forth by the Kentucky Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the Kentucky Annual Surcharge Report Form are typically set by the state and can vary each year. Generally, businesses are required to file this form by a specific date, often aligned with the annual tax filing deadline. It is important to stay informed about any changes to deadlines to avoid late fees. Check the Kentucky Department of Revenue's official announcements for the most current information regarding filing dates.

Form Submission Methods (Online / Mail / In-Person)

The Kentucky Annual Surcharge Report Form can be submitted through various methods to accommodate different preferences. Businesses have the option to file online using the Kentucky Department of Revenue's e-filing system, which allows for quicker processing and confirmation. Alternatively, the form can be printed and mailed to the appropriate state office. In-person submissions may also be possible at designated state revenue offices, providing another avenue for compliance.

Quick guide on how to complete kentucky annual surcharge report 2015 2018 form

Your assistance manual on how to prepare your Kentucky Annual Surcharge Report Form

If you’re wondering how to finalize and submit your Kentucky Annual Surcharge Report Form, here are some concise guidelines to simplify the tax declaration process.

Firstly, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to edit, generate, and complete your tax forms effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures and return to modify information as needed. Enhance your tax management with advanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your Kentucky Annual Surcharge Report Form in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Access our directory to locate any IRS tax form; browse through versions and schedules.

- Select Get form to open your Kentucky Annual Surcharge Report Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if applicable).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can lead to increased return errors and delayed refunds. Additionally, before e-filing your taxes, check the IRS website for filing regulations applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct kentucky annual surcharge report 2015 2018 form

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

-

When and how are the assignments for IGNOU CHR to be submitted for the December 2018 TEE? How and when to fill out the examination form? Where do I look for the datasheet?

First download the assignments from IGNOU - The People's University website and write them with A4 size paper then submitted it in your study center.check the above website you will find a link that TEE from fill up for dec 2018 after got the link you will fill your tee from online.Remember while filling your TEE you should put tick mark on the box like this;Are you submitted assignments: yes[ ] No[ ]

Create this form in 5 minutes!

How to create an eSignature for the kentucky annual surcharge report 2015 2018 form

How to generate an eSignature for the Kentucky Annual Surcharge Report 2015 2018 Form online

How to create an eSignature for the Kentucky Annual Surcharge Report 2015 2018 Form in Chrome

How to make an electronic signature for signing the Kentucky Annual Surcharge Report 2015 2018 Form in Gmail

How to make an eSignature for the Kentucky Annual Surcharge Report 2015 2018 Form from your smartphone

How to make an eSignature for the Kentucky Annual Surcharge Report 2015 2018 Form on iOS

How to make an eSignature for the Kentucky Annual Surcharge Report 2015 2018 Form on Android

People also ask

-

What is the Kentucky Annual Surcharge Report Form?

The Kentucky Annual Surcharge Report Form is a mandatory document that businesses must file to report certain fee collections and surcharge obligations to the state. Completing this form accurately is critical for compliance, and airSlate SignNow can help streamline this process by providing eSigning capabilities and secure document storage.

-

How does airSlate SignNow simplify the Kentucky Annual Surcharge Report Form process?

airSlate SignNow makes the Kentucky Annual Surcharge Report Form process easier by allowing users to eSign documents quickly and efficiently from anywhere. This eliminates the need for physical signatures, reduces turnaround time, and ensures that your forms are filed promptly to meet state deadlines.

-

Is there a cost associated with using airSlate SignNow for the Kentucky Annual Surcharge Report Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. These plans provide access to the features necessary to complete the Kentucky Annual Surcharge Report Form, including unlimited eSignatures, templates, and integrations, all at a budget-friendly cost.

-

Can I integrate airSlate SignNow with other software to manage the Kentucky Annual Surcharge Report Form?

Absolutely! airSlate SignNow can be easily integrated with various business tools and software. This means you can efficiently manage your projects, automate workflows, and complete the Kentucky Annual Surcharge Report Form using your existing systems for seamless operations.

-

What are the benefits of using airSlate SignNow for the Kentucky Annual Surcharge Report Form?

Using airSlate SignNow to complete the Kentucky Annual Surcharge Report Form offers numerous benefits, including enhanced security, faster processing times, and improved accuracy. The platform's user-friendly interface allows businesses to manage documents effectively, ensuring compliance and saving valuable time.

-

Do I need any special skills to use airSlate SignNow for the Kentucky Annual Surcharge Report Form?

No special skills are required to use airSlate SignNow. The platform is designed for ease of use, allowing anyone to navigate through the process of filling out and signing the Kentucky Annual Surcharge Report Form without extensive training or technical knowledge.

-

Can I track the status of my Kentucky Annual Surcharge Report Form with airSlate SignNow?

Yes, airSlate SignNow provides tools that enable you to track the status of your Kentucky Annual Surcharge Report Form in real-time. This feature allows you to stay updated on document progress, ensuring that all necessary signatures are obtained and that filings are completed on time.

Get more for Kentucky Annual Surcharge Report Form

- Dove hunting checklist form

- Form t1223

- New staff orientation oregon early learning division form

- 4 h horsepony identification form washtenaw county 4 h ewashtenaw

- Pdf network connection application form nc1 horizon networks

- Anuncio del boletn oficial de la rioja gobierno de la rioja form

- Www sanidad gob esenorganizacionministerio de sanidad consumo y bienestar social form

- 0000891092 08 000575 txt sec gov form

Find out other Kentucky Annual Surcharge Report Form

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template