Notice of Levy California 2002-2026

What is the Notice of Levy California

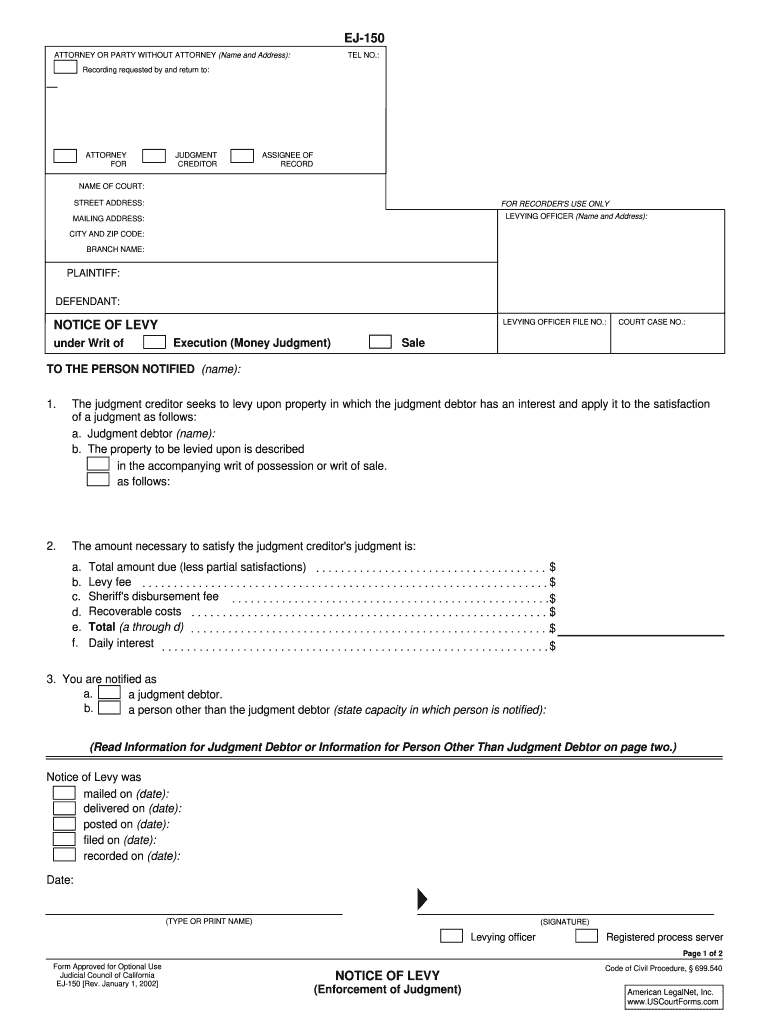

The Notice of Levy in California is a legal document used by government agencies to seize assets to satisfy a tax debt. This form is typically issued by the California Franchise Tax Board or other local authorities when an individual or business fails to pay owed taxes. The notice informs the taxpayer of the impending seizure of their assets, which may include bank accounts, wages, or property. Understanding this form is crucial for taxpayers to ensure compliance and to take appropriate action to protect their assets.

How to Use the Notice of Levy California

Using the Notice of Levy involves several steps to ensure compliance with California tax laws. First, the taxpayer must carefully review the notice to understand the amount owed and the assets being targeted. Next, they should gather any relevant documentation that supports their case, such as proof of payment or disputes regarding the debt. If the taxpayer believes the levy is unjust, they can respond to the notice with a formal objection or request a hearing. Utilizing a reliable electronic signature solution can streamline this process, ensuring that all documents are completed and submitted efficiently.

Steps to Complete the Notice of Levy California

Completing the Notice of Levy requires careful attention to detail. Here are the essential steps:

- Review the notice for accuracy, including the amount owed and the details of the levy.

- Gather supporting documents that may include payment receipts or correspondence with tax authorities.

- Fill out any required sections of the notice, ensuring all information is accurate and complete.

- Sign the document electronically using a secure platform to ensure its validity.

- Submit the completed notice to the appropriate tax authority by the specified deadline.

Legal Use of the Notice of Levy California

The legal use of the Notice of Levy is governed by specific regulations under California tax law. It is essential for taxpayers to understand their rights and obligations when receiving this notice. The levy must comply with state laws, including proper notification and the opportunity for the taxpayer to contest the levy. Failure to adhere to these legal requirements can result in penalties or the invalidation of the levy. Taxpayers should consider seeking legal advice if they are unsure about their rights or the implications of the notice.

Key Elements of the Notice of Levy California

Several key elements are essential for the Notice of Levy to be considered valid. These include:

- The name and contact information of the issuing authority.

- The taxpayer's name, address, and identification number.

- A detailed description of the assets being levied.

- The total amount owed, including any penalties and interest.

- Instructions for the taxpayer on how to respond to the notice.

Form Submission Methods

Taxpayers can submit the Notice of Levy through various methods, depending on the requirements of the issuing authority. Common submission methods include:

- Online submission via the official tax authority website, which often allows for secure electronic filing.

- Mailing the completed form to the designated address provided in the notice.

- In-person delivery at local tax authority offices, where taxpayers can receive immediate assistance.

Quick guide on how to complete notice of levy california

Complete Notice Of Levy California effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect eco-conscious alternative to conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Notice Of Levy California on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to edit and electronically sign Notice Of Levy California without hassle

- Find Notice Of Levy California and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in a few clicks from any chosen device. Edit and electronically sign Notice Of Levy California to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the notice of levy california

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the ej 150 form and how can airSlate SignNow help with it?

The ej 150 form is a crucial document for various business processes. With airSlate SignNow, you can easily create, send, and eSign the ej 150 form, streamlining your workflow and ensuring that all parties involved can quickly approve the document.

-

Is airSlate SignNow a cost-effective solution for managing the ej 150 form?

Yes, airSlate SignNow offers a cost-effective solution for managing the ej 150 form. Our pricing plans are designed to fit various budgets, ensuring that businesses of all sizes can utilize our platform for their document management needs without overspending.

-

What features does airSlate SignNow offer for handling the ej 150 form?

airSlate SignNow provides numerous features for the ej 150 form, including customizable templates, secure eSigning, and easy document sharing. These features facilitate a seamless experience when preparing, sending, and managing your ej 150 form.

-

Can I integrate airSlate SignNow with other tools for managing the ej 150 form?

Absolutely! airSlate SignNow supports integration with various applications, allowing you to manage your ej 150 form alongside other tools you already use. This integration ensures a smooth workflow and enhanced productivity.

-

What are the benefits of using airSlate SignNow for the ej 150 form?

Using airSlate SignNow for the ej 150 form provides benefits such as faster turnaround times, reduced paper waste, and improved document security. This not only enhances operational efficiency but also builds trust with your clients through timely and secure interactions.

-

How do I get started with airSlate SignNow for the ej 150 form?

Getting started with airSlate SignNow for the ej 150 form is easy! Simply sign up for a free trial on our website, explore the features, and begin creating your electronic forms instantly. Our user-friendly interface ensures you can quickly navigate through the setup process.

-

Is there customer support available for questions about the ej 150 form?

Yes, airSlate SignNow provides comprehensive customer support for all inquiries regarding the ej 150 form. Our dedicated support team is available through multiple channels to assist you with any questions or concerns you may have.

Get more for Notice Of Levy California

Find out other Notice Of Levy California

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online