Texas Non Foreign Affidavit under IRC 1445 Form

What is the Texas Non Foreign Affidavit Under IRC 1445

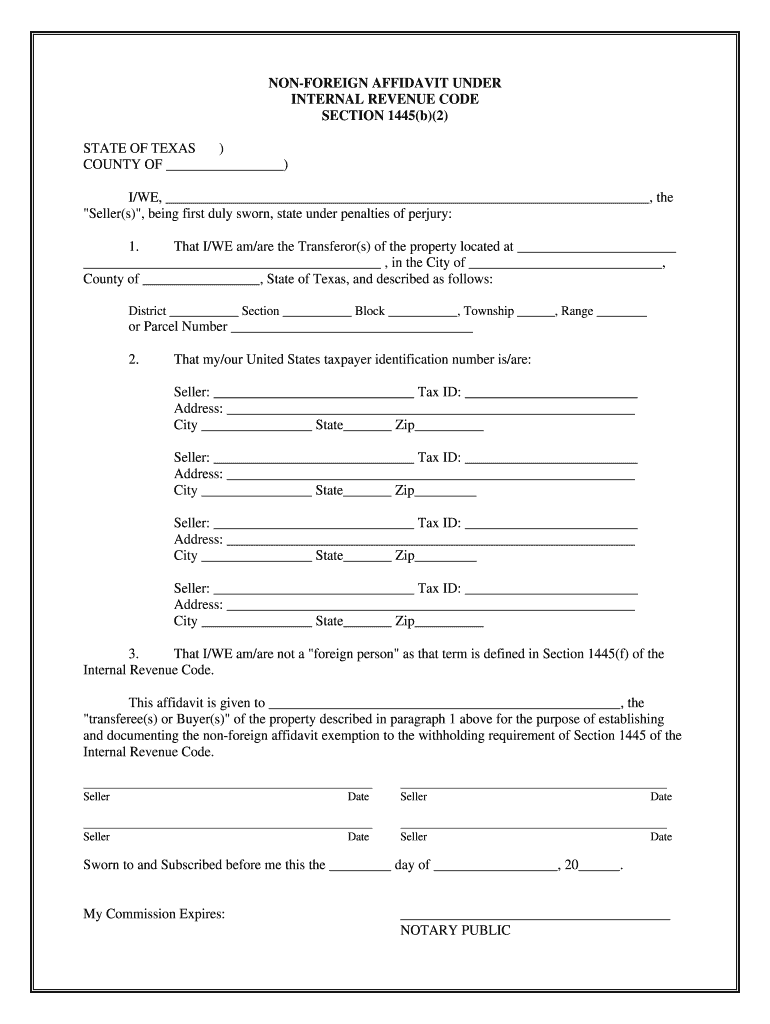

The Texas Non Foreign Affidavit is a legal document used in real estate transactions involving foreign sellers. Under IRC Section 1445, this affidavit certifies that the seller is not a foreign person, which is crucial for withholding tax purposes during the sale of U.S. real property. The form helps buyers avoid the obligation to withhold tax on the sale proceeds, ensuring compliance with U.S. tax regulations. By completing this affidavit, sellers affirm their non-foreign status, thus facilitating smoother transactions.

Steps to complete the Texas Non Foreign Affidavit Under IRC 1445

Completing the Texas Non Foreign Affidavit involves several key steps:

- Gather necessary information: Collect details such as the seller's name, address, and taxpayer identification number (TIN).

- Fill out the affidavit: Accurately complete the form, ensuring all information is correct and up to date.

- Sign the affidavit: The seller must sign the document in the presence of a notary public to validate the affidavit.

- Provide the affidavit to the buyer: Once completed, the seller should deliver the signed affidavit to the buyer for their records.

Legal use of the Texas Non Foreign Affidavit Under IRC 1445

The Texas Non Foreign Affidavit serves a vital legal function in real estate transactions. By declaring a seller's non-foreign status, the affidavit protects buyers from potential tax liabilities associated with foreign sellers. This document must be executed correctly to ensure its legal validity. In the event of an audit or inquiry by the IRS, having a properly completed affidavit can provide essential proof of compliance with tax regulations.

Required Documents

To complete the Texas Non Foreign Affidavit, certain documents are typically required:

- Proof of identity, such as a driver's license or passport.

- Taxpayer identification number (TIN) or Social Security number.

- Any prior tax documents relevant to the property transaction.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Texas Non Foreign Affidavit. These guidelines outline the requirements for sellers and buyers, including the need for accurate information and proper signatures. The IRS mandates that sellers must provide this affidavit to avoid withholding taxes on the sale proceeds. Familiarity with these guidelines is essential for both parties to ensure compliance and avoid penalties.

Filing Deadlines / Important Dates

When dealing with the Texas Non Foreign Affidavit, it is important to be aware of key deadlines. Typically, the affidavit should be completed and submitted at the time of closing on the property sale. Buyers and sellers should coordinate to ensure that the affidavit is filed in a timely manner to comply with IRS regulations and avoid any potential penalties related to late submissions.

Quick guide on how to complete texas non foreign affidavit under irc 1445

Prepare Texas Non Foreign Affidavit Under IRC 1445 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and without hassle. Manage Texas Non Foreign Affidavit Under IRC 1445 on any platform using airSlate SignNow's Android or iOS apps and enhance any document-related procedure today.

How to modify and eSign Texas Non Foreign Affidavit Under IRC 1445 with ease

- Obtain Texas Non Foreign Affidavit Under IRC 1445 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal value as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Texas Non Foreign Affidavit Under IRC 1445 and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out Form B under the Insolvency and Bankruptcy code? Does the affidavit require a stamp paper?

Affidavit is always on stamp paper

-

How do I find out whether I belong to the OBC creamy or non-creamy layer while filling out a form?

Please go to the caste census of 2011 to find out whether you are a backward caste . Then find out from the website of Backward Classes Commission whether you fall in OBC list .Having found that , the criteria is as under -You will be in non-creamy layer if your parents’ total annual income is not more than Rs.8 lakh . Your own income , if any , is not included . Any agricultural income of your parents is also not included .

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

Single member Wyoming LLC, owned by a foreign non-resident, and under this LLC I have an apparel Shopify dropshipping store with products from China. Do I have to pay for taxes in the US? What forms do I need to fill?

I am not resident and have a company in Wyoming and Delaware both for purpose to get local payment getaways . But I dont use Shopify for dropshipping I use free platform now for my dropshipping as I get better traffic there with same choice of tools like oberlo. Anyways what I know of taxes is if you collecting money in U.S with U.S payment gateway then you need to pay with holding tax and rest file taxes in your home country but if you are collecting payment else where not in U.S payment provider then you dont have to pay any taxes . But if you are local resident then you need to pay federal tax even if you are in tax free state .

-

How do I get admission to TU if I have qualified for the JEE Mains? I am from Assam, and I want to do so under the state quota. Will there be any state rank list to be released, or do I have fill out any form?

If you haven't filled up any form then I am not sure if you are gonna get any chance now….This is the procedure they follow--- after you have qualified in JEE-MAINS. You have to fill up a form through which they come to know that you have qualified. Then they give a list of student according to their ranks (both AIR & state ranks). Then according to that there's three list A,B & C in which there's all the quota and all. And they relaese one list in general. According to that list theu release a date of your counselling .Note- The form fillup is must.

Create this form in 5 minutes!

How to create an eSignature for the texas non foreign affidavit under irc 1445

How to make an electronic signature for the Texas Non Foreign Affidavit Under Irc 1445 online

How to make an electronic signature for your Texas Non Foreign Affidavit Under Irc 1445 in Google Chrome

How to generate an electronic signature for putting it on the Texas Non Foreign Affidavit Under Irc 1445 in Gmail

How to make an electronic signature for the Texas Non Foreign Affidavit Under Irc 1445 right from your smartphone

How to make an electronic signature for the Texas Non Foreign Affidavit Under Irc 1445 on iOS devices

How to make an electronic signature for the Texas Non Foreign Affidavit Under Irc 1445 on Android

People also ask

-

What is a Texas Non Foreign Affidavit Under IRC 1445?

A Texas Non Foreign Affidavit Under IRC 1445 is a declaration stating that a seller is not a foreign person, which helps buyers avoid withholding taxes during real estate transactions. This affidavit is essential for compliance with U.S. tax regulations and ensures smooth property transfers in Texas.

-

How does airSlate SignNow help with Texas Non Foreign Affidavit Under IRC 1445?

airSlate SignNow simplifies the process of creating and signing a Texas Non Foreign Affidavit Under IRC 1445 by providing an easy-to-use platform for document management. Our solution allows users to quickly fill out, sign, and send the affidavit securely, streamlining the entire process.

-

What features does airSlate SignNow offer for managing Texas Non Foreign Affidavit Under IRC 1445?

With airSlate SignNow, users can access features such as customizable templates, secure eSigning, and document tracking specifically for the Texas Non Foreign Affidavit Under IRC 1445. These features enhance efficiency and ensure that all necessary information is accurately captured.

-

Is airSlate SignNow cost-effective for processing Texas Non Foreign Affidavit Under IRC 1445?

Yes, airSlate SignNow offers competitive pricing tailored for businesses needing to process Texas Non Foreign Affidavit Under IRC 1445 efficiently. Our plans provide extensive features at an affordable rate, making it a smart investment for document management.

-

Can I integrate airSlate SignNow with other software for Texas Non Foreign Affidavit Under IRC 1445?

Absolutely! airSlate SignNow seamlessly integrates with a variety of applications, allowing users to streamline the process of preparing and signing Texas Non Foreign Affidavit Under IRC 1445. This ensures that your workflow remains uninterrupted and efficient.

-

What are the benefits of using airSlate SignNow for Texas Non Foreign Affidavit Under IRC 1445?

Using airSlate SignNow for your Texas Non Foreign Affidavit Under IRC 1445 offers numerous benefits, including increased efficiency, security, and compliance. Our platform ensures that your documents are legally binding and professionally managed, which can save time and reduce errors.

-

How secure is airSlate SignNow for handling Texas Non Foreign Affidavit Under IRC 1445?

airSlate SignNow prioritizes security, utilizing advanced encryption and authentication methods to protect sensitive information related to the Texas Non Foreign Affidavit Under IRC 1445. You can trust that your documents are safe and secure while using our platform.

Get more for Texas Non Foreign Affidavit Under IRC 1445

Find out other Texas Non Foreign Affidavit Under IRC 1445

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF