941 V Form 2001

What is the 941 V Form

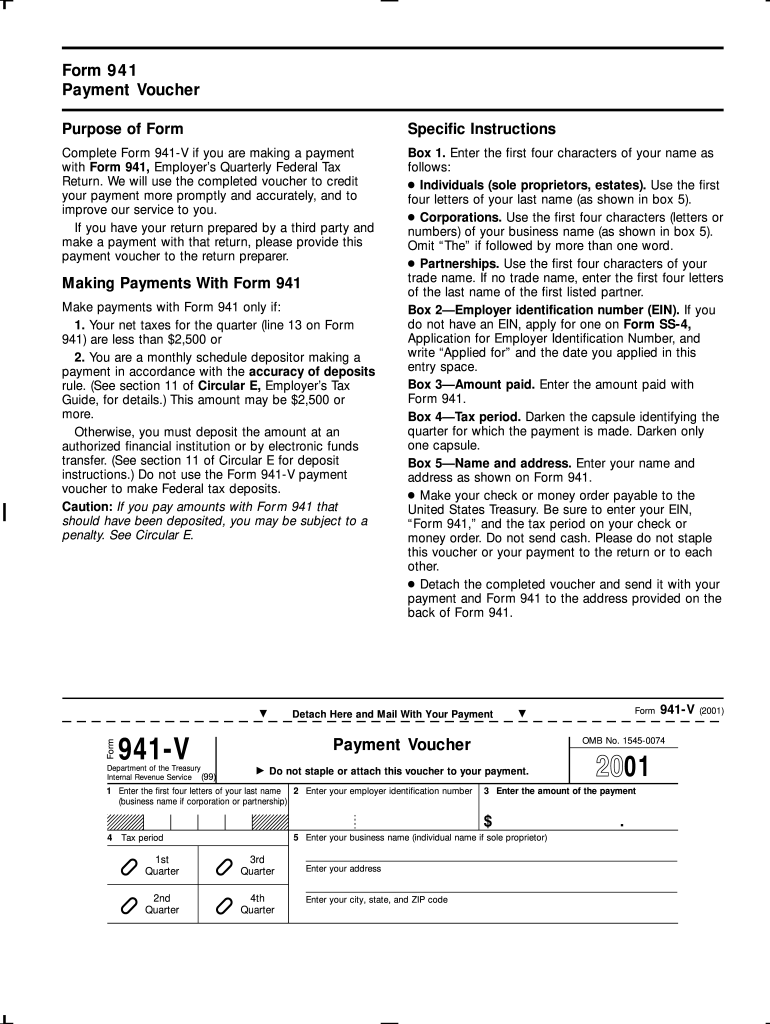

The 941 V Form is a payment voucher used by employers to submit their federal payroll taxes to the Internal Revenue Service (IRS). This form is specifically designed for use with Form 941, which is the Employer's Quarterly Federal Tax Return. The 941 V Form helps ensure that payments are correctly applied to the employer's tax account, streamlining the process of remitting taxes owed for employee wages. It is essential for maintaining accurate records and fulfilling tax obligations.

How to use the 941 V Form

Using the 941 V Form involves a few straightforward steps. First, ensure that you have completed Form 941 for the relevant quarter. After determining the amount owed, fill out the 941 V Form with your business information, including the employer identification number (EIN), the quarter for which you are making the payment, and the payment amount. This form should accompany your payment, whether you are sending a check or making an electronic payment. Always keep a copy for your records to track your submissions and payments.

Steps to complete the 941 V Form

Completing the 941 V Form requires attention to detail. Follow these steps:

- Obtain the latest version of the 941 V Form from the IRS website.

- Fill in your business name and address accurately.

- Enter your employer identification number (EIN) in the designated field.

- Specify the quarter for which you are making the payment.

- Indicate the total payment amount due.

- Review the form for accuracy before submission.

Once completed, submit the form along with your payment to ensure proper processing by the IRS.

Legal use of the 941 V Form

The 941 V Form must be used in compliance with IRS regulations to ensure that payments are legally recognized. It serves as a formal declaration of the amount owed and is critical for maintaining compliance with federal tax laws. Employers must ensure that the form is filled out correctly and submitted on time to avoid penalties. The use of this form is governed by the same legal standards that apply to all tax-related documents, ensuring that it is treated as a valid and enforceable instrument in the eyes of the law.

Filing Deadlines / Important Dates

Filing deadlines for the 941 V Form align with those for Form 941. Employers must submit Form 941 and any associated payments by the last day of the month following the end of each quarter. The deadlines are as follows:

- First quarter (January to March): Due by April 30

- Second quarter (April to June): Due by July 31

- Third quarter (July to September): Due by October 31

- Fourth quarter (October to December): Due by January 31

It is crucial to adhere to these deadlines to avoid late fees and interest charges.

Form Submission Methods (Online / Mail / In-Person)

The 941 V Form can be submitted in several ways, providing flexibility for employers. The submission methods include:

- Mail: Send the completed form and payment to the address specified by the IRS for your location.

- Online: Use the IRS Electronic Federal Tax Payment System (EFTPS) for electronic payments, ensuring that you include the 941 V Form details as required.

- In-Person: Payments can also be made at designated IRS offices, although this method may vary based on location.

Choosing the appropriate submission method can help streamline the payment process and ensure timely compliance with tax obligations.

Quick guide on how to complete 941 v 2001 form

Effortlessly Prepare 941 V Form on Any Device

Digital document management has become increasingly favored by enterprises and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the required forms and securely store them online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage 941 V Form on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign 941 V Form Seamlessly

- Locate 941 V Form and click on Get Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you want to send your form—via email, text message (SMS), an invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign 941 V Form to guarantee outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 941 v 2001 form

Create this form in 5 minutes!

How to create an eSignature for the 941 v 2001 form

How to create an electronic signature for the 941 V 2001 Form online

How to create an electronic signature for the 941 V 2001 Form in Google Chrome

How to make an eSignature for signing the 941 V 2001 Form in Gmail

How to make an electronic signature for the 941 V 2001 Form from your smartphone

How to make an electronic signature for the 941 V 2001 Form on iOS

How to create an eSignature for the 941 V 2001 Form on Android

People also ask

-

What is the 941 V Form and who needs it?

The 941 V Form is a payment voucher that accompanies the IRS Form 941, used for reporting income taxes withheld and FICA taxes. Businesses and employers who withhold payroll taxes are required to file this form to ensure proper payment. Using airSlate SignNow, you can easily eSign and submit the 941 V Form directly from your device.

-

How can airSlate SignNow help with the 941 V Form?

airSlate SignNow streamlines the process of completing and submitting the 941 V Form by allowing users to eSign documents quickly and securely. You can fill out your 941 V Form online, ensuring that your payments are processed without delays. This user-friendly solution makes managing your tax forms more efficient.

-

Is there a cost associated with using airSlate SignNow for the 941 V Form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. You can choose a plan that fits your budget while ensuring that you have the necessary tools to manage your 941 V Form and other documents efficiently. Explore our pricing options to find the right fit for your business.

-

What features does airSlate SignNow offer for managing the 941 V Form?

airSlate SignNow provides several features that simplify the management of the 941 V Form, including eSigning, document templates, and secure cloud storage. You can easily track the status of your 941 V Form and receive notifications when your document is signed. This level of organization helps prevent errors in your submissions.

-

Are there integrations available for the 941 V Form with airSlate SignNow?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software and other business applications, allowing you to manage your 941 V Form alongside your financial records. These integrations enhance productivity by ensuring all your documents are in one place, making filing your taxes easier.

-

Can I store my completed 941 V Form securely with airSlate SignNow?

Yes, airSlate SignNow provides secure cloud storage for all your documents, including the 941 V Form. You can rest assured that your sensitive tax information is protected with advanced security measures. Access your documents anytime, anywhere, ensuring you have what you need for your financial records.

-

What are the benefits of using airSlate SignNow for the 941 V Form?

Using airSlate SignNow for your 941 V Form offers numerous benefits, including time savings, enhanced accuracy, and improved compliance with tax regulations. The eSigning feature eliminates the need for printing and scanning, while the intuitive interface makes it easy to complete your forms without hassle.

Get more for 941 V Form

Find out other 941 V Form

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself