Mn Revenue Fill in Form M 1w 2010

What is the Mn Revenue Fill In Form M 1w

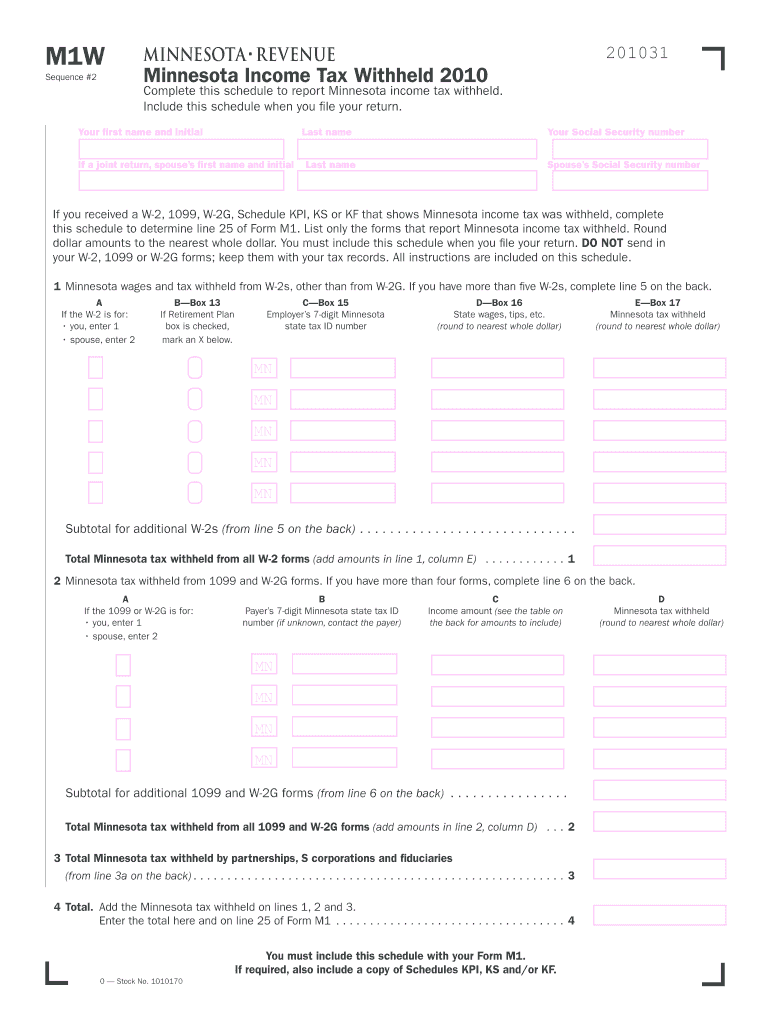

The Mn Revenue Fill In Form M 1w is a tax-related document utilized by individuals and businesses in Minnesota. This form is essential for reporting specific financial information to the Minnesota Department of Revenue. It serves as a means to ensure compliance with state tax regulations and helps in the accurate calculation of tax obligations. Understanding its purpose is crucial for anyone looking to maintain their tax responsibilities in Minnesota.

How to use the Mn Revenue Fill In Form M 1w

Using the Mn Revenue Fill In Form M 1w involves several steps to ensure accurate completion. First, gather all necessary financial documents that pertain to your income and deductions. Next, access the form either online or through a physical copy. Fill in the required fields with precise information, such as your name, address, and financial details. It is important to review the completed form for any inaccuracies before submission. Finally, submit the form according to the guidelines provided by the Minnesota Department of Revenue.

Steps to complete the Mn Revenue Fill In Form M 1w

Completing the Mn Revenue Fill In Form M 1w requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the Minnesota Department of Revenue website.

- Fill in your personal information, including your name and Social Security number.

- Provide accurate financial data, including income, deductions, and credits.

- Double-check all entries for accuracy.

- Sign and date the form to validate your submission.

Legal use of the Mn Revenue Fill In Form M 1w

The legal use of the Mn Revenue Fill In Form M 1w is governed by Minnesota tax laws. To be considered valid, the form must be filled out completely and accurately. It is essential to use the form in accordance with state regulations to avoid penalties. Additionally, electronic submissions are recognized as legally binding, provided they comply with eSignature laws. This ensures that your submission is both secure and accepted by the Minnesota Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the Mn Revenue Fill In Form M 1w are crucial for compliance. Typically, the form must be submitted by April 15 of the tax year. However, extensions may be available under certain circumstances. It is important to stay informed about any changes in deadlines, as they can vary from year to year. Marking these dates on your calendar can help ensure timely submission and avoid potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The Mn Revenue Fill In Form M 1w can be submitted through various methods, providing flexibility for taxpayers. You can choose to file online through the Minnesota Department of Revenue’s e-filing system, which is often the fastest option. Alternatively, you may print the completed form and mail it to the appropriate address. In-person submissions are also possible at designated state offices. Each method has its own processing times, so consider your needs when selecting a submission method.

Quick guide on how to complete mn revenue fill in form m 1w 2010

Effortlessly Prepare Mn Revenue Fill In Form M 1w on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily locate the right template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Handle Mn Revenue Fill In Form M 1w on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Mn Revenue Fill In Form M 1w with minimal effort

- Obtain Mn Revenue Fill In Form M 1w and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Generate your signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information, then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Edit and eSign Mn Revenue Fill In Form M 1w to guarantee effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mn revenue fill in form m 1w 2010

Create this form in 5 minutes!

How to create an eSignature for the mn revenue fill in form m 1w 2010

How to generate an eSignature for the Mn Revenue Fill In Form M 1w 2010 in the online mode

How to make an eSignature for the Mn Revenue Fill In Form M 1w 2010 in Chrome

How to create an eSignature for signing the Mn Revenue Fill In Form M 1w 2010 in Gmail

How to make an eSignature for the Mn Revenue Fill In Form M 1w 2010 from your smartphone

How to generate an eSignature for the Mn Revenue Fill In Form M 1w 2010 on iOS

How to create an eSignature for the Mn Revenue Fill In Form M 1w 2010 on Android

People also ask

-

What is the Mn Revenue Fill In Form M 1w, and why is it important?

The Mn Revenue Fill In Form M 1w is a crucial document for businesses in Minnesota that need to report their tax adjustments. It ensures compliance with state regulations and helps avoid potential fines. Properly filling out this form is essential for maintaining good standing with the Minnesota Department of Revenue.

-

How can airSlate SignNow help with completing the Mn Revenue Fill In Form M 1w?

airSlate SignNow simplifies the process of completing the Mn Revenue Fill In Form M 1w by providing an easy-to-use interface for document creation and eSigning. You can quickly fill out, edit, and securely sign the form online. This efficiency saves time and reduces the likelihood of errors.

-

What are the pricing options for using airSlate SignNow for the Mn Revenue Fill In Form M 1w?

airSlate SignNow offers various pricing plans that cater to different business needs, including options for individuals and teams. You can choose a monthly or annual subscription based on your frequency of use. Each plan provides access to essential features for managing documents like the Mn Revenue Fill In Form M 1w.

-

Can I integrate airSlate SignNow with other tools I use for the Mn Revenue Fill In Form M 1w?

Yes, airSlate SignNow offers integrations with popular software applications such as CRM systems and cloud storage services. This capability allows you to efficiently manage the Mn Revenue Fill In Form M 1w alongside your existing tools. Seamless integration enhances your workflow and makes document management more efficient.

-

What security features does airSlate SignNow provide for the Mn Revenue Fill In Form M 1w?

airSlate SignNow prioritizes security with features such as end-to-end encryption and robust authentication protocols. These measures protect sensitive information on the Mn Revenue Fill In Form M 1w from unauthorized access. Rest assured, your documents are secure while being handled through our platform.

-

Is there a mobile app for accessing the Mn Revenue Fill In Form M 1w through airSlate SignNow?

Yes, airSlate SignNow provides a mobile app that allows you to access and manage documents, including the Mn Revenue Fill In Form M 1w, on the go. This feature is particularly useful for busy professionals who need to review, eSign, or share documents while away from their desks. The app maintains all functionalities of the desktop version.

-

What are the benefits of using airSlate SignNow for the Mn Revenue Fill In Form M 1w?

Using airSlate SignNow for the Mn Revenue Fill In Form M 1w offers numerous benefits, including increased efficiency and reduced paperwork. The platform allows for quick document preparation and secure eSigning, making tax compliance straightforward. Additionally, the user-friendly interface ensures that even those with limited technical skills can navigate the process easily.

Get more for Mn Revenue Fill In Form M 1w

Find out other Mn Revenue Fill In Form M 1w

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation