Eiv Income Discrepancy Resolutions 2015-2026

What is the EIV Income Discrepancy Resolution?

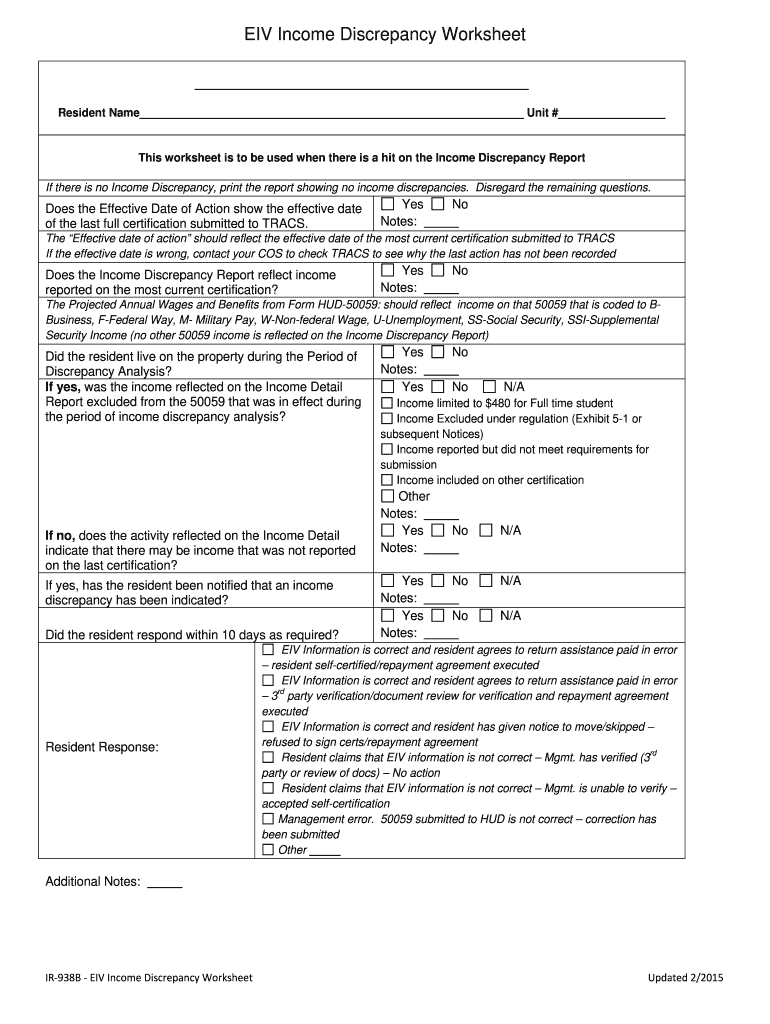

The EIV Income Discrepancy Resolution refers to a process used to address inconsistencies in income information reported by tenants in federally assisted housing programs. This resolution is crucial for ensuring that the income reported aligns with the data obtained from the Enterprise Income Verification (EIV) system. The EIV system is a tool used by housing authorities to verify income and ensure compliance with federal regulations. When discrepancies arise, it is essential to follow the proper procedures to resolve these issues effectively.

Steps to Complete the EIV Income Discrepancy Resolution

Completing the EIV Income Discrepancy Resolution involves several key steps:

- Identify the Discrepancy: Review the EIV report and identify any income discrepancies between what the tenant reported and what the EIV system indicates.

- Notify the Tenant: Inform the tenant about the discrepancy and request any necessary documentation to clarify the income details.

- Gather Documentation: Collect supporting documents from the tenant, such as pay stubs, tax returns, or other relevant income verification.

- Review Documentation: Assess the provided documents to determine if they resolve the discrepancy.

- Update Records: If the tenant's documentation is valid, update the tenant's income records accordingly.

- Complete the Resolution: Document the resolution process and maintain records for compliance purposes.

Required Documents for EIV Income Discrepancy Resolution

When addressing an EIV income discrepancy, specific documents are necessary to support the resolution process. These may include:

- Pay stubs or earning statements

- Tax returns or W-2 forms

- Bank statements

- Social Security statements

- Any other relevant income verification documents

Having these documents readily available will facilitate a smoother resolution process and ensure compliance with federal guidelines.

Legal Use of the EIV Income Discrepancy Resolution

The EIV Income Discrepancy Resolution must comply with various legal frameworks governing housing assistance programs. It is essential to ensure that all actions taken during the resolution process adhere to the regulations set forth by the U.S. Department of Housing and Urban Development (HUD). This includes maintaining confidentiality, providing tenants with the opportunity to contest discrepancies, and ensuring that all documentation is handled securely and in accordance with privacy laws.

IRS Guidelines Related to EIV Income Discrepancy

The Internal Revenue Service (IRS) provides guidelines that may intersect with the EIV Income Discrepancy Resolution, particularly regarding income reporting and verification. It is important to ensure that any income discrepancies addressed through the EIV system align with IRS regulations to avoid potential compliance issues. Understanding these guidelines can help housing authorities and tenants navigate the resolution process more effectively.

Examples of Using the EIV Income Discrepancy Resolution

Real-world scenarios illustrate how the EIV Income Discrepancy Resolution is applied:

- A tenant reports an annual income of $30,000, but the EIV system indicates $40,000 based on reported wages. The housing authority must follow the resolution steps to clarify the discrepancy.

- A tenant submits a tax return showing a lower income than what is reflected in the EIV report. The housing authority reviews the documentation and updates the tenant's records accordingly.

These examples highlight the importance of a thorough and systematic approach to resolving income discrepancies.

Quick guide on how to complete eiv income discrepancy resolutions

Complete Eiv Income Discrepancy Resolutions easily on any gadget

Digital document management has gained popularity among enterprises and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can locate the suitable form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents efficiently without delays. Manage Eiv Income Discrepancy Resolutions on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to edit and eSign Eiv Income Discrepancy Resolutions effortlessly

- Locate Eiv Income Discrepancy Resolutions and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Eiv Income Discrepancy Resolutions and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the eiv income discrepancy resolutions

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is an EIV report checklist?

An EIV report checklist is a detailed guide that outlines all the necessary steps and documents required to complete the EIV (Enterprise Income Verification) process. This checklist ensures that you have all the proper documentation to verify income accurately and efficiently.

-

How can airSlate SignNow help me with my EIV report checklist?

airSlate SignNow simplifies the process of managing your EIV report checklist by allowing you to create, send, and receive electronically signed documents quickly. With user-friendly features, you can track the status of your checklist items in real-time, ensuring compliance and accuracy.

-

What features should I look for in an EIV report checklist tool?

When looking for an EIV report checklist tool, consider features such as document templates, electronic signatures, automatic reminders, and integration with existing software. airSlate SignNow provides all these features, making it a great choice for organizing and completing your EIV report checklist.

-

Is airSlate SignNow cost-effective for managing an EIV report checklist?

Yes, airSlate SignNow is a highly cost-effective solution for managing your EIV report checklist. With various pricing plans available, businesses of all sizes can benefit from its capabilities without breaking the bank, ensuring that compliance and efficiency are both attainable.

-

Can I integrate airSlate SignNow with other tools for my EIV report checklist?

Absolutely! airSlate SignNow offers seamless integrations with a wide range of applications, which is ideal for enhancing your EIV report checklist process. Whether you use CRMs, project management tools, or cloud storage services, airSlate SignNow can align with your workflow.

-

What benefits does airSlate SignNow provide for my EIV report checklist process?

Using airSlate SignNow for your EIV report checklist streamlines document handling, ensures compliance, and accelerates signature turnaround times. These benefits enhance productivity and help you manage your documentation efficiently, allowing you to focus on your core business activities.

-

How secure is airSlate SignNow when handling my EIV report checklist?

airSlate SignNow prioritizes security by utilizing advanced encryption methods to protect your data. When managing sensitive information related to your EIV report checklist, you can trust airSlate SignNow to provide a safe and secure environment for your documents.

Get more for Eiv Income Discrepancy Resolutions

Find out other Eiv Income Discrepancy Resolutions

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online