Personal Organizer Amp Deduction Checklist Taxes PhD Form

Understanding the Tax Preparation Worksheet PDF

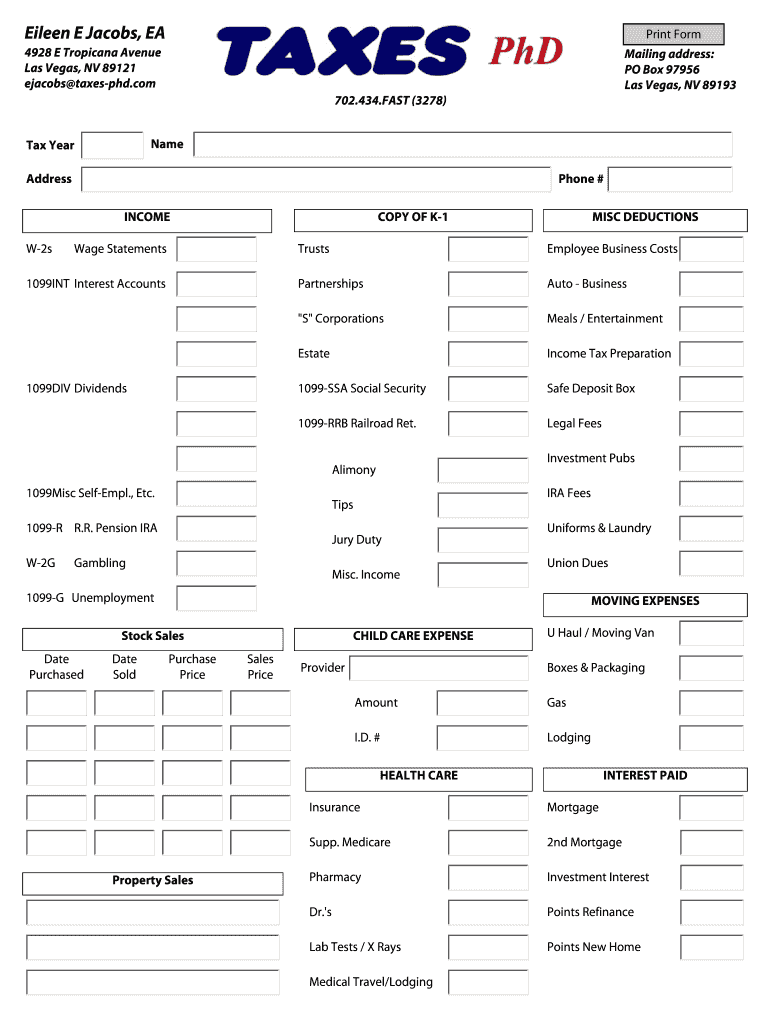

The tax preparation worksheet PDF serves as a comprehensive tool for organizing financial information needed for filing taxes. It typically includes sections for income, deductions, and credits, allowing taxpayers to compile all necessary data in one place. This form is essential for both individuals and businesses, as it helps streamline the tax filing process and ensures that no important details are overlooked.

Steps to Complete the Tax Preparation Worksheet PDF

Completing the tax preparation worksheet PDF involves several key steps:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts for deductible expenses.

- Fill in your personal information, such as name, address, and Social Security number.

- Document your income sources, ensuring to include all taxable income.

- List your deductions, such as mortgage interest, medical expenses, and charitable contributions.

- Review the completed worksheet for accuracy before submission.

Key Elements of the Tax Preparation Worksheet PDF

Several key elements are essential for a thorough tax preparation worksheet PDF:

- Income Section: A detailed account of all income sources, including wages, dividends, and interest.

- Deductions Section: A comprehensive list of all eligible deductions that can reduce taxable income.

- Credits Section: Information on any tax credits that may apply, which can directly reduce the tax owed.

- Signature Line: A section for the taxpayer's signature, confirming the accuracy of the information provided.

IRS Guidelines for Tax Preparation Worksheets

The IRS provides specific guidelines for completing tax preparation worksheets. These guidelines ensure that taxpayers accurately report their income and claim all eligible deductions. It is crucial to refer to the IRS publications relevant to your filing status and income level. Adhering to these guidelines helps avoid potential penalties and ensures compliance with federal tax laws.

Required Documents for Tax Preparation

To effectively complete the tax preparation worksheet PDF, certain documents are required:

- W-2 forms from employers, detailing annual wages and withheld taxes.

- 1099 forms for freelance work or other income sources.

- Receipts for deductible expenses, such as medical bills and educational costs.

- Prior year tax returns, which can provide a reference for current year filings.

Filing Deadlines and Important Dates

Awareness of filing deadlines is crucial for timely tax submissions. Generally, the deadline for individual tax returns is April 15. However, this date may vary if it falls on a weekend or holiday. Additionally, extensions may be available, but it's important to file the necessary forms to avoid penalties. Keeping track of these dates helps ensure compliance and prevents last-minute stress.

Quick guide on how to complete free personal organizer amp deduction checklist taxes phd

Manage Personal Organizer Amp Deduction Checklist Taxes PhD seamlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, adjust, and electronically sign your documents quickly and efficiently. Handle Personal Organizer Amp Deduction Checklist Taxes PhD on any device using the airSlate SignNow Android or iOS applications, and enhance any document-centric process today.

How to adjust and electronically sign Personal Organizer Amp Deduction Checklist Taxes PhD effortlessly

- Find Personal Organizer Amp Deduction Checklist Taxes PhD and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your edits.

- Decide how you want to send your form—whether via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, boring form searches, or errors that necessitate printouts of new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Personal Organizer Amp Deduction Checklist Taxes PhD while ensuring excellent communication throughout your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the free personal organizer amp deduction checklist taxes phd

The best way to make an eSignature for your PDF file in the online mode

The best way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is an itemized deductions list PDF and why do I need it?

An itemized deductions list PDF is a detailed breakdown of qualifying expenses that can be deducted from your taxable income. It's essential for individuals looking to maximize their tax refunds and ensure they don't miss out on any potential savings. By providing a clear summary of your deductible expenses, you can simplify your tax preparation process.

-

How can airSlate SignNow help me manage my itemized deductions list PDF?

airSlate SignNow empowers you to easily create, send, and eSign your itemized deductions list PDF documents. Its user-friendly interface and robust features allow you to streamline your documentation process, ensuring that your tax documents are signed securely and quickly. This integration simplifies the collection of necessary signatures, making tax season less stressful.

-

Are there costs associated with using airSlate SignNow for itemized deductions list PDFs?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs when managing itemized deductions list PDFs. Their cost-effective solutions provide great value for businesses looking to enhance document management without breaking the bank. You can choose from monthly or annual plans depending on your usage needs.

-

Can I integrate airSlate SignNow with other tools for managing itemized deductions list PDFs?

Absolutely! airSlate SignNow seamlessly integrates with many popular applications and platforms, which enhances your ability to manage your itemized deductions list PDF. Whether you use accounting software or project management tools, these integrations can help you organize your documents more effectively and improve your workflow.

-

What features does airSlate SignNow offer for itemized deductions list PDFs?

airSlate SignNow provides several powerful features for managing your itemized deductions list PDF, including customizable templates, eSignature capabilities, and automated reminders. These features not only save time but also ensure that your documentation processes are efficient and error-free. You can keep track of all your signing status and document workflows in one place.

-

Is it secure to send itemized deductions list PDFs using airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security measures to protect your itemized deductions list PDFs during transmission. You can confidently send your sensitive documents knowing they are safeguarded against unauthorized access.

-

Can I edit my itemized deductions list PDF after I've created it?

Yes, you can easily edit your itemized deductions list PDF within airSlate SignNow before sending it out for signatures. This flexibility allows you to update expenses or make corrections, ensuring that all information is accurate and up-to-date before submission. Our platform simplifies the editing process, making it user-friendly and efficient.

Get more for Personal Organizer Amp Deduction Checklist Taxes PhD

Find out other Personal Organizer Amp Deduction Checklist Taxes PhD

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF