P60 2018

What is the P60

The P60 is a tax document issued by employers in the United States that summarizes an employee's total earnings and the taxes withheld during a specific tax year. It serves as a crucial record for employees when filing their annual tax returns. This form provides essential details such as gross pay, federal income tax withheld, Social Security tax, and Medicare tax. Understanding the P60 is vital for ensuring accurate tax reporting and compliance with IRS regulations.

How to obtain the P60

To obtain a P60, employees should first contact their employer or human resources department. Employers are required to provide this form to employees by a specific deadline, usually by the end of January for the previous tax year. If the P60 is not received, employees can request a replacement P60 online or through direct communication with their employer. Additionally, some employers may offer electronic versions of the P60, allowing for quicker access and easier storage.

Steps to complete the P60

Completing the P60 involves several straightforward steps:

- Gather necessary information, including personal identification details and income records.

- Review the form for accuracy, ensuring all earnings and tax withholdings are correctly reported.

- Fill in any missing information, such as your Social Security number and address, if not already pre-filled.

- Sign and date the form, if required, to validate the information provided.

- Keep a copy for your records and submit it as needed for tax filing purposes.

Legal use of the P60

The P60 is legally recognized as an official document that provides evidence of employment income and tax withholdings. It is essential for tax filing and may be required for various financial transactions, such as applying for loans or mortgages. To ensure legal validity, the P60 must be accurately completed and submitted within the designated time frames established by the IRS. Failure to provide accurate information on the P60 can lead to penalties or issues during tax audits.

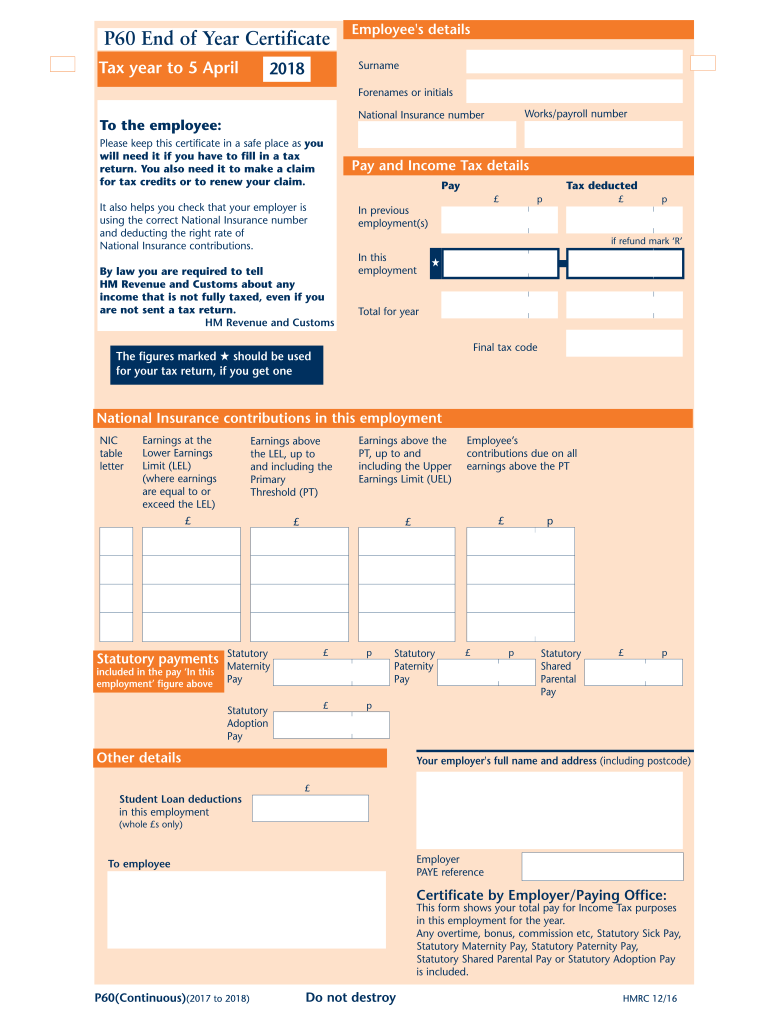

Key elements of the P60

Key elements of the P60 include:

- Employee Information: Name, address, and Social Security number.

- Employer Information: Employer's name, address, and Employer Identification Number (EIN).

- Income Details: Total earnings for the year, including wages, bonuses, and other compensation.

- Tax Withholdings: Amounts withheld for federal income tax, Social Security, and Medicare.

- Year of Issue: The tax year for which the P60 is issued.

IRS Guidelines

The IRS provides specific guidelines regarding the issuance and use of the P60. Employers must adhere to these guidelines to ensure compliance with tax laws. Key points include:

- Employers must issue the P60 by January 31 of the following tax year.

- The form must accurately reflect all earnings and withholdings.

- Employees should retain the P60 for at least three years for tax purposes.

Quick guide on how to complete p60

Prepare P60 effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and store it securely in the cloud. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without any delays. Manage P60 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

How to alter and eSign P60 with ease

- Obtain P60 and click Get Form to initiate the process.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive data with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign P60 while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct p60

Create this form in 5 minutes!

How to create an eSignature for the p60

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What are P60 forms and why are they important?

P60 forms are annual tax documents issued by employers to summarize an employee's earnings and the tax they've paid during the tax year. These forms are crucial for employees as they are required for filing tax returns and ensuring compliance with tax regulations.

-

How can airSlate SignNow help with P60 forms?

airSlate SignNow provides a streamlined way to electronically sign and send P60 forms, ensuring that they are securely delivered to employees. The platform's user-friendly interface makes it easy for both employers and employees to manage these important documents.

-

Are there any costs associated with using airSlate SignNow for P60 forms?

airSlate SignNow offers a variety of pricing plans that cater to different business needs. The cost-effective solution allows businesses to sign and manage P60 forms without incurring excessive expenses, making it accessible for organizations of all sizes.

-

Can airSlate SignNow integrate with other payroll systems for managing P60 forms?

Yes, airSlate SignNow easily integrates with various payroll and HR systems, allowing for automated workflows related to P60 forms. This integration enhances efficiency by eliminating manual data entry and ensuring that documents are always up-to-date.

-

What are the benefits of using airSlate SignNow for document management?

Using airSlate SignNow for document management, including P60 forms, offers numerous benefits such as enhanced security, ease of access, and improved compliance. The platform simplifies the signing process, reduces paperwork, and ensures that all documents are stored safely and can be retrieved easily.

-

Is it easy to set up airSlate SignNow for P60 form management?

Setting up airSlate SignNow for managing P60 forms is quick and straightforward. With a comprehensive onboarding process and user support, businesses can begin using the platform to manage their documents efficiently with minimal delay.

-

Can I track the status of P60 forms sent through airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all documents, including P60 forms. You'll receive notifications on status updates, allowing you to monitor who has viewed or signed the documents effortlessly.

Get more for P60

- City of clearwater citation affidavit form

- N9b form

- Oebb weight watchers form

- Notice to employer arizona department of economic security azdes form

- Bill of lading interworld freight form

- Investigation 3 4b1 blood worksheet answers form

- Reference check consent form lakehead public schools lakeheadschools

- City of hamilton city hall 71 main street west po form

Find out other P60

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF