Illinois General Notice of Default for Contract for Deed Form

What is the Illinois General Notice of Default for Contract for Deed

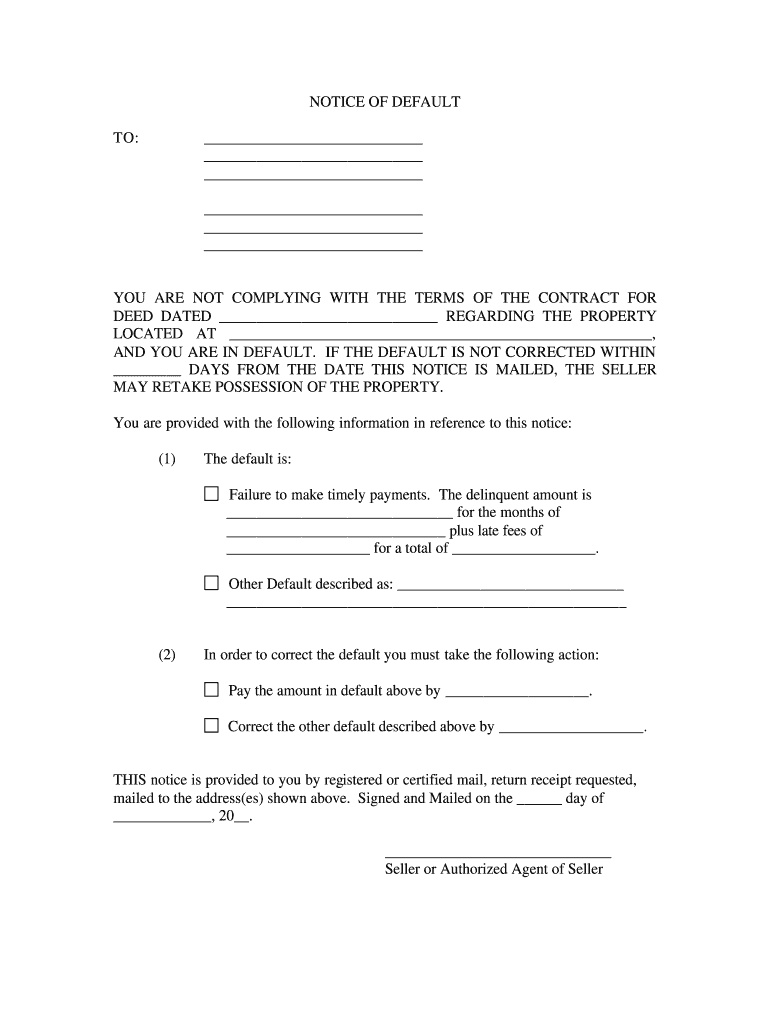

The Illinois General Notice of Default for Contract for Deed is a formal document used to notify a buyer when they have failed to meet the terms of their contract for deed. This notice serves as a crucial step in the process of addressing defaults in payment or other obligations outlined in the contract. It is essential for both buyers and sellers to understand this document, as it outlines the rights and responsibilities of each party involved in the transaction.

Key Elements of the Illinois General Notice of Default for Contract for Deed

This notice typically includes several key elements that are vital for its effectiveness:

- Identification of Parties: Clearly states the names and addresses of both the buyer and seller.

- Description of the Property: Provides details about the property involved in the contract for deed.

- Details of Default: Specifies the nature of the default, including missed payments or other breaches of contract.

- Remedies Available: Outlines the actions the seller may take if the default is not remedied, such as initiating foreclosure proceedings.

- Timeframe for Cure: Indicates the period within which the buyer must rectify the default to avoid further legal action.

Steps to Complete the Illinois General Notice of Default for Contract for Deed

Completing the Illinois General Notice of Default involves several important steps:

- Gather Information: Collect all necessary details about the contract, including the names of the parties and property description.

- Draft the Notice: Use a template or create a document that includes all key elements of the notice.

- Review for Accuracy: Ensure all information is correct and that the notice complies with Illinois law.

- Deliver the Notice: Send the notice to the buyer via certified mail or another method that provides proof of delivery.

- Keep Records: Maintain a copy of the notice and any correspondence related to the default.

Legal Use of the Illinois General Notice of Default for Contract for Deed

The legal use of the Illinois General Notice of Default is governed by state laws regarding contracts and real estate transactions. It is important that the notice is executed in compliance with the Illinois contract for deed statute to ensure its enforceability. Failure to properly issue this notice may result in legal complications for the seller, including the inability to initiate foreclosure proceedings.

How to Obtain the Illinois General Notice of Default for Contract for Deed

Obtaining the Illinois General Notice of Default can be done through various means:

- Online Resources: Many legal websites provide templates and forms that can be downloaded and customized.

- Legal Aid Offices: Local legal aid organizations may offer assistance in drafting the notice.

- Real Estate Attorneys: Consulting with a real estate attorney can ensure that the notice is correctly prepared and compliant with state laws.

State-Specific Rules for the Illinois General Notice of Default for Contract for Deed

Illinois has specific rules governing the issuance of the General Notice of Default for Contract for Deed. These rules dictate the required content of the notice, the delivery method, and the timeframe for the buyer to respond. Understanding these state-specific regulations is crucial for both buyers and sellers to ensure compliance and protect their legal rights.

Quick guide on how to complete illinois general notice of default for contract for deed

Handle Illinois General Notice Of Default For Contract For Deed seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to easily find the correct form and securely store it online. airSlate SignNow provides you with all the features you need to design, edit, and eSign your documents rapidly without any holdups. Manage Illinois General Notice Of Default For Contract For Deed on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Illinois General Notice Of Default For Contract For Deed effortlessly

- Find Illinois General Notice Of Default For Contract For Deed and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight specific parts of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the details and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Illinois General Notice Of Default For Contract For Deed and ensure excellent coordination at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

-

How do I fill out the form for a national scholarship, being in the general category?

Hari om , you are asking a question as to : “How do I fill out the form for a national scholarship, being in the general category?.”All categories candidates are eligible for national scholarships.It is a purely merit based scholarship.Simply fill all the columns & submit the application to the concerned authorities within the due date.If you are meritorious among the eligible applicants , you will be awarded the scholarships.Best of luck. Hari om.

-

Did you fill out the form "1099 misc"? If so, for what purpose? Within the context of work, is it like a contract?

One of the most common reasons you’d receive tax form 1099-MISC is if you are self-employed or did work as an independent contractor during the previous year. The IRS refers to this as “non-employee compensation.”In most circumstances, your clients are required to issue Form 1099-MISC when they pay you $600 or more in any year.As a self employed person you are required to report your self employment income if the amount you receive from all sources totals $400 or more. In this situation, the process of filing your taxes is a little different than a taxpayer who only receives regular employment income reported on a W-2.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

If I am living in UK with T2 General visa and work as a contractor for a US company with W-8BEN form filled out, do I still need to pay income tax to the UK government?

Yes.Every country in the world taxes people who live there. The US (which claims global jurisdiction over its citizens) taxes you because you are a citizen, the UK (which accepts that its jurisdiction stops at its own border, like every other country except the US) taxes you because you are present and earning money.But you don’t pay tax twice.The UK gets the first bite of the cherry - you’re living there, so you should pay towards public services. If you’re resident, you are taxed like the British taxpayers alongside whom you work, except if you have US investment or rental income that you don’t transfer or remit to the UK, special rules for ‘non-domiciled’ visitors may mean there’s no UK tax on this non-UK income (this is a complex area - take proper advice).You then report all your income to Uncle Sam too. The IRS lets you exclude a certain amount of foreign earned income for US tax purposes (up to $103,900 for 2018). If, even with the exclusion, you still owe US income taxes on your UK compensation, you should be able to claim a credit for UK taxes paid that reduces your US tax liability.Again, this is a complex area - take proper advice.It’s actually even more complex, because social security taxes operate under different rules. You should pay in only the UK or the US, but which country’s rules apply depends on the exact circumstances and how they fit with the US-UK bilateral social security treaty.Take advice (I hope that is clear by now!).

Create this form in 5 minutes!

How to create an eSignature for the illinois general notice of default for contract for deed

How to generate an electronic signature for your Illinois General Notice Of Default For Contract For Deed in the online mode

How to generate an electronic signature for the Illinois General Notice Of Default For Contract For Deed in Chrome

How to make an electronic signature for putting it on the Illinois General Notice Of Default For Contract For Deed in Gmail

How to make an eSignature for the Illinois General Notice Of Default For Contract For Deed straight from your mobile device

How to create an eSignature for the Illinois General Notice Of Default For Contract For Deed on iOS devices

How to make an eSignature for the Illinois General Notice Of Default For Contract For Deed on Android OS

People also ask

-

What is the Illinois General Notice Of Default For Contract For Deed?

The Illinois General Notice Of Default For Contract For Deed is a legal document that notifies a borrower of default on their contract for deed agreement. This notice is essential for initiating foreclosure proceedings and outlines the specific terms of the default. Understanding this document is crucial for both buyers and sellers involved in a contract for deed.

-

How can airSlate SignNow assist with the Illinois General Notice Of Default For Contract For Deed?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning the Illinois General Notice Of Default For Contract For Deed. Our user-friendly interface ensures that you can easily customize the document to meet legal requirements. This streamlines the process, allowing you to focus on resolving defaults quickly and effectively.

-

What features does airSlate SignNow offer for managing legal documents like the Illinois General Notice Of Default For Contract For Deed?

airSlate SignNow offers robust features such as customizable templates, electronic signature capabilities, and secure document storage for managing the Illinois General Notice Of Default For Contract For Deed. Additionally, our platform supports real-time collaboration, ensuring that all parties can review and sign documents efficiently.

-

Is airSlate SignNow cost-effective for small businesses dealing with contracts like the Illinois General Notice Of Default For Contract For Deed?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses handling documents such as the Illinois General Notice Of Default For Contract For Deed. Our competitive pricing plans are tailored to fit various budgets, enabling businesses to manage their legal documents without incurring high costs.

-

Can I integrate airSlate SignNow with other software for managing the Illinois General Notice Of Default For Contract For Deed?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to manage the Illinois General Notice Of Default For Contract For Deed alongside your existing tools. This interoperability enhances your workflow and ensures that you can maintain all necessary records and documents in one place.

-

What are the benefits of using airSlate SignNow for the Illinois General Notice Of Default For Contract For Deed?

Using airSlate SignNow for the Illinois General Notice Of Default For Contract For Deed offers numerous benefits, including speed, efficiency, and enhanced document security. Our platform simplifies the signing process, reduces paperwork, and ensures compliance with legal standards, making it easier for you to manage defaults effectively.

-

How secure is airSlate SignNow when handling sensitive documents like the Illinois General Notice Of Default For Contract For Deed?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect sensitive documents like the Illinois General Notice Of Default For Contract For Deed. Our platform adheres to industry standards for data protection, ensuring that your information remains confidential and secure throughout the signing process.

Get more for Illinois General Notice Of Default For Contract For Deed

Find out other Illinois General Notice Of Default For Contract For Deed

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template