Form Ct3 2015

What is the Form Ct3

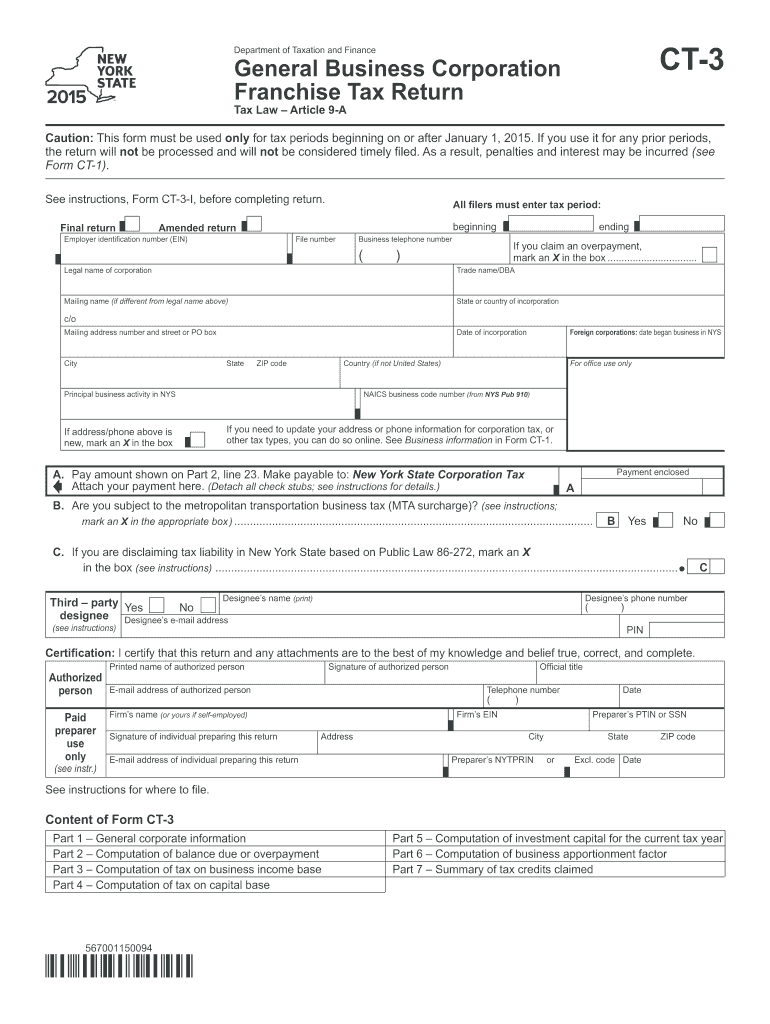

The Form Ct3 is a crucial tax document used primarily by corporations in the United States to report their income, deductions, and tax liabilities to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations and is typically filed annually. Corporations must accurately complete this form to determine their tax obligations and avoid potential penalties. Understanding the purpose and requirements of the Form Ct3 is vital for any corporation looking to maintain good standing with the IRS.

How to use the Form Ct3

Using the Form Ct3 involves a series of steps that require careful attention to detail. First, gather all necessary financial documents, including income statements, balance sheets, and prior year tax returns. Next, complete the form by entering the required information, ensuring that all figures are accurate and reflect the corporation's financial status. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the Form Ct3 to the IRS by the specified deadline to avoid penalties.

Steps to complete the Form Ct3

Completing the Form Ct3 involves several key steps:

- Gather financial records: Collect all relevant financial documents, including income statements and expense reports.

- Fill out the form: Enter the required information, including revenue, deductions, and tax credits.

- Review for accuracy: Check all entries for correctness to prevent errors that could lead to penalties.

- Submit the form: File the completed Form Ct3 with the IRS by the designated deadline.

Legal use of the Form Ct3

The legal use of the Form Ct3 is essential for corporations to fulfill their tax obligations. When completed accurately, this form serves as a legal document that reports a corporation's financial activities to the IRS. It is important to ensure that all information provided is truthful and complete, as inaccuracies can lead to audits, penalties, or legal ramifications. Compliance with IRS regulations regarding the Form Ct3 is crucial for maintaining the corporation's legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ct3 are critical for ensuring compliance with tax regulations. Typically, corporations must file the form by the fifteenth day of the fourth month following the end of their fiscal year. For corporations operating on a calendar year, this means the deadline is April 15. It is important to be aware of any extensions or changes to deadlines that may occur, as these can affect the timely submission of the form.

Required Documents

To complete the Form Ct3, several documents are required to ensure accurate reporting. These include:

- Income statements detailing revenue and expenses.

- Balance sheets showing the corporation's financial position.

- Prior year tax returns for reference and consistency.

- Documentation for any deductions or credits claimed.

Having these documents ready will facilitate a smoother completion process and help avoid errors.

Penalties for Non-Compliance

Failure to file the Form Ct3 on time or inaccuracies in reporting can result in significant penalties. These may include fines imposed by the IRS, interest on unpaid taxes, and potential legal action against the corporation. It is crucial for corporations to understand the importance of timely and accurate filing to avoid these consequences. Regularly reviewing tax obligations and maintaining organized financial records can help mitigate the risk of non-compliance.

Quick guide on how to complete form ct3 2015

Effortlessly Prepare Form Ct3 on Any Device

Managing documents online has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it digitally. airSlate SignNow provides all the resources you require to create, adjust, and electronically sign your documents swiftly and without delays. Manage Form Ct3 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related activity today.

The Easiest Way to Modify and Electronically Sign Form Ct3 with Ease

- Obtain Form Ct3 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious searches for forms, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form Ct3 and ensure excellent communication during every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct3 2015

Create this form in 5 minutes!

How to create an eSignature for the form ct3 2015

How to generate an eSignature for your Form Ct3 2015 in the online mode

How to generate an electronic signature for the Form Ct3 2015 in Chrome

How to make an eSignature for signing the Form Ct3 2015 in Gmail

How to make an eSignature for the Form Ct3 2015 straight from your mobile device

How to generate an eSignature for the Form Ct3 2015 on iOS

How to generate an electronic signature for the Form Ct3 2015 on Android

People also ask

-

What is Form Ct3 and why is it important for my business?

Form Ct3 is a critical tax form used by corporations to report their income and calculate their tax obligations. Utilizing airSlate SignNow to manage Form Ct3 ensures timely submission and compliance with tax regulations, ultimately saving your business from potential penalties.

-

How can airSlate SignNow help me complete and submit Form Ct3?

With airSlate SignNow, you can easily fill out Form Ct3 online, sign it digitally, and send it directly to the appropriate tax authorities. The platform's intuitive interface streamlines the entire process, making it simple for users to manage their tax documentation efficiently.

-

Is there a cost associated with using airSlate SignNow for Form Ct3?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses looking to manage Form Ct3 and other documents. Our plans are competitively priced, providing a cost-effective solution that enhances document workflow without compromising on quality.

-

What features does airSlate SignNow offer for managing Form Ct3?

AirSlate SignNow provides a range of features for managing Form Ct3, including customizable templates, eSignature capabilities, and secure document storage. These features make it easy to complete and organize your tax forms, ensuring you have everything you need at your fingertips.

-

Can I integrate airSlate SignNow with other software for Form Ct3 management?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to seamlessly manage Form Ct3 alongside your existing software solutions. Whether you use accounting software or customer relationship management tools, integration is straightforward and efficient.

-

What are the benefits of using airSlate SignNow for Form Ct3 over traditional methods?

Using airSlate SignNow for Form Ct3 offers numerous benefits over traditional paper methods, including faster processing times, reduced errors, and enhanced security. Additionally, digital document management saves physical space and increases accessibility for your team.

-

Is airSlate SignNow secure for handling sensitive information on Form Ct3?

Yes, airSlate SignNow prioritizes security, ensuring that all data related to Form Ct3 is encrypted and stored safely. Our platform complies with industry standards, so you can trust that your sensitive information is protected throughout the document signing process.

Get more for Form Ct3

- Temporary lodging expense form

- Speed of light by voigt form

- Nc topps mental health and substance abuse child ages 6 11 ncdhhs form

- Fire drill record templatepdffillercom form

- Op 175 fillable form 11916445

- Accounting form 2012

- Nyc uxp form

- Blue coats scholarship apppdf university of louisville louisville form

Find out other Form Ct3

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment