Ny it 2105 2015

What is the NY IT 2105?

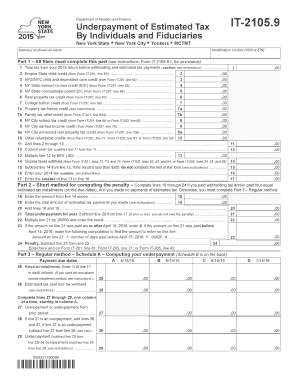

The NY IT 2105 is a tax form used by individuals and businesses in New York State to report certain types of income. Specifically, it is designed for non-residents and part-year residents who have income sourced from New York State. This form aids in determining the appropriate tax liability based on the income earned within the state during the tax year. Understanding the NY IT 2105 is crucial for compliance with state tax regulations and ensuring accurate reporting of income.

How to Use the NY IT 2105

To effectively use the NY IT 2105, individuals must first gather all relevant financial information, including income statements and any applicable deductions. The form requires detailed reporting of income earned in New York, alongside any credits or deductions that may apply. It is essential to fill out the form accurately to avoid issues with the New York State Department of Taxation and Finance. Once completed, the form can be submitted either electronically or by mail, depending on the taxpayer's preference.

Steps to Complete the NY IT 2105

Completing the NY IT 2105 involves several key steps:

- Gather all necessary documentation, including W-2s and 1099s.

- Determine your residency status for the tax year.

- Fill out the form, ensuring all income sources are accurately reported.

- Calculate any deductions or credits you are eligible for.

- Review the completed form for accuracy before submission.

- Submit the form electronically or mail it to the appropriate tax office.

Legal Use of the NY IT 2105

The NY IT 2105 is legally binding when filled out correctly and submitted on time. Compliance with state tax laws is essential to avoid penalties. The form must be signed and dated by the taxpayer, and it is advisable to keep copies of all submitted documents for personal records. Adhering to the guidelines set forth by the New York State Department of Taxation and Finance ensures that the form is used legally and effectively.

Filing Deadlines / Important Dates

Filing deadlines for the NY IT 2105 typically align with the federal tax filing deadlines. For most taxpayers, the due date is April fifteenth of the following year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is crucial to stay informed about any changes to these deadlines to ensure timely filing and avoid late fees or penalties.

Required Documents

When completing the NY IT 2105, several documents are necessary to support your income claims and deductions. These may include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Documentation for deductions, such as receipts or statements

Having these documents ready can streamline the process of filling out the form and ensure accuracy in reporting.

Quick guide on how to complete it 2105 9 2015 form

Effortlessly prepare Ny It 2105 on any device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the correct forms and securely store them online. airSlate SignNow supplies all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Handle Ny It 2105 on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process right now.

How to edit and eSign Ny It 2105 with ease

- Locate Ny It 2105 and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to send your form: via email, text (SMS), invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Ny It 2105 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 2105 9 2015 form

Create this form in 5 minutes!

How to create an eSignature for the it 2105 9 2015 form

How to generate an electronic signature for the It 2105 9 2015 Form online

How to create an electronic signature for the It 2105 9 2015 Form in Google Chrome

How to generate an eSignature for signing the It 2105 9 2015 Form in Gmail

How to create an eSignature for the It 2105 9 2015 Form right from your smart phone

How to make an electronic signature for the It 2105 9 2015 Form on iOS

How to create an eSignature for the It 2105 9 2015 Form on Android

People also ask

-

What is the Ny It 2105 form, and how does airSlate SignNow help with it?

The Ny It 2105 form is a New York State tax form used for personal income tax filings. With airSlate SignNow, businesses can easily send and eSign the Ny It 2105, streamlining the process of document management and ensuring compliance with state regulations.

-

How much does airSlate SignNow cost for handling Ny It 2105 forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective for managing forms like the Ny It 2105. You can choose from various subscription tiers, allowing you to select the option that best fits your budget and requirements.

-

What features does airSlate SignNow provide for the Ny It 2105?

airSlate SignNow provides a range of features tailored for the Ny It 2105, including customizable templates, secure eSigning, and real-time tracking. These features ensure that your tax documents are processed efficiently and securely, saving you time and reducing errors.

-

Can I integrate airSlate SignNow with other software for Ny It 2105 management?

Yes, airSlate SignNow offers seamless integrations with popular software applications, enhancing your workflow for managing the Ny It 2105. You can connect with platforms like Google Drive, Dropbox, and CRM systems to streamline your document handling and eSigning processes.

-

Is airSlate SignNow secure for handling sensitive Ny It 2105 tax information?

Absolutely! airSlate SignNow prioritizes security, implementing advanced encryption and compliance measures to protect sensitive information, including the Ny It 2105 tax data. This ensures that your documents remain confidential and secure throughout the signing process.

-

How does airSlate SignNow improve the efficiency of completing the Ny It 2105?

By utilizing airSlate SignNow, businesses can signNowly enhance the efficiency of completing the Ny It 2105. The platform allows for quick eSigning and document sharing, reducing turnaround times and enabling faster tax filing.

-

What benefits does airSlate SignNow offer for small businesses using Ny It 2105?

For small businesses, airSlate SignNow offers numerous benefits when dealing with the Ny It 2105, including cost savings, user-friendly interfaces, and robust support. These advantages help small businesses manage their tax documents more effectively without incurring high costs.

Get more for Ny It 2105

- Sample monthly medication log administration record form

- Navy sop form

- Menu plannerpdffillercom form

- Tdcj employee performance log tdcj state tx

- Tb skin test form

- Adult residential license through pennsylvania department of public welfare form

- Va travel reimbursement direct deposit form

- Texas jurisprudence study guide form

Find out other Ny It 2105

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template