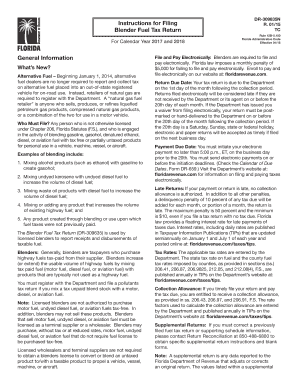

General Information Instructions for Filing Blender Fuel Tax Return 2017

What is the General Information Instructions For Filing Blender Fuel Tax Return

The General Information Instructions for Filing Blender Fuel Tax Return provides essential guidelines for taxpayers who blend different types of fuel and need to report their activities to the appropriate tax authorities. This document outlines the necessary steps, requirements, and legal considerations involved in completing the tax return accurately. Understanding these instructions is crucial for compliance with federal regulations and ensuring that all tax obligations are met.

Steps to Complete the General Information Instructions For Filing Blender Fuel Tax Return

Completing the General Information Instructions for Filing Blender Fuel Tax Return involves several important steps:

- Gather all relevant documentation, including records of fuel purchases and blending activities.

- Review the specific instructions provided for the form to understand the required information.

- Fill out the form carefully, ensuring all sections are completed accurately.

- Calculate the total tax liability based on the blended fuel amounts and applicable rates.

- Submit the completed form by the designated deadline, either electronically or via mail.

Legal Use of the General Information Instructions For Filing Blender Fuel Tax Return

The legal use of the General Information Instructions for Filing Blender Fuel Tax Return is governed by federal tax laws. It is important to ensure that the information provided is accurate and truthful to avoid potential legal repercussions. The use of electronic signatures is recognized as legally binding under the ESIGN and UETA acts, provided that proper authentication measures are in place. This ensures that the form is executed in compliance with legal standards.

Filing Deadlines / Important Dates

Timely filing of the Blender Fuel Tax Return is crucial to avoid penalties. Key deadlines include:

- Quarterly filing due dates, typically within one month after the end of each quarter.

- Annual filing deadlines for those who opt for annual reporting.

- Specific dates for submitting any amendments or corrections to previously filed returns.

Required Documents

To complete the General Information Instructions for Filing Blender Fuel Tax Return, several documents are necessary:

- Records of all fuel transactions, including invoices and receipts.

- Documentation of blending activities, detailing the types and quantities of fuel blended.

- Previous tax returns, if applicable, for reference and consistency.

Form Submission Methods (Online / Mail / In-Person)

The General Information Instructions for Filing Blender Fuel Tax Return can be submitted through various methods, including:

- Online submission through the designated tax authority’s electronic filing system.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if available.

Penalties for Non-Compliance

Failure to comply with the requirements of the General Information Instructions for Filing Blender Fuel Tax Return can result in significant penalties. These may include:

- Monetary fines based on the amount of tax due.

- Interest charges on unpaid taxes.

- Potential legal action for repeated non-compliance or fraudulent activity.

Quick guide on how to complete general information instructions for filing blender fuel tax return

Prepare General Information Instructions For Filing Blender Fuel Tax Return effortlessly on any device

Online document management has gained increased traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage General Information Instructions For Filing Blender Fuel Tax Return on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign General Information Instructions For Filing Blender Fuel Tax Return effortlessly

- Locate General Information Instructions For Filing Blender Fuel Tax Return and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign General Information Instructions For Filing Blender Fuel Tax Return and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct general information instructions for filing blender fuel tax return

Create this form in 5 minutes!

How to create an eSignature for the general information instructions for filing blender fuel tax return

How to create an eSignature for the General Information Instructions For Filing Blender Fuel Tax Return in the online mode

How to make an eSignature for your General Information Instructions For Filing Blender Fuel Tax Return in Chrome

How to make an electronic signature for signing the General Information Instructions For Filing Blender Fuel Tax Return in Gmail

How to create an eSignature for the General Information Instructions For Filing Blender Fuel Tax Return right from your smart phone

How to make an electronic signature for the General Information Instructions For Filing Blender Fuel Tax Return on iOS devices

How to make an eSignature for the General Information Instructions For Filing Blender Fuel Tax Return on Android devices

People also ask

-

What are the General Information Instructions For Filing Blender Fuel Tax Return?

The General Information Instructions For Filing Blender Fuel Tax Return provide detailed guidelines on how to complete the tax return accurately. They cover essential aspects such as eligibility, required forms, and deadlines to ensure compliance with tax regulations. It's crucial for businesses involved in blending fuels to understand these instructions thoroughly.

-

How can airSlate SignNow help with filing the Blender Fuel Tax Return?

airSlate SignNow streamlines the process of filing the Blender Fuel Tax Return by allowing users to eSign and send documents securely and efficiently. With our platform, you can easily manage your tax forms and related documents, ensuring that you adhere to the General Information Instructions For Filing Blender Fuel Tax Return. This simplifies your workflow and reduces the risk of errors.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, automated reminders, and secure cloud storage to assist with tax document management. These tools enable users to follow the General Information Instructions For Filing Blender Fuel Tax Return more effectively, ensuring that all necessary documents are completed and submitted on time.

-

Is there a cost associated with using airSlate SignNow for filing taxes?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our cost-effective solutions provide you with access to tools that facilitate compliance with the General Information Instructions For Filing Blender Fuel Tax Return, making it a worthwhile investment for businesses looking to streamline their tax filing processes.

-

Can I integrate airSlate SignNow with other software for tax filing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to manage the Blender Fuel Tax Return process. By utilizing these integrations, you can ensure that your submissions align with the General Information Instructions For Filing Blender Fuel Tax Return, improving accuracy and efficiency.

-

What are the benefits of using airSlate SignNow for tax returns?

Using airSlate SignNow for tax returns offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By following the General Information Instructions For Filing Blender Fuel Tax Return through our platform, users can minimize the chances of errors and ensure timely submissions, leading to smoother tax filing experiences.

-

Is airSlate SignNow user-friendly for those new to tax filing?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for individuals new to tax filing. Our platform provides intuitive navigation and helpful resources to guide users through the General Information Instructions For Filing Blender Fuel Tax Return, ensuring that everyone can manage their tax documents with confidence.

Get more for General Information Instructions For Filing Blender Fuel Tax Return

Find out other General Information Instructions For Filing Blender Fuel Tax Return

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT