De 4p 2011

What is the de 4p?

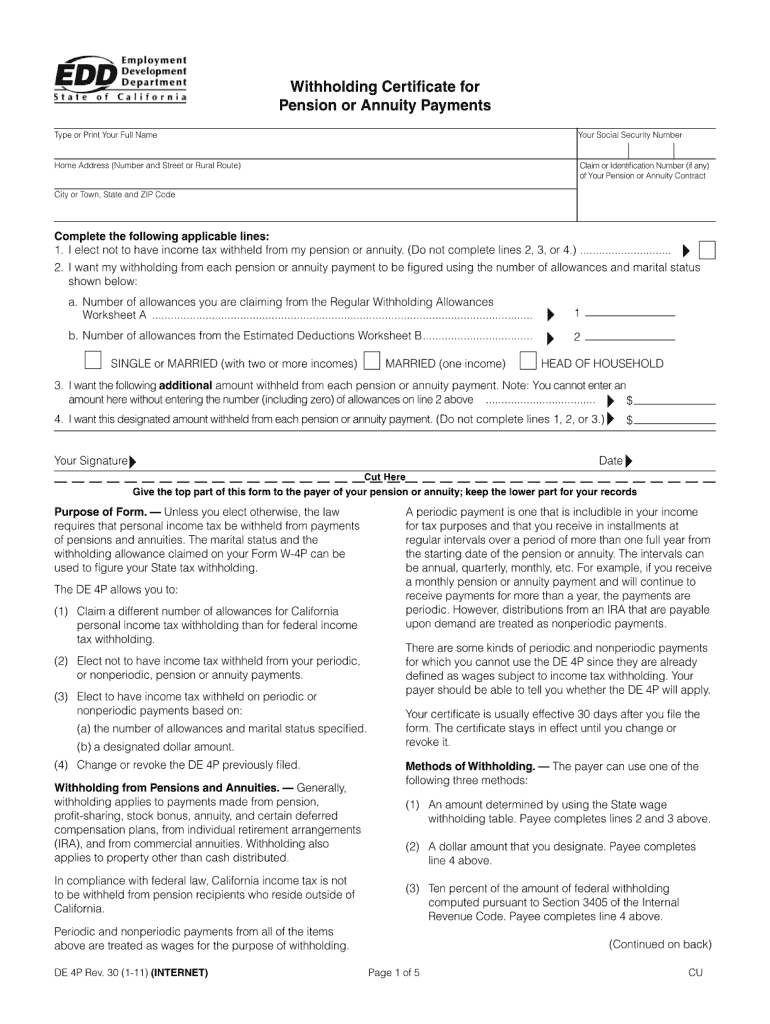

The de 4p form, also known as the California Withholding Allowance Certificate, is an essential document for employees in California. It is used to determine the amount of state income tax that should be withheld from an employee's paycheck. By completing this form, employees can indicate their withholding preferences based on their personal circumstances, such as marital status and the number of dependents. This form plays a crucial role in ensuring that the correct amount of tax is withheld throughout the year, helping to avoid underpayment or overpayment of taxes.

How to use the de 4p

Using the de 4p form involves a straightforward process. First, employees need to obtain the form from their employer or download it from the California state website. Once in possession of the form, they should fill it out accurately, providing information such as their name, address, and Social Security number. Employees must also indicate their filing status and the number of allowances they wish to claim. After completing the form, it should be submitted to the employer's payroll department to ensure that the correct withholding amount is applied to their paychecks.

Steps to complete the de 4p

Completing the de 4p form requires careful attention to detail. Follow these steps:

- Obtain the de 4p form from your employer or the California state website.

- Fill in your personal information, including your full name, mailing address, and Social Security number.

- Choose your filing status: single, married, or head of household.

- Determine the number of allowances you are eligible to claim based on your personal situation.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer’s payroll department.

Legal use of the de 4p

The legal use of the de 4p form is governed by California tax laws. It is important for employees to understand that the information provided on this form must be truthful and accurate. Misrepresentation or false claims can lead to penalties, including fines or increased tax liabilities. The de 4p form is legally binding, and employers are required to adhere to the withholding amounts indicated by their employees. This ensures compliance with state tax regulations and helps maintain the integrity of the tax system.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for employees completing the de 4p form. While there is no specific deadline for submitting the form itself, it should be completed and submitted to the employer as soon as employment begins or when there is a change in personal circumstances. Additionally, employees should keep in mind that adjustments to withholding can affect their tax obligations, so timely submission is essential for accurate withholding throughout the year.

Form Submission Methods (Online / Mail / In-Person)

Submitting the de 4p form can be done through various methods, depending on the employer's preferences. Typically, the form is submitted in person to the payroll department. However, some employers may allow electronic submissions through their payroll systems. It is advisable to check with the employer regarding their preferred submission method. In rare cases, if an employee is unable to submit the form in person or electronically, mailing the completed form may be an option, but this should be confirmed with the employer first.

Key elements of the de 4p

The de 4p form includes several key elements that are essential for accurate tax withholding. These elements consist of:

- Employee's personal information, including name and Social Security number.

- Filing status options: single, married, or head of household.

- Number of allowances claimed, which directly impacts withholding amounts.

- Signature and date, certifying the accuracy of the information provided.

Quick guide on how to complete de 4p

Complete De 4p effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a fantastic environmentally friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without any delays. Manage De 4p on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign De 4p with ease

- Locate De 4p and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), an invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and eSign De 4p and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct de 4p

Create this form in 5 minutes!

How to create an eSignature for the de 4p

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is airSlate SignNow and how does it relate to de 4p?

airSlate SignNow is a comprehensive eSignature solution designed to streamline the document signing process. It incorporates de 4p features, making it easy for businesses to send, sign, and manage documents efficiently.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose. We offer competitive pricing tailored to the needs of users looking for an effective de 4p solution, ensuring that you get the best value for your investment.

-

What features does airSlate SignNow offer for de 4p?

airSlate SignNow includes a variety of features specifically designed for de 4p. These include customizable templates, advanced security measures, and real-time tracking, all aimed at enhancing your document signing experience.

-

How can airSlate SignNow benefit my business with de 4p?

By utilizing airSlate SignNow, businesses can signNowly reduce the time and costs associated with document signing. The efficiency provided by de 4p not only accelerates workflows but also improves overall customer satisfaction.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with numerous applications, allowing you to incorporate de 4p into your existing workflows. This means you can connect it with tools you already use, enhancing productivity and ease of use.

-

Is airSlate SignNow secure for signing documents related to de 4p?

Absolutely! airSlate SignNow employs top-notch security features that comply with industry standards, ensuring that your de 4p documents remain protected. This includes encryption and secure storage to safeguard sensitive information.

-

Can I use airSlate SignNow for mobile signing with de 4p?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to send and sign documents on-the-go with de 4p. This mobile functionality ensures that you can manage your important documents easily and efficiently, irrespective of your location.

Get more for De 4p

Find out other De 4p

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation