1120 Fillable Form

What is the 1120 Fillable Form

The 1120 Fillable Form is a U.S. federal tax form used by corporations to report income, gains, losses, deductions, and credits. This form is essential for C corporations as it provides the IRS with a comprehensive overview of the company's financial activities for the tax year. The form includes various lines and schedules that allow corporations to detail their income sources, expenses, and other financial information. By using a fillable version, businesses can easily complete and submit the form electronically, ensuring accuracy and efficiency in their tax reporting.

Steps to complete the 1120 Fillable Form

Completing the 1120 Fillable Form involves several key steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements, balance sheets, and receipts for deductions. Next, access the fillable form through a reliable platform that supports electronic signatures and submissions. Carefully fill in each section, starting with basic information about the corporation, such as its name, address, and Employer Identification Number (EIN). Then, proceed to report income and deductions, ensuring that all figures are accurate and supported by documentation. After completing the form, review it thoroughly for any errors before submitting it electronically or printing it for mail submission.

IRS Guidelines

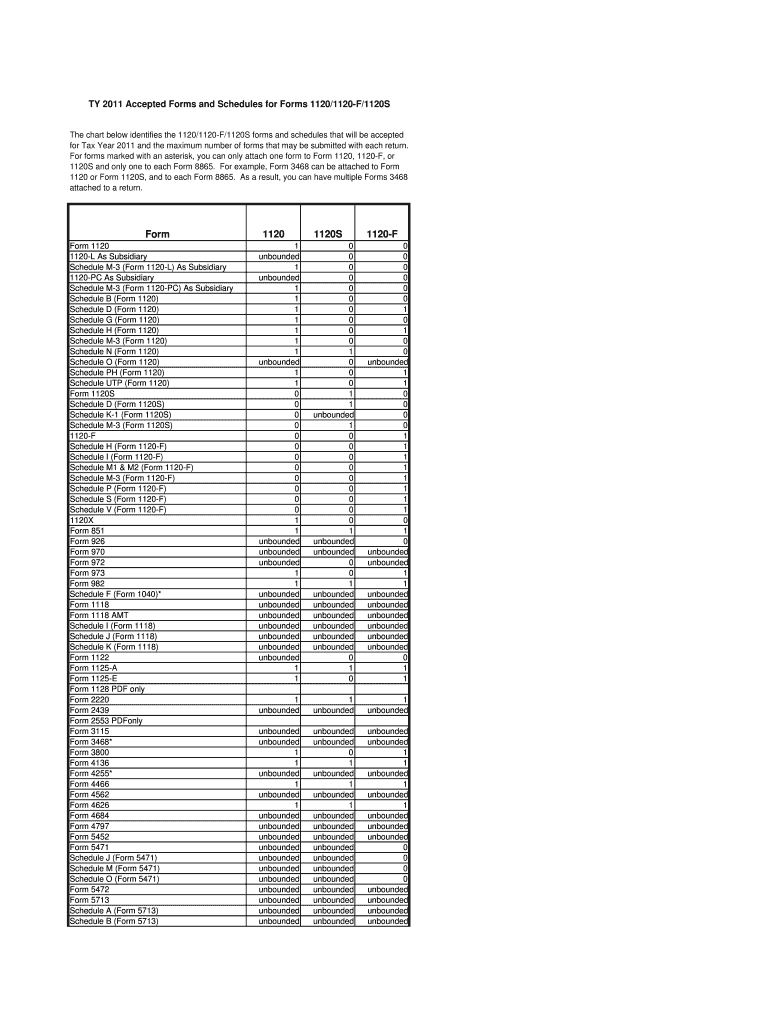

The IRS provides specific guidelines for completing the 1120 Fillable Form to ensure compliance with federal tax laws. These guidelines include instructions on how to report various types of income, allowable deductions, and credits. Corporations must adhere to the latest tax laws and regulations, which may change annually. It is crucial to consult the IRS instructions accompanying the form, as they offer detailed explanations of each line item and any relevant schedules that may need to be attached. Following these guidelines helps minimize the risk of errors and potential penalties during the filing process.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the 1120 Fillable Form to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April fifteenth. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may also apply for an automatic six-month extension to file, but this does not extend the time to pay any taxes owed.

Required Documents

To complete the 1120 Fillable Form accurately, corporations need to gather several required documents. These include financial statements, such as profit and loss statements, balance sheets, and records of all income and expenses. Additionally, documentation supporting any deductions claimed, such as receipts and invoices, should be collected. Having these documents organized and readily available simplifies the process of completing the form and ensures that all reported figures are accurate and substantiated.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the 1120 Fillable Form can result in significant penalties for corporations. The IRS imposes fines for late filings, which can accumulate daily until the form is submitted. Additionally, inaccuracies on the form may lead to further scrutiny and potential audits. Corporations may also face interest charges on any unpaid taxes. To avoid these penalties, it is essential to file the form on time and ensure that all information is complete and accurate.

Quick guide on how to complete 1120 fillable form

Complete 1120 Fillable Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any holdups. Manage 1120 Fillable Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign 1120 Fillable Form effortlessly

- Locate 1120 Fillable Form and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign 1120 Fillable Form and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How do I fill out a fillable PDF on an iPad?

there is an app for that !signNow Fill & Sign on the App Store

-

How do I transfer data from Google Sheets cells to a PDF fillable form?

I refer you a amazing pdf editor, her name is Puspita, She work in fiverr, She is just amazing, Several time I am use her services. You can contact with her.puspitasaha : I will create fillable pdf form or edit pdf file for $5 on www.fiverr.com

-

How do I send a fillable form by email?

Well, contrary to the belief of some people, you CAN send a fillable form by email, the platform just has to support the Interactive Email feature(which is basically a micro site).

Create this form in 5 minutes!

How to create an eSignature for the 1120 fillable form

How to generate an eSignature for the 1120 Fillable Form in the online mode

How to generate an eSignature for your 1120 Fillable Form in Google Chrome

How to generate an electronic signature for signing the 1120 Fillable Form in Gmail

How to make an electronic signature for the 1120 Fillable Form right from your mobile device

How to make an electronic signature for the 1120 Fillable Form on iOS devices

How to create an eSignature for the 1120 Fillable Form on Android devices

People also ask

-

What is the 1120 Fillable Form?

The 1120 Fillable Form is a tax form used by corporations to report their income, gains, losses, and taxes owed to the Internal Revenue Service (IRS). With airSlate SignNow, you can easily create, fill out, and eSign this form, ensuring your tax filing is accurate and compliant. Our platform streamlines the process, making it simple for businesses to manage their tax documents.

-

How can airSlate SignNow help with the 1120 Fillable Form?

airSlate SignNow provides a user-friendly interface that allows you to fill out the 1120 Fillable Form electronically. By using our platform, you can save time and reduce errors by filling out the form digitally, and you can securely eSign it, ensuring a smooth submission process. Our solution is designed to make tax compliance efficient and hassle-free.

-

Is the 1120 Fillable Form available for free on airSlate SignNow?

While airSlate SignNow offers a variety of pricing plans, the 1120 Fillable Form is included in our subscription packages. We provide a cost-effective solution that allows you to fill out, eSign, and manage your tax documents without hidden fees. This makes it an economical choice for businesses looking to streamline their tax filing processes.

-

Can I integrate airSlate SignNow with other software for managing the 1120 Fillable Form?

Yes, airSlate SignNow offers integrations with popular accounting and tax software, allowing you to manage your 1120 Fillable Form seamlessly. By connecting your existing tools, you can enhance your workflow and ensure that all your tax-related documents are organized in one place. This integration capability simplifies the entire process for businesses.

-

What features does airSlate SignNow provide for the 1120 Fillable Form?

airSlate SignNow offers multiple features for the 1120 Fillable Form, including easy document creation, electronic signatures, and secure storage. You can also track the status of your form and receive notifications when it has been signed. Our platform enhances collaboration and ensures that your tax documents are processed efficiently.

-

How do I access the 1120 Fillable Form on airSlate SignNow?

To access the 1120 Fillable Form on airSlate SignNow, simply sign up for an account and navigate to our document library. From there, you can search for the 1120 Fillable Form, fill it out online, and eSign it with ease. Our intuitive platform ensures that you can find and manage your tax forms quickly.

-

What are the benefits of using airSlate SignNow for the 1120 Fillable Form?

Using airSlate SignNow for the 1120 Fillable Form offers numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform eliminates the need for paper forms, reducing your environmental footprint and ensuring that your information is stored safely. Additionally, eSigning eliminates the hassle of printing and scanning documents.

Get more for 1120 Fillable Form

- Illinois court of claims illinois secretary of state form

- Dv 109 form

- Mi summons 2012 2019 form

- Court proof service form

- Illinois petitioner investigative alcoholdrug evaluation form

- Hearing officer facility locations illinois secretary of state form

- Illinois court of claims illinois secretary of state 6966502 form

- 2017 m4 corporation franchise tax return form

Find out other 1120 Fillable Form

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer