Ihs 810 2009-2026

What is the IHS 810?

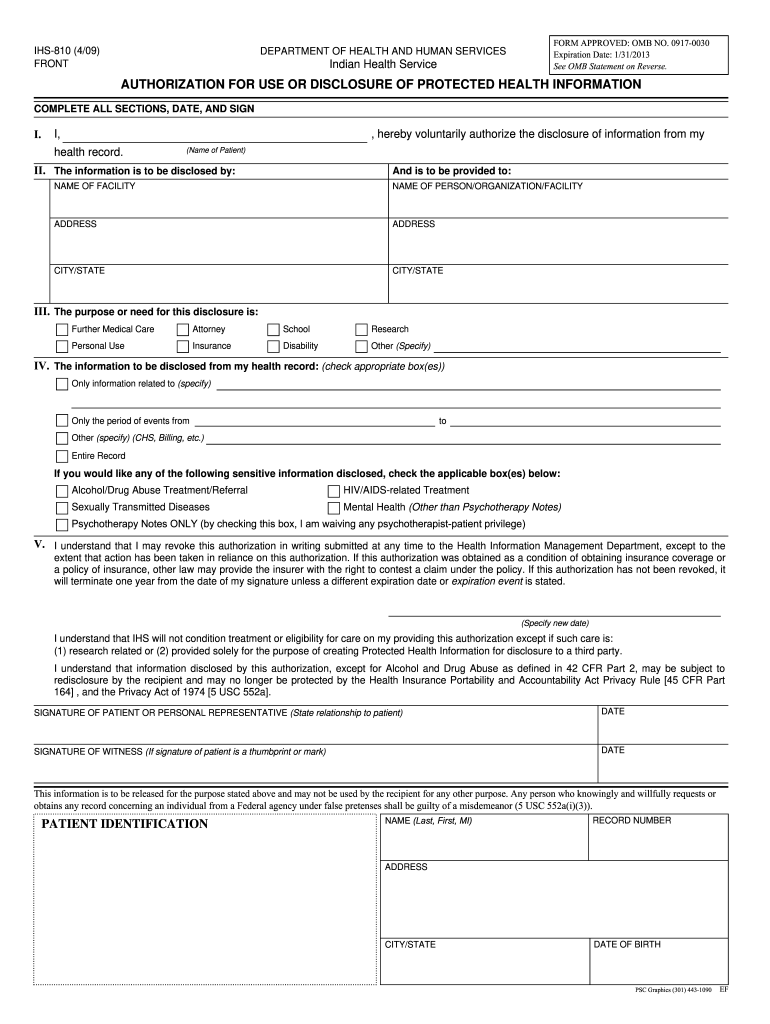

The IHS 810 form, also known as the Authorization for Use and Disclosure of Protected Health Information, is a crucial document used within the Indian Health Service (IHS) framework. It allows patients to authorize the release of their protected health information (PHI) to designated individuals or entities. This form ensures compliance with the Health Insurance Portability and Accountability Act (HIPAA), safeguarding patient privacy while facilitating necessary information sharing for healthcare purposes.

How to use the IHS 810

Using the IHS 810 form involves several straightforward steps. First, individuals must clearly identify the specific information they wish to disclose, including the purpose of the disclosure and the parties receiving the information. Next, the patient must complete the form by providing necessary personal details, including their name, date of birth, and contact information. After filling out the form, it should be signed and dated by the patient or their legal representative to validate the authorization. Finally, the completed form can be submitted to the appropriate IHS facility or healthcare provider for processing.

Steps to complete the IHS 810

Completing the IHS 810 form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the IHS 810 form from an authorized IHS source.

- Fill in your personal information, including your full name, date of birth, and contact details.

- Clearly specify the information you wish to disclose and the purpose of the disclosure.

- Identify the individuals or organizations that will receive your information.

- Sign and date the form, ensuring that all required fields are completed.

- Submit the form to your healthcare provider or the designated IHS office.

Legal use of the IHS 810

The IHS 810 form is legally binding and must comply with HIPAA regulations. It is essential for ensuring that patient information is shared appropriately and with the patient's consent. The form protects both the patient and the healthcare provider by establishing clear guidelines on how and when PHI can be disclosed. Understanding the legal implications of using this form is vital for both patients and healthcare professionals to maintain compliance and protect patient rights.

Disclosure Requirements

When using the IHS 810 form, specific disclosure requirements must be met. Patients must provide explicit consent for the release of their protected health information, detailing what information is to be disclosed and to whom. The form must also specify the purpose of the disclosure, ensuring that it aligns with legal standards. Additionally, patients have the right to revoke their authorization at any time, which must be documented appropriately to ensure compliance with HIPAA regulations.

Examples of using the IHS 810

There are various scenarios where the IHS 810 form may be utilized. For instance, a patient may need to authorize their primary care physician to share medical records with a specialist for further evaluation. Another example includes a patient allowing a family member to access their health information for caregiving purposes. Each scenario underscores the importance of patient consent and the legal framework that governs the sharing of protected health information.

Quick guide on how to complete disclosure protected information

The optimal method to discover and endorse Ihs 810

On the scale of an entire organization, ineffective workflows surrounding document authorization can consume signNow work hours. Executing documents such as Ihs 810 is an inherent aspect of operations in any corporation, which is why the efficiency of each agreement’s lifecycle critically impacts the overall performance of the business. With airSlate SignNow, endorsing your Ihs 810 can be as straightforward and rapid as possible. You’ll find with this platform the most recent version of nearly any form. Even better, you can sign it instantly without needing to install external applications on your device or produce any hard copies.

How to obtain and endorse your Ihs 810

- Browse our collection by category or use the search bar to identify the form you require.

- View the form preview by clicking Learn more to confirm it is the correct one.

- Click Get form to start editing immediately.

- Fill out your form and insert any essential information using the toolbar.

- Upon completion, click the Sign tool to endorse your Ihs 810.

- Select the signature method that suits you best: Draw, Generate initials, or upload a photo of your handwritten signature.

- Click Done to conclude editing and move on to document-sharing options if needed.

With airSlate SignNow, you possess all you require to manage your documentation efficiently. You can find, complete, modify, and even dispatch your Ihs 810 within a single tab without complications. Optimize your workflows with a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Given that nothing in the US Constitution gives citizens or the president a right to keep tax returns secret, shouldn’t Federalist Supreme Court justices agree that statutes requiring presidents or candidates to release their tax returns are valid?

The US Constitution is a set of restrictions on the domain and powers of the government, not citizens. The Bill of Rights specifically denies the government any power to infringe on certain basic natural rights, and the Ninth Amendment says that this is not an exclusive list. There may be other rights not specifically listed, which shall also not be infringed by government.US statutes guarantee the rights of citizens to strict confidentiality regarding the information they submit to the IRS for their taxes. The IRS has by its charter a clear obligation to protect the confidentiality of those records, including from other government agencies. Congress has some extremely limited authority to request tax information, but there has to be a genuine reason for a genuine legislative purpose, and it is patently clear that one person’s tax returns are not going to be materially critical to how Congress writes tax laws. Aggregate information on a large number of taxpayers may be useful for some legitimate purpose, but individual data and identities would not be disclosed. So that is a dead end for the Democrats.The stated reason of the Ways and Means Committee was to determine if the President’s taxes were being properly audited. Not a single person on that committee is a currently certified CPA and licensed practicing tax attorney, so none are qualified to audit anybody’s taxes, much less anything as complex and arcane as a multi-billionaire with business interests in hundreds of companies around the world. The premise is preposterous. All they need is a certification by the IRS Director that yes, they have audited his taxes…. No need or authority to see his tax returns. Seeing his tax returns would do nothing to answer the purpose specified by the request.The requests by the Democrat-run committees fail every smell test of legitimacy, and are brazen and obvious fishing expeditions and witch hunts. Of course the opposition Party wants to pore through his taxes to find grist for the Hate Trump Derangement Syndrome, especially since Mueller, Barr, and Rosenstein all exonerated him on all counts of collusion, conspiracy, or obstruction. The Democrats desperately need new ammunition to try to invalidate his Presidency and fabricate any excuse to impeach him.Being President doesn’t strip anyone of their legal and civil rights. Presidential candidates have filled out detailed financial disclosures that provide a list of every debt they owe and all their business interests. Obviously Democrats cannot find anything incriminating or embarrassing in that, so they want to mine his private tax records for any possible dirt they can find or allege.Do they really think that even if he were engaged in some kind of criminal activity, for which there is no evidence whatsoever to justify an investigation, that he would report it on his tax returns? Give me a break.

-

How can I add my business location on instagram"s suggested locations?

Making a custom location on Instagram is actually quite easy and gives you an advantage to other businesses because it allows you to drive traffic via location.First off, Facebook owns Instagram; therefore, any location listed on Facebook also appears on Instagram. So you are going to need to create a business location on Facebook.So let’s dive into how to create a business location on Instagram.Make sure that you have enabled location services through the Facebook App or in your phone settings. If you are using an iPhone, select “Settings” → “Account Settings” → “Location” → “While Using The App”You need to create a Facebook check-in status. You do this by making a status and type the name of what you want your location to be called. For example “Growth Hustlers HQ”. Scroll to the bottom of the options and select “Add Custom Location” then tap on it!Now that you’ve created a custom location you need to describe it. It will ask you to choose which category describes your location, which you will answer “Business”.After choosing a category Facebook will ask you to choose a location. You can either choose “I’m currently here” or you can search for a location that you want to create for your business.Finally, publish your status. Congratulations! You have just created a custom location to be used on Facebook and Instagram.Now you are able to tag your business or a custom location on Instagram.If you have any questions about Social Media Marketing for businesses feel free to check out GrowthHustlers.com where you can find tons of resources about growing your Instagram following.

-

How can I learn mutual funds investment?

Its not that complex… Here, i have written everything you need to know about Mutual funds. Read this, you can start investing without anyone’s help.Mutual fund is like fixed deposit where we deposit our money and it will give us return.There are three types of mutual funds, they are debt fund, equity fund & balanced fund.Debt fund is similar to Bank. When we invest our money in debt fund, fund house will use our money to give loans to private companies or Indian government or State government.Debt fund - Risk is low. Return is around 8%. If you withdraw money within 3 years, you need to pay tax based on your income tax slab (like 10% or 20% or 30%). If you withdraw after 3 years, you need to pay 20% tax with indexation.Indexation: 20% tax with indexation means you will be discounting inflation while paying tax. So you will be paying less tax after discounting inflation (less than 15%)Inflation: Inflation is most important factor when comes to finance. It means decrease in purchasing power of money. To give you an example, before 10 years Rs.10 is a big amount. But now??? In 10 years from now Rs.10 will be nothing. Thats the inflation, every year value of money will get reduced. Government regularly release inflation details.There are many types of debt funds like gilt, income, short term, liquid, ultra short term.Gilt fund - your money will be loaned to government. Risk is very low since borrower is Government.Income fund - you will receive monthly income. Suitable for retired people.Liquid fund - you can withdraw your money anytime without any charges. It is like savings account.Short term or Ultra short term - if you like to invest only for some months.Let me warn you, debt funds are not risk free. They too carry some risk. Sometimes company default loans (Vijay Mallya, Nirav Modi). Then there is a risk of interest rate.If like to invest with minimal risk, then open the debt fund in valueresearchonline website. There you will find the below diagram (or chart?). Good low risk debt fund should have black box in red area. The meaning is, the fund is less sensitive to interest rate change and has good credit quality.Equity fund. As the name says, your money will get invested in Share market.Equity fund is riskier than debt fund. But it gives good return like 12% to 25%. If you withdraw withing an year you need to pay short term capital gain tax of 15%. If you withdraw after 1 year and if your return is more than 1 lakh, you need to pay capital gain tax of 10%.It is recommended to hold equity mutual funds at least 5 years to see decent return.Equity mutual funds comes in many types like large cap, mid cap, small cap, sector.Large cap or Bluechip fund - your money will get invested in big companies. Risk is low and return is around 10% - 13%.Mid cap fund - your money will get invested in medium size companies. Return is more than 13%. Medium risk.Small cap fund - your money will get invested in small companies. Very risky but good return, more than 20%.Sector fund - your money will get invested in companies in specific sector. For example, Equity Infra fund means, your money will get invested in Infrastructure companies. Return varies based on sector, but it will be more than 15%.Index fund - Return is around 10%. Medium risk.What is index fund? There are many indices in India like Nifty, Sensex, Bank nifty, etc., Each index comprise of many companies with different weightage. For example, Nifty comprise of top 50 companies in NSE. If you invest your money in Nifty index fund, it is like investing in top 50 companies in NSE.ELSS - It is tax saving mutual fund. You can save tax under Section 80C. It is getting popular now. Lock in period is 3 years. Return is around 12%.Arbitrage fund - It is very very low risk equity fund. Arbitrage fund won’t get affected by markets up and down. Return is 8%. Taxing is same as equity mutual funds.Balanced or Hybrid fund. It is mix of Equity and Debt fund. (65% equity and 35% debt). Low risk. Return around 12%. Taxation is similar to equity fund.First, choose fund type based on your risk potential (like debt or equity or balanced).If you are retired person or if you don’t want to take any risks then choose Debt funds.If you like to take only small amount of risk, choose balanced fund.If you earn average income, then choose balanced fund or large cap or both.If you fall under huge income category, then mix large cap, mid cap and small cap.To choose fund, visit Funds - Value Research Online. Here are the list of things to note while choosing fund…See the fund’s performance from inception. See yearly, 3 year, 5 year and overall return.See the expense ratio. Expense ratio is the amount you are going to pay as commission. Less than 1% is better.See exit load. This is amount you need to pay when you withdraw.Value research online gives star rating for all funds. Choose funds with atleast 4 Stars.IMPORTANT NOTE: All funds comes in two plans Regular & Direct plan. Regular means you invest via Broker or Agent. Direct means you invest directly. Broker or Agents charge commission. Their commission will be around 1% per year. IT IS LOT OF MONEY. So never go with Broker or Agents.If you are new to mutual fund, you need to register KYC first. It is one time process and it is centralized. Once you get registered, you can invest in any mutual funds just by giving your PAN number. To register KYC, first select fund house (example, SBI Mutual fund or HDFC mutual fund). Find their office in your city and go and register KYC. You can also register e-KYC online, but it has some limitations. So i suggest you to visit office and do it in person.Once KYC is done, you can invest in any mutual funds. If you do KYC in SBI mutual fund, you can also invest in HDFC or ICICI mutual funds. KYC is centralized.Once KYC is done, visit mutual fund company website (like SBI mutual fund site or LT mutual fund site). Register there. Start investing. You can either invest as Lump sum. Or as SIP. SIP means you can invest small amount monthly. Money will be automatically deducted from your account.FAQ:When should i invest?If you are planning to invest via SIP you can start anytime. But if you are planning to invest as Lumpsum, there is a completely different approach. If you like to invest lumpsum in debt fund. You can invest anytime, no issues.But if you like to invest lumpsum in equity mutual fund, you need to follow different approach, since investing lumpsum in equity mutual fund is very risky. First invest your lump amount in liquid fund or ultra short term debt fund [Lets call Fund A]. These funds don’t have exit load (or withdrawing fee), so there is no charges when money gets transferred. Now, set up STP (Systematic Transfer Plan) to transfer a fixed amount monthly to an equity fund [Fund B]. For example, if you have 1 lakh lump amount, set a monthly amount to Rs.5,000. Every month, Rs.5,000 from Fund A will get transferred to Fund B. Fully automatic.Note: Never invest lump amount directly in equity mutual funds.Is there any service which helps me to invest in Mutual funds easily?There are so many apps these days which help you to invest money in mutual funds via direct plan. Like, Zerodha Coins [Not a promotion, you can try any app you want]. These apps are not free, they charge small amount monthly. You can easily set up investments from the app and also you can track the fund performance. I personally find such apps useful.I heard mutual fund is risky.Every investment is risky, whether it is real estate, gold or FD.Gold. What if someone stole or you lose is somewhere? Think how many times you heard from your friends or relatives (or happened to you) that they lost Jewels?FD. FD return is very low. If you are a tax payer and if you invest in FD, then you are LOSING MONEY because of tax and inflation. You will be losing 1% or more per year if you invest in FD. And also, what happens if bank goes bankrupt? FD is insured for Rs.1 lakh. If you have 10 lakhs in FD and bank goes bankrupt, you receive Rs.1 lakh.Real estate. Many factors affect real estate like current government, policies, economy, water issue, etc., And there is liquidity problem . You can’t buy or sell real estate fast.Like these mutual funds also carry risk. If you plan properly you can reduce the risk by investing GILT fund or Arbitrage fund. Remember, mutual fund house invest your money in companies like ICICI bank, TCS, ITC, Tata motors, etc., It is very unlikely that these companies shut down their business.Is it true that debt fund carry Zero Risk?No. As i said earlier Risk is everywhere. When compared with equity, debt fund carry low risk. Still there is some risk. Companies default their loan (remember Kingfisher?). Companies goes bankrupt.What funds are you investing?I am investing in…Aditya Birla SL Balanced '95 Direct-G (Balanced fund)IDFC Focused Equity Direct-G (Large and mid cap)L&T Emerging Businesses Direct-G (Small cap)What should i choose? Growth or Dividend or Dividend reinvestment?Growth - To unleash the power of compound interest choose Growth. It will give you massive return in long term. (Recommended)Dividend - If you want regular income from your investment, then choose Dividend. This option is recommended for retired people.Dividend reinvestment - Companies release dividend regularly. If you choose this option then fund house will buy new units of the fund with dividend money.If I choose dividend fund, do I need to pay income tax for dividend income?No, there is no income tax for dividend income.What is the minimum age required to invest in mutual fund?There is no minimum age. You can start at any age. If you are below 18, you need to provide birth certificate.What is the minimum amount needed to invest in mutual fund?You can start with as low as Rs.500.I am already investing via Regular plan. How to switch to direct plan?Visit fund company website. Register yourself and login. There will be option to Switch. While switching select Direct plan. Simple.How do I know whether I am investing in Regular plan or Direct plan?Login to your account or check your statement. See the fund name. If the name ends with Direct, it is direct plan. Or if it ends with regular it is regular plan.What should i do after investing?It takes atleast 5 years to see decent return from equity mutual funds. Bookmark the website value research online. It is popular site about mutual funds. They give star rating for all mutual funds. Good fund should have atleast 4 stars. Every once in a while check number of stars for your fund. If it goes below 3 stars, i suggest you to switch fund.I am investing in equity mutual fund. I got negative returns. Now i have less money than what i invest. What should i do?Market fluctuates. It is normal. As i said earlier, you need to wait atleast 5 years to see decent return from equity mutual funds.How to withdraw money?Login to your account. Choose redeem option. Money will be withdrawn to your bank account.How to terminate mutual fund?First redeem your money. Then you need to send post (physical, no email) to mutual fund company asking them to terminate. But it is not necessary. Just withdraw money and done with that.What happens if I fail to pay monthly instalment for SIP because of no funds in my savings account?Nothing will happen. Don't worry.How to switch funds?Case 1: Switch funds from same fund house. For example, LT Fund A to LT Fund B. Login to fund house website. Choose switch option. It is simple.Case 2: Switch funds of different fund house. For example, LT Fund A to SBI Fund A. There is no direct option for this. First you need to withdraw money from fund A and invest freshly in Fund B.How to track my mutual funds investments?If you are investing via apps like Zerodha coin, you can easily track form those apps.What are open ended and close ended mutual funds?When comes to mutual funds always go with open ended funds. Open ended fund gives better return than close ended. And also you can enter and exit open ended funds anytime.———————————————————————————————————Hope, i explained everything here. Please don’t contact me with questions which i already explained here. I won’t respond. Spend some time to read. If i missed anything, do comment here.Invest with your own risk. Market fluctuates, sometimes market crashes, companies default their loans. Anything can happen. I am just sharing knowledge.Happy investing.Ashok Ramesh.

-

How do alcohol and drug abuse patient privacy laws protect a patient's disclosure of information related to substance abuse?

There needs to be no release of information whatsoever. If you don’t sign off on releases of information, treaters cannot even mention they have any awareness of your existence.However, because of employment and insurance needs (to substantiate the leave) SOME information must be released—but only to eyes/people also subject to HIPAA rules—HR and the insurance co. It shouldn’t go to any supervisor or employee you work with except HR, who processes the information.Realistically, HIPAA (Health Insurance Portability & Accountability Act) is VERY tightly kept, but insurance companies need to know about your progress with an outpatient treater or an inpatient facility. The insurance company, depending on the degree of your treatment, will get a pretty thorough report on your progress, because as treatment winds down, they will be parceling out longer stays day by day.This should not concern you that much. They also are bound by HIPAA, and face immediately dismissal if they violate HIPAA.As a nurse working in the field and a new nurse during the peak of the AIDS epidemic, when HIPAA came into effect, I know the information is tightly guarded. If a treater not assigned to you so much as looks up your progress on the computer, the IT people will have a chat with you, and chances are 99% that person (MD, RN, CNA) will be out the door.It’s probably not a secret that you have a substance abuse problem to your employees, and whoever knows the symptoms of the disease will have recognized your behavior for what it is. Nonetheless, THEY are not allowed to say anything about it.Usually a good employer just wants you get well and will be relieved you are seeking treatment. This is just understood.You should check with your insurance carrier first to see which facilities they will cover most extensively, as costs vary widely as does efficacy of treatment.If you’re not in a healthcare setting, you can’t believe how strictly these policies are enforced. If you are, you KNOW.Here’s the wikipedia link to more about HIPAA:Health Insurance Portability and Accountability Act - Wikipedia

-

Are health clubs, gyms and other public businesses that require customers and clients to fill out health and/or medical forms or releases required to protect that information under HIPAA?

This does not fall under HIPAA. Under the HIPAA regulations, the entities that must comply with the rules are defined as "covered entities" which are: health care plans, health care providers, and health care clearinghouses. So health clubs or gyms do not meet this definition and are therefore not subject to HIPAA. However, depending on your state, there may be laws which protect the sharing of this type of information.

-

Why do many adopted people actively avoid trying to track down their biological parents?

I'm in my 50s. I've known I was adopted since I was three or four. There was a little book, explaining how it all worked in very kid friendly terms. My sister was also adopted, a year and a half after I was; my brother was not.It was known, openly discussed in our family, but once everyone was on board with the underlying facts, it wasn't a topic of conversation. In fact, I don't recall it being mentioned at all for decades at a time.When I was in high school, it came up in an unexpected way. My girlfriend did some really egregiously over the top things that offended my parents, who insisted that I break up with her immediately. I declined. In the predictable fallout from that, in a fit of pique, she suggested that I move out and "find my real parents".I was shocked, to put it mildly. As far as I was concerned, the people that raised me were my "real parents". That conversation (and the ones that followed) did more damage to my relationship with her than with my parents.Through my 20s and 30s, I never really thought about it. I mean, like at all. It was part of the fabric of my life, part of the wallpaper. It just was.In my early 40s, some things happened that set me to thinking. A therapist suggested that some of my attachment issues might be deeply seated in that whole "given up for adoption at birth" thing, and set me on a course of reading, material from authors who supported that concept. I gave it some thought. I signed up for a registry, and nothing happened. I stopped thinking about it.Some years later, not long after marrying my wife, we got pregnant. And that set a whole new chain of thoughts into motion. My wife had grown up not knowing her father, or actually even knowing who he was, and had only met him a few years prior in her late 30s. She talked about how hard it was with her older kids, having to cross out whole sections on medical intake forms and write in "Unknown". How scary it was to wonder what genetic predispositions they might have to unknown conditions.She earnestly suggested that I might not want to experience that, and that our unborn child might also want to have that information, and contact with actual biological family.I hesitated. I dragged my feet. I prevaricated. Eventually, I re-contacted the registry - and discovered that I hadn't heard anything because I'd not correctly filled out my intake form. I corrected that, and instantly got a response back from a researcher. I had a name.Lucy Smith.I had some back-story, thanks to my high-school girlfriend. Her mother had been the assistant to the attorney that handled my adoption paperwork for my parents, and she knew stuff that I hadn't been told. That my mom was 16 at the time, from somewhere in Oklahoma. That she was very much in love with a slightly older boy, had gotten pregnant, and had wound up being forcibly separated from him and put in a home for unwed mothers.From there, I had facts. I knew the name of the establishment, knew the name of the hospital I was born in, and had enough of a case to petition for opening my sealed adoption records, based on medical need.The file was empty. Literally, empty. Nothing. No contents.It pretty much let the air out of my balloon. I halfheartedly did some more research and learned that the particular home for unwed mothers where my biological mother wound up was ultra protective of its girls, and that they frequently used pseudonyms for the girls both in the house and at the hospital. And that they'd been closed for some time, and the organization which inherited custody wasn't open to disclosure, and had been accused of destroying records in the past.Was "Lucy Smith" a fake name? Or possibly worse, a real one? And what's the path to finding an answer? I sure can't find one.For me, there might or might not be closure in it. For my son, there's a chance of having an extended family that he'd never have otherwise. I'd be delighted for his sake if there were an answer, but the trail I have is old, and cold, and protected by people who are guarding the secrets of the past from a sense of morality that's past its expiration date.If I had more to go on, I'd still be looking.

-

How are journalists, doctors, lawyers, and others with access to privileged client information protected from criminals who try and threaten that information out of them?

There's really nothing stopping a determined set of criminals from accessing or attempting to access "privileged information" from any source they want to. While extortion and bribery laws may slow most down and encryption might stymie a few more, most criminals with ready cash and a burning desire to know, can pretty much find out what they want.What probably stops or halts most are the following:Most criminals are stupid - They haven't considered what they will do when they are detected or caught ( most assume that it will never happen) and when it does occur, they foolishly have no plans as to what they can do to mitigate or end the threat of prosecution against them.Many criminals are surprisingly poor planners - This is slightly different than them being stupid in that they may be intelligent, but they are unable to form coherent and cohesive plans on how effectively avoid being prosecuted and jailed. Poor planning is the undoing of most criminal activities.Many times it just doesn't work - Someone calls an attorney or a witnesses home and leaves an anonymous threat. And...nothing happens. The threat is either vague, considered to be b*llshit or it simply doesn't deter the person from testifying. If your threats are ignored, you'll have to:Follow through with them - Most criminals won't follow through with a threat. They are too cowardly; they have waited too long before making the threat or they have no means to do so. If you threaten serious harm, you have to be willing and able to follow up on that threat. If you do not, then your words become meaningless.Many are resigned to their fates - Surprisingly, many criminals will allow themselves to be prosecuted and sent to prison even though they have the assets on hand to flee or to "impair" the ability of witnesses. They seemingly don't even consider that leaving or "altering a witness' mindset" will stall or halt any prosecution against and they go to court and to prison like lambs to slaughter.

-

How do I fill out FAFSA without my kid seeing all my financial information?

You will have a FSA ID. Keep it somewhere secure and where you can find it when it is needed again over the time your kid is in college. Use this ID to “sign” the parent’s part of the FAFSA.Your student will have their own FSA ID. They need to keep it somewhere secure and where they can find it when it is needed again over the time they are in college. They will use the ID to “sign” their part of the FAFSA.There is no need to show your student your part of the FAFSA. I do suggest you just casually offer to help your student fill out their part of the form.The Parent’s Guide to Filling Out the FAFSA® Form - ED.gov BlogThe FAFSA for school year 2018–19 has been available since October 1. Some financial aid is first come-first served. I suggest you get on with this.How to Fill Out the FAFSA, Step by StepNotes:Reading the other answers brings up some other points:The student pin was replaced by the parent’s FSA ID and the student’s FSA ID in May, 2015. Never the twain need meet.Families each need to deal with three issues in their own way:AffordabilityIf you read my stuff you know I am a devotee of Frank Palmasani’s, Right College, Right Price. His book describes an “affordability” exercise with the parents and the student. The purpose is to determine what the family can afford to spend on post-secondary education and to SET EXPECTATIONS. He’s not talking about putting your 1040 on the dining room table, but sharing some of the basics of family finances.I get the impression that many families ignore this issue. I have a study that shows five out of eight students assume their families are going to pay for college regardless of cost. Most of these students are in for a big surprise.PrivacySome parents may want to hold their “financial cards” closer to their chest than others. In my opinion that’s OK. I suppose an 18 year old kid, theoretically, has the right to keeping his finances private. My approach to this would not be to make a big deal out of it but to offer to help them fill out their part of the FAFSA. The main objective should be to get the FAFSA filled out properly, in a timely fashion.FraudThis is absolutely not acceptable, and, hopefully, those who try it get caught and suffer the consequences. (I had a conversation with a father recently who was filling out the CSS Profile. He wasn’t intent on committing fraud. He thought he was being clever in defining assets. After our conversation he had to file a signNow revision. This revision was a good thing because two or three years from now his mistake was going to come to light. I’m not sure what the consequences of all that would have been, but, at a minimum, it would have been a big mess to unwind.)

Create this form in 5 minutes!

How to create an eSignature for the disclosure protected information

How to make an electronic signature for the Disclosure Protected Information online

How to make an electronic signature for your Disclosure Protected Information in Google Chrome

How to create an electronic signature for signing the Disclosure Protected Information in Gmail

How to make an eSignature for the Disclosure Protected Information right from your smart phone

How to create an electronic signature for the Disclosure Protected Information on iOS devices

How to create an eSignature for the Disclosure Protected Information on Android OS

People also ask

-

What is the form IHS 810 and why is it important?

The form IHS 810 is a key document used for reporting and managing service requests efficiently. It is crucial for maintaining compliance and streamlining operations in various industries. By utilizing the form IHS 810, organizations can ensure accurate tracking of requests and improve overall service delivery.

-

How can airSlate SignNow help me manage the form IHS 810?

airSlate SignNow provides a convenient platform to create, send, and eSign the form IHS 810 effortlessly. The user-friendly interface allows you to customize the form and gather signatures quickly, ensuring a seamless process. This efficiency helps in reducing turnaround times for approvals and documentation.

-

What are the pricing options for using airSlate SignNow with the form IHS 810?

airSlate SignNow offers flexible pricing plans tailored to fit the needs of various businesses using the form IHS 810. Each plan provides a range of features, ensuring you get the best value whether you are a small startup or a larger enterprise. Contact our sales team for detailed pricing that suits your requirements.

-

Which features of airSlate SignNow enhance the use of the form IHS 810?

Key features of airSlate SignNow that enhance the usability of the form IHS 810 include customizable templates, automated workflows, and real-time tracking of document status. These features not only save time but also eliminate errors, making your document management process more reliable.

-

Can airSlate SignNow integrate with other software while using the form IHS 810?

Yes, airSlate SignNow seamlessly integrates with various software and CRM platforms, allowing you to manage the form IHS 810 alongside your existing systems. Whether you're using a project management tool or a customer relationship management system, our integrations ensure a cohesive workflow. This integration improves data accuracy and accessibility.

-

How does airSlate SignNow ensure the security of the form IHS 810?

airSlate SignNow prioritizes your security and complies with industry standards to protect the form IHS 810 and all associated data. With encryption, secure servers, and user authentication, we ensure that your documents are safe from unauthorized access and manipulation. Trust us to safeguard your important business documents.

-

Is there customer support available for airSlate SignNow users dealing with the form IHS 810?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any issues related to the form IHS 810. Our knowledgeable support team is available through various channels, including email and live chat, to ensure you can efficiently manage your documents without any disruptions.

Get more for Ihs 810

- Port saint lucie homestead exemption form 2009

- Cook county senior citizens exemption certificate of error form

- Wyoming fire suppression form

- Dmv ol56 form

- Minnesota property tax exemption form

- Application for property tax exemption form 136 2010

- Atiga form d

- Iaea scientific visit applucation doc form

Find out other Ihs 810

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT