StudentSpouse Non Filing Statement 2017-2026

What is the StudentSpouse Non Filing Statement

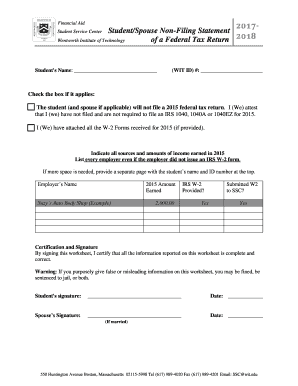

The StudentSpouse Non Filing Statement is a formal document used primarily by students and their spouses to declare that they did not file a federal tax return for a given tax year. This statement is often required for financial aid applications, particularly when applying for federal student aid through the Free Application for Federal Student Aid (FAFSA). It serves as a verification tool to confirm that the individual did not have a filing requirement based on their income level.

Steps to complete the StudentSpouse Non Filing Statement

Completing the StudentSpouse Non Filing Statement involves several clear steps:

- Gather necessary information, including personal details such as Social Security numbers and income information for the relevant tax year.

- Download the official form or template for the non filing statement from a reliable source.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the completed statement for accuracy and completeness.

- Sign and date the document to validate it.

Legal use of the StudentSpouse Non Filing Statement

The StudentSpouse Non Filing Statement holds legal significance as it is often required by educational institutions and financial aid offices to confirm an applicant's financial status. When properly completed and signed, it can be used to demonstrate eligibility for various forms of financial assistance. Compliance with relevant federal and state regulations is essential to ensure that the statement is accepted by the institutions requesting it.

Required Documents

To complete the StudentSpouse Non Filing Statement, certain documents may be necessary. These typically include:

- Proof of identity, such as a driver's license or state ID.

- Social Security cards for both the student and spouse.

- Documentation of income, if applicable, to support the claim of non-filing.

- Any previous tax documents that may be relevant, even if they do not require filing.

Who Issues the Form

The StudentSpouse Non Filing Statement is typically issued by educational institutions or financial aid offices. These organizations provide the necessary forms and guidelines for students and their spouses to complete the statement correctly. In some cases, the form may also be available through official government websites or financial aid resources.

Eligibility Criteria

Eligibility for using the StudentSpouse Non Filing Statement generally includes individuals who are students and their spouses who did not meet the income threshold for filing a tax return. Specific criteria may vary by institution, but typically, this includes:

- Individuals who earned below the minimum income requirement set by the IRS.

- Students enrolled at least half-time in an eligible program.

- Spouses of students who are also not required to file a tax return.

Quick guide on how to complete studentspouse non filing statement

Complete StudentSpouse Non Filing Statement effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It presents a suitable eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and store it securely online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle StudentSpouse Non Filing Statement on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to alter and eSign StudentSpouse Non Filing Statement with ease

- Locate StudentSpouse Non Filing Statement and click on Get Form to begin.

- Employ the tools we provide to fill out your form.

- Mark important sections of your documents or redact sensitive details using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional signature done in ink.

- Review the details and then click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign StudentSpouse Non Filing Statement and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the studentspouse non filing statement

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is a statement of non filing, and why do I need one?

A statement of non filing is a document that confirms that a tax return has not been filed for a specific period. It is often required by financial institutions or government entities as part of the verification process. Using airSlate SignNow, you can quickly create and eSign a statement of non filing, ensuring that your information is up-to-date and compliant.

-

How can airSlate SignNow help me with my statement of non filing?

airSlate SignNow streamlines the process of creating and signing a statement of non filing. Our platform allows you to easily generate custom documents, add electronic signatures, and send them to recipients without hassle. This saves you time and ensures your documents are legally binding.

-

Is airSlate SignNow cost-effective for managing statements of non filing?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our cost-effective solution ensures that you can manage your statement of non filing needs without breaking the bank. With a range of features included, you can effectively handle all your document signing needs.

-

What features does airSlate SignNow offer for statements of non filing?

airSlate SignNow provides a variety of features specifically designed for handling statements of non filing, including template creation, document tracking, and secure cloud storage. You can also integrate with other tools to automate your workflow, making document management effortless and efficient.

-

Can I integrate airSlate SignNow with other software for my statement of non filing needs?

Absolutely! airSlate SignNow supports integration with a wide range of third-party applications, allowing you to streamline your processes related to the statement of non filing. Whether you're using CRM systems, accounting software, or other document management tools, our platform works seamlessly to enhance your productivity.

-

How secure is my statement of non filing when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and robust authentication measures to protect your statement of non filing and other documents. You can confidently eSign and store sensitive information, knowing that it is safeguarded against unauthorized access.

-

Can I customize my statement of non filing templates in airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your statement of non filing templates to meet your specific requirements. You can add logos, modify text, and adjust formatting, ensuring that your documents reflect your branding and meet your needs perfectly.

Get more for StudentSpouse Non Filing Statement

- Respiratory diseases drivers license number state of connecticut p 142r new 5 2011 department of motor vehicles driver services form

- Cdcsgh or name arizona department of health services bureau of child care licensing emergency information and immunization

- State of north carolina county consent to adoption by parent who is spouse of stepparent stepparent adoption i declare 1 info form

- Facility medical record last 4 of ssn admitting state hospitaladatc date time nc division of mental healthdevelopmental form

- Universal pharmacy oral prior authorization form pharmacy amerihealth caritas pennsylvania universal pharmacy oral prior

- Notice to clients the department of social and health services dshs can help you better if we are able to work with other form

- Forwardhealth prior authorization care plan attachment pacpa f 11096 forwardhealth prior authorization care plan attachment form

- Communications within the standards of nursing practice workbook communications within the standards of nursing practice form

Find out other StudentSpouse Non Filing Statement

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself