Employee State Income Tax Texas A&M University 2020-2026

What is the Employee State Income Tax Texas A&M University

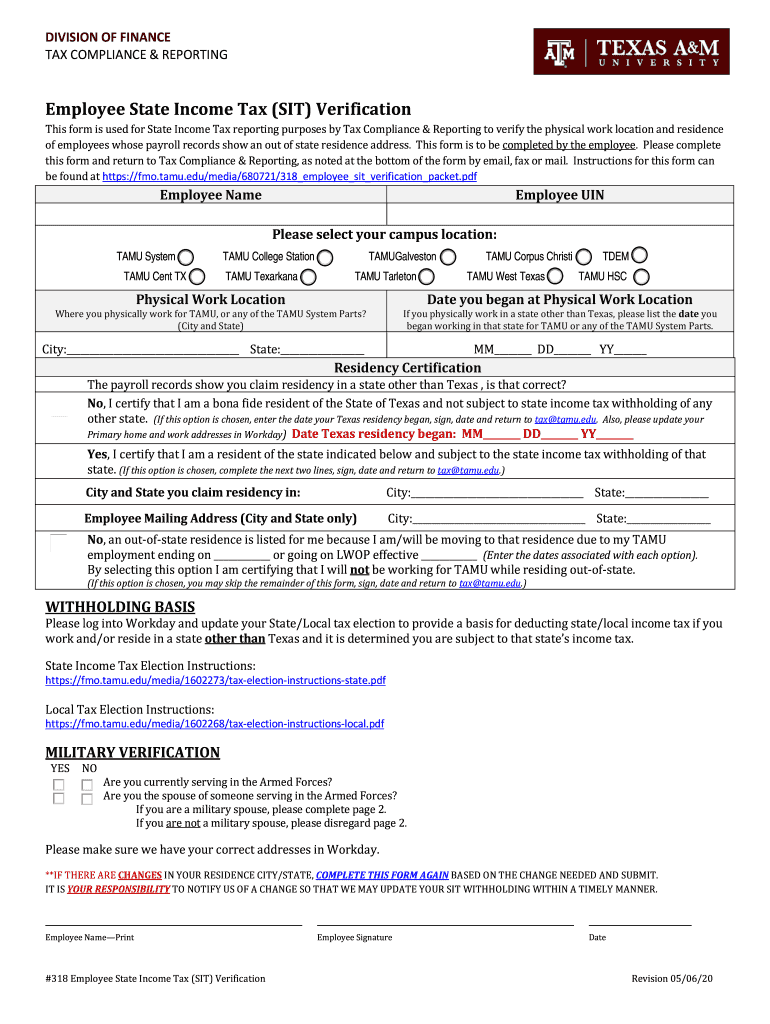

The Employee State Income Tax Texas A&M University is a mandatory tax that applies to employees working within the state of Texas. This tax is used to fund various state services and programs. Although Texas does not impose a state income tax on individuals, employees may still need to complete specific forms related to their employment status. Understanding this tax is essential for compliance and ensuring accurate payroll deductions.

Steps to complete the Employee State Income Tax Texas A&M University

Completing the Employee State Income Tax Texas A&M University involves several key steps:

- Gather necessary personal information, including your Social Security number and employment details.

- Access the appropriate form, which may be available online or through your department.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form according to the specified method, whether online, by mail, or in person.

Legal use of the Employee State Income Tax Texas A&M University

The legal use of the Employee State Income Tax Texas A&M University is governed by state regulations. It is crucial to ensure that the form is filled out correctly and submitted on time to avoid any legal repercussions. Compliance with state laws not only protects the employee but also the university as an employer. Understanding the legal framework surrounding this tax helps maintain transparency and accountability.

Required Documents

To complete the Employee State Income Tax Texas A&M University, certain documents may be required:

- Proof of identity, such as a driver's license or passport.

- Social Security card or number for verification purposes.

- Any previous tax forms or employment records that may be relevant.

Filing Deadlines / Important Dates

It is essential to be aware of filing deadlines for the Employee State Income Tax Texas A&M University. Typically, forms must be submitted by specific dates to ensure compliance with state regulations. Missing these deadlines can result in penalties or delays in processing. Keeping a calendar of important dates can help employees stay organized and informed.

Form Submission Methods

The Employee State Income Tax Texas A&M University can be submitted through various methods:

- Online submission via the university's designated platform.

- Mailing the completed form to the appropriate department.

- In-person submission at designated offices within the university.

IRS Guidelines

Understanding IRS guidelines is crucial for completing the Employee State Income Tax Texas A&M University. These guidelines provide detailed instructions on how to properly fill out the form, what information is required, and how to report income accurately. Adhering to these guidelines helps ensure compliance with federal tax laws and avoids potential issues with the IRS.

Quick guide on how to complete employee state income tax texas aampm university

Effortlessly Prepare Employee State Income Tax Texas A&M University on Any Device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly and without hold-ups. Manage Employee State Income Tax Texas A&M University on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric workflow today.

How to Modify and Electronically Sign Employee State Income Tax Texas A&M University with Ease

- Obtain Employee State Income Tax Texas A&M University and then select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight essential portions of the documents or obscure sensitive information with tools specifically available from airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all information and then click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or inaccuracies that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign Employee State Income Tax Texas A&M University and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employee state income tax texas aampm university

How to generate an eSignature for your PDF in the online mode

How to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is tamu sit and how does it relate to airSlate SignNow?

Tamu sit refers to a unique term that embodies the ease of electronically signing documents through airSlate SignNow. With tamu sit, you can quickly create legally binding signatures on any document without the hassle of printing or scanning.

-

How does the pricing for airSlate SignNow compare for users interested in tamu sit?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, including those looking to utilize tamu sit. By choosing the plan that best fits your usage, you can maximize your savings while enjoying robust eSigning features.

-

What key features does airSlate SignNow offer for tamu sit users?

AirSlate SignNow provides various features beneficial for tamu sit users, including document templates, automated workflows, and extensive integrations. These features enable businesses to streamline their signing processes and reduce turnaround time.

-

What are the main benefits of using airSlate SignNow for tamu sit?

Utilizing airSlate SignNow for tamu sit enhances efficiency and productivity by simplifying the document signing process. Users can enjoy quick turnaround times, increased security for sensitive documents, and the convenience of accessing documents from anywhere.

-

Can I integrate airSlate SignNow for tamu sit with other applications?

Yes, airSlate SignNow supports integration with numerous applications, making it easier for tamu sit users to incorporate into their existing workflows. Integrations with platforms such as Google Drive, Salesforce, and more streamline document management.

-

Is airSlate SignNow user-friendly for those unfamiliar with tamu sit?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it accessible for anyone, including those new to tamu sit. With intuitive navigation and helpful tutorials, users can easily learn to send and eSign documents efficiently.

-

What types of documents can be signed using tamu sit on airSlate SignNow?

You can sign a wide variety of documents using tamu sit on airSlate SignNow, including contracts, agreements, and forms. The platform supports multiple file formats, ensuring that you can manage all your signing needs in one place.

Get more for Employee State Income Tax Texas A&M University

Find out other Employee State Income Tax Texas A&M University

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe