Rebill Fedex Com 2003-2026

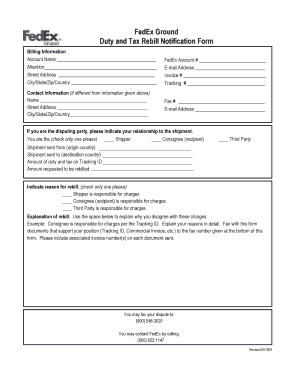

What is the Rebill Fedex Com

The Rebill Fedex Com is an online platform designed to facilitate the management of ground duty taxes associated with FedEx shipments. This system allows users to receive notifications regarding any rebill notifications, ensuring that they stay informed about their tax obligations. The platform is particularly useful for individuals and businesses that frequently use FedEx services, as it streamlines the process of handling tax-related documents and communications.

How to Use the Rebill Fedex Com

Using the Rebill Fedex Com is straightforward. Users need to visit the website and enter their tracking information to access their rebill notifications. Once logged in, they can review any outstanding duties or taxes associated with their shipments. The platform provides a user-friendly interface that guides users through the necessary steps to complete their tax obligations efficiently. It is essential to ensure that all information entered is accurate to avoid any delays in processing.

Steps to Complete the Rebill Fedex Com

Completing the Rebill Fedex Com involves several key steps:

- Visit the Rebill Fedex Com website.

- Enter your tracking number or relevant shipment details.

- Review the rebill notification for any outstanding duties or taxes.

- Follow the prompts to complete the necessary forms.

- Submit the completed forms electronically for processing.

By following these steps, users can ensure that their rebill notifications are handled promptly and accurately.

Legal Use of the Rebill Fedex Com

The Rebill Fedex Com operates within the legal framework established for electronic signatures and document submissions in the United States. Compliance with regulations such as the ESIGN Act and UETA ensures that documents submitted through the platform are legally binding. Users should be aware of their obligations regarding the accuracy of the information provided and maintain records of their submissions for future reference.

Required Documents

When using the Rebill Fedex Com, users may need to provide specific documents to complete their rebill notifications. Commonly required documents include:

- Proof of shipment, such as tracking numbers or receipts.

- Tax identification numbers for individuals or businesses.

- Any previous communications regarding rebill notifications.

Having these documents readily available can expedite the process and ensure compliance with tax obligations.

Penalties for Non-Compliance

Failure to comply with the obligations set forth in the Rebill Fedex Com can result in various penalties. These may include fines, interest on unpaid taxes, or additional fees for late submissions. It is crucial for users to stay informed about their tax responsibilities and ensure timely completion of their rebill notifications to avoid these potential consequences.

Quick guide on how to complete rebill fedex com

Prepare Rebill Fedex Com effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Rebill Fedex Com on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest method to edit and eSign Rebill Fedex Com without hassle

- Obtain Rebill Fedex Com and then click Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your choice. Edit and eSign Rebill Fedex Com and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rebill fedex com

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is rebilldt fedex com and how is it related to airSlate SignNow?

rebilldt fedex com is a billing platform that manages recurring charges, and it integrates seamlessly with airSlate SignNow. This allows businesses to eSign their documents related to billing while keeping their transactions efficient and organized. Incorporating rebilldt fedex com through airSlate SignNow enhances the overall workflow for businesses that require both eSignature and billing solutions.

-

How does airSlate SignNow benefit businesses using rebilldt fedex com?

airSlate SignNow offers a user-friendly interface that complements rebilldt fedex com by simplifying the eSigning process of billing agreements and invoices. Users can easily send and manage documents, reducing the time spent on manual tasks. This integration streamlines operations, helping businesses save time and resources.

-

What pricing options does airSlate SignNow offer for users of rebilldt fedex com?

airSlate SignNow provides flexible pricing plans that cater to various business needs, even for those utilizing rebilldt fedex com. From basic plans for small businesses to advanced options for enterprises, pricing is designed to provide value at every level. Additionally, using airSlate SignNow can lead to cost savings through more efficient processes.

-

Can airSlate SignNow integrate with rebilldt fedex com?

Yes, airSlate SignNow is designed to integrate smoothly with rebilldt fedex com. This integration allows users to eSign documents associated with their billing directly, creating a cohesive and efficient billing process. Businesses benefit from improved document management when using both platforms together.

-

What features does airSlate SignNow offer that complement rebilldt fedex com?

airSlate SignNow provides features like customizable templates, advanced tracking, and secure storage that are highly beneficial for users of rebilldt fedex com. These features enhance the eSigning experience, making it easier to manage and retrieve documents tied to billing. Furthermore, users can automate reminders and notifications to streamline the workflow.

-

Is there a mobile app for airSlate SignNow that works with rebilldt fedex com?

Yes, airSlate SignNow offers a mobile app that allows users to access their documents and eSign on the go, perfectly complementing the capabilities of rebilldt fedex com. The app ensures that businesses can manage their billing documentation anytime and anywhere, increasing flexibility and efficiency. This is especially useful for teams that travel frequently or work remotely.

-

How secure is the integration of airSlate SignNow with rebilldt fedex com?

The integration of airSlate SignNow with rebilldt fedex com is built on a foundation of security, ensuring that all documents are encrypted and protected. airSlate SignNow complies with industry standards to safeguard sensitive information during the eSigning process. Businesses can trust that their billing documents are secure while utilizing both platforms.

Get more for Rebill Fedex Com

- Awc guide to wood construction in high wind areas 110 mph wind zone form

- Gbls cori manual mass legal services form

- Know your rights greater boston legal services form

- Ccoc complaint submission form

- Request new service central maine powerelectricians examining boardoffice of professional and electricians examining form

- Cmp 1360 form

- 515 form

- Lg920 bar bingo paper sales excludes electronic linked bingo form

Find out other Rebill Fedex Com

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement