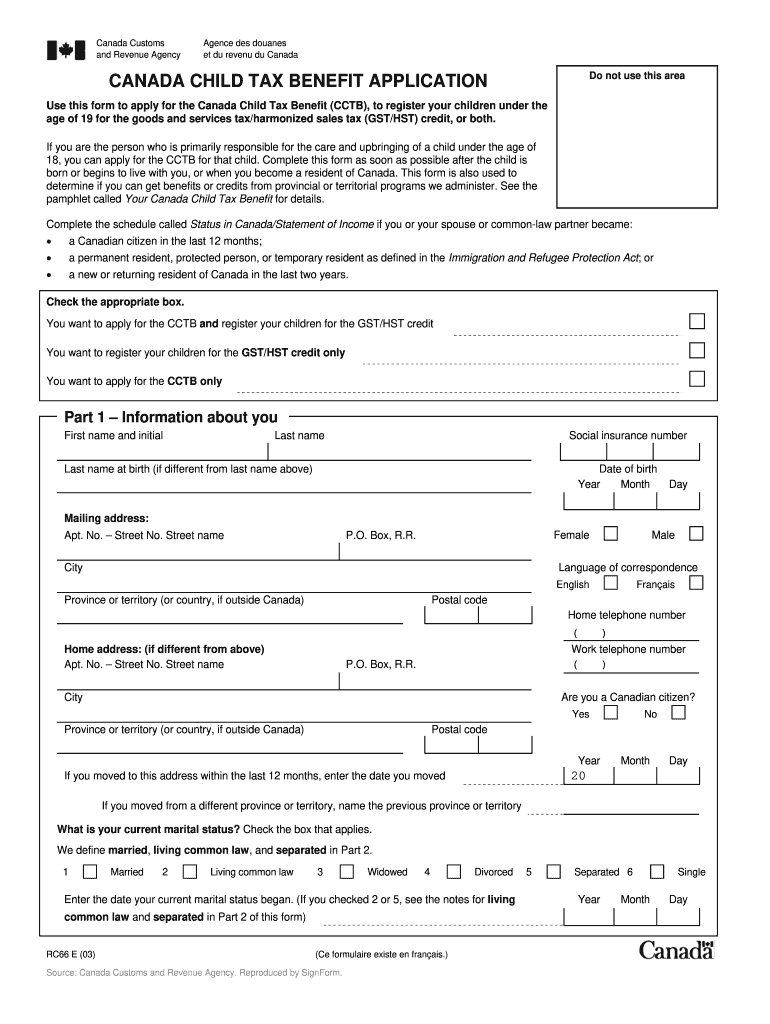

Child Tax Application Form 2003

What is the Child Tax Application Form

The Child Tax Application Form is a crucial document used by parents or guardians to apply for tax credits related to their dependent children. This form allows eligible families to receive financial support, which can significantly reduce their tax burden. The application typically includes information about the taxpayer, the children for whom the credit is being claimed, and any relevant income details. Understanding this form is essential for maximizing potential tax benefits and ensuring compliance with IRS regulations.

How to use the Child Tax Application Form

Using the Child Tax Application Form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including Social Security numbers for both the taxpayer and the children. Next, fill out the form carefully, ensuring that all details are correct. After completing the form, review it for accuracy before submitting it to the IRS. Utilizing digital tools can streamline this process, allowing for easy corrections and efficient submission.

Steps to complete the Child Tax Application Form

Completing the Child Tax Application Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather required documents, including Social Security cards and income statements.

- Fill in personal information, including your name, address, and filing status.

- List each qualifying child, providing their name, date of birth, and Social Security number.

- Calculate the total credit amount based on the number of qualifying children.

- Review all entries for accuracy and completeness.

- Submit the form electronically or via mail, depending on your preference.

Legal use of the Child Tax Application Form

The Child Tax Application Form is legally binding when filled out correctly and submitted according to IRS guidelines. To ensure its legal standing, it is essential to provide truthful information and maintain compliance with applicable tax laws. Misrepresentation or errors can lead to penalties or denial of the tax credit. Utilizing a reliable eSignature platform can enhance the legitimacy of the submission process, ensuring that all signatures are authenticated and documented appropriately.

Eligibility Criteria

Eligibility for the Child Tax Application Form depends on several factors. Generally, to qualify, the taxpayer must have a qualifying child under the age of 17 at the end of the tax year. Additionally, the taxpayer's income must fall within specific limits set by the IRS. These limits may vary annually, so it is important to check the latest guidelines. Other considerations include the taxpayer's filing status and whether the child is a dependent on the tax return.

Required Documents

To complete the Child Tax Application Form, several documents are necessary. These include:

- Social Security numbers for the taxpayer and qualifying children.

- Income statements, such as W-2 forms or 1099s.

- Proof of residency for the children, if applicable.

- Any previous tax returns that may provide context for the application.

Form Submission Methods

The Child Tax Application Form can be submitted through various methods, depending on the taxpayer's preference and circumstances. Options include:

- Online submission via the IRS e-file system, which is fast and secure.

- Mailing a paper form to the appropriate IRS address, which may take longer to process.

- In-person submission at designated IRS offices, if assistance is needed.

Quick guide on how to complete child tax application form 2003

Effortlessly Prepare Child Tax Application Form on Any Device

The management of online documents has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the functionalities necessary to create, modify, and electronically sign your documents quickly without delays. Handle Child Tax Application Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

Effortlessly Modify and eSign Child Tax Application Form

- Locate Child Tax Application Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for such purposes.

- Generate your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, the hassle of searching for forms, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Child Tax Application Form to ensure clear communication at any stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct child tax application form 2003

Create this form in 5 minutes!

How to create an eSignature for the child tax application form 2003

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is the Child Tax Application Form?

The Child Tax Application Form is a document used by individuals to apply for tax credits related to dependent children. This form helps you claim the Child Tax Credit, which can signNowly reduce your tax liability. With airSlate SignNow, you can easily manage, send, and eSign your Child Tax Application Form securely and efficiently.

-

How can airSlate SignNow assist with my Child Tax Application Form?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your Child Tax Application Form. Our solution ensures that your application is processed quickly and securely, reducing the time spent on paperwork. Additionally, you can track the status of your form in real time, giving you peace of mind throughout the application process.

-

Is there a cost associated with using airSlate SignNow for the Child Tax Application Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including those specifically designed for managing documents like the Child Tax Application Form. Our cost-effective solutions ensure that you can access the features you need without breaking the bank. Check out our pricing page for detailed options and choose the plan that best fits your requirements.

-

Can I integrate airSlate SignNow with other tools for my Child Tax Application Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications to streamline your workflow when handling the Child Tax Application Form. Whether you use CRM systems, document storage solutions, or productivity tools, our integrations enhance your efficiency and simplify the entire process.

-

What are the benefits of using airSlate SignNow for signing the Child Tax Application Form?

Using airSlate SignNow to sign your Child Tax Application Form offers numerous benefits, including enhanced security, ease of use, and faster processing times. You can eSign documents from anywhere, on any device, making it incredibly convenient. Moreover, our platform ensures that your information remains confidential and secure.

-

Do I need to have prior experience to use airSlate SignNow for my Child Tax Application Form?

No prior experience is necessary to use airSlate SignNow for your Child Tax Application Form. Our platform is designed with user-friendliness in mind, guiding you through each step of the process. Whether you're tech-savvy or not, you can easily create, send, and eSign your forms with confidence.

-

How long does it take to process the Child Tax Application Form via airSlate SignNow?

The processing time of the Child Tax Application Form can vary based on the specifics of your situation and the tax authority's timeline. However, using airSlate SignNow dramatically speeds up the submission and signing process. You can expect quicker turnaround times, ensuring that you meet important deadlines without unnecessary delays.

Get more for Child Tax Application Form

- Analyticalaboratory technology analysis biotechnology form

- Wholesale account application form la maison du macaron

- Conditional po form

- Play to win strategy canvas form

- 2016 2021 isu contract agreement governors office of employee form

- Use this form if you are trying to ndpersndgov

- Ndpers 400 east broadway po box 1657 bismarck north dakota 58502 1657 form

- Lacera com form

Find out other Child Tax Application Form

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP