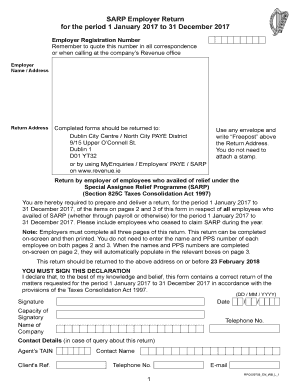

Sarp Employer Return 2017

What is the Sarp Employer Return

The Sarp Employer Return is a crucial document for employers in the United States, designed to report specific tax information related to employee compensation and benefits. This form is essential for ensuring compliance with federal tax regulations and provides the necessary details for accurate tax reporting. Employers must complete this form to reflect their contributions and the benefits provided to employees, ensuring transparency and adherence to legal obligations.

Steps to Complete the Sarp Employer Return

Completing the Sarp Employer Return involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including employee records and financial statements. Next, accurately fill out each section of the form, ensuring that all information is current and reflects the correct figures. Once completed, review the form for any errors or omissions. Finally, submit the form through the appropriate channels, whether online or by mail, as specified by the IRS guidelines.

Legal Use of the Sarp Employer Return

The Sarp Employer Return holds legal significance as it serves as an official record of an employer's tax obligations. To be considered legally binding, the form must be completed accurately and submitted within the designated timeframes. Compliance with relevant laws, such as the Internal Revenue Code, is essential, as failure to adhere to these regulations may result in penalties or legal repercussions. Employers should ensure they understand the legal implications of the information reported on this form.

Penalties for Non-Compliance

Failure to file the Sarp Employer Return on time or inaccuracies in the submitted information can lead to significant penalties. The IRS imposes fines for late submissions, which can accumulate over time. Additionally, employers may face increased scrutiny during audits, leading to further complications. Understanding these potential penalties highlights the importance of timely and accurate filing to maintain compliance and avoid unnecessary financial burdens.

Required Documents

To accurately complete the Sarp Employer Return, employers must gather specific documents. These typically include employee W-2 forms, payroll records, and any relevant financial statements that detail compensation and benefits provided. Having these documents readily available simplifies the completion process and ensures that all reported figures are accurate, reducing the risk of errors that could lead to penalties.

Form Submission Methods

The Sarp Employer Return can be submitted through various methods, including online platforms, traditional mail, or in-person submissions at designated IRS offices. Each method has its own set of guidelines and deadlines, so it is important for employers to choose the method that best suits their needs while ensuring compliance with submission requirements. Online submission may offer quicker processing times, while mail submissions require careful attention to deadlines to avoid penalties.

Eligibility Criteria

Eligibility to file the Sarp Employer Return typically depends on the employer's business structure and the nature of the employment relationship with their workers. Generally, all employers who provide compensation to employees are required to file this return. However, specific criteria may vary based on state regulations and the size of the workforce. Employers should familiarize themselves with both federal and state requirements to determine their obligations accurately.

Quick guide on how to complete sarp employer return 2017

Complete Sarp Employer Return effortlessly on any device

Online document management has gained popularity with companies and individuals. It provides an ideal eco-friendly substitute for standard printed and signed paperwork, as you can locate the relevant form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Sarp Employer Return on any platform with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Sarp Employer Return with ease

- Find Sarp Employer Return and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you prefer to share your form, via email, SMS, invite link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Sarp Employer Return and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sarp employer return 2017

Create this form in 5 minutes!

How to create an eSignature for the sarp employer return 2017

The way to create an eSignature for your PDF online

The way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

What is the sarp employer form and why is it important?

The sarp employer form is an essential document used by employers to report specific employee data. It helps in compliance with regulations and provides necessary information to tax authorities. Understanding and managing this form is crucial for accurate record-keeping and avoiding penalties.

-

How can airSlate SignNow help with filling out the sarp employer form?

airSlate SignNow offers an intuitive platform that simplifies the process of filling out the sarp employer form. With customizable templates and easy collaboration features, your team can ensure accurate and timely completion of this important document. Plus, our eSignature capabilities make the approval process seamless.

-

Is there a cost associated with using airSlate SignNow for the sarp employer form?

Yes, airSlate SignNow offers various pricing plans to suit different organizational needs. Each plan provides access to features that facilitate the efficient handling of the sarp employer form, ensuring that you only pay for what you need. We recommend checking out our pricing page for detailed information on the best plan for your business.

-

What features does airSlate SignNow offer for managing the sarp employer form?

airSlate SignNow includes robust features like document templates, eSignatures, real-time collaboration, and audit trails specifically tailored for handling the sarp employer form. These features streamline the document preparation process, making it easier to manage compliance and maintain accurate records.

-

Can airSlate SignNow integrate with other software for sarp employer form processing?

Yes, airSlate SignNow integrates with various business applications, enhancing the workflow for processing the sarp employer form. Our platform allows seamless connections with popular tools such as CRMs, HR software, and cloud storage solutions, ensuring smooth data transfer and improved efficiency.

-

What are the benefits of using airSlate SignNow for the sarp employer form?

Using airSlate SignNow for the sarp employer form offers numerous benefits, including increased efficiency, reduced errors, and expedited processing times. Our secure eSignature feature ensures that your documents are legally binding and compliant. This results in a more streamlined experience for both employers and employees.

-

How does airSlate SignNow ensure the security of the sarp employer form?

airSlate SignNow prioritizes document security by implementing advanced encryption and compliance protocols for the sarp employer form. All data is protected both in transit and at rest, ensuring that sensitive information remains confidential. Additionally, our platform provides audit logs to track document access and changes.

Get more for Sarp Employer Return

- Bcal 1049 afc group application packet michigan form

- Pdf certificate of amendment to the state of michigan form

- Cscl cd715 form

- City of champlin permits form

- How did you hear about this loan program form

- Montana department of environmental montana deq form

- Telecommunications exemption form

- Resale certificate nevada form

Find out other Sarp Employer Return

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple