SARP Employer Return for the Period 1 January to 31 December Return by Employer of Employees Who Availed of Relief under the Spe 2016

What is the SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Special Assignee Relief Programme SARP Section 825C, Taxes Consolidation Act Revenue

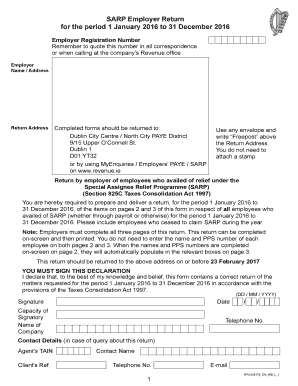

The SARP Employer Return is a specific tax form required under Section 825C of the Taxes Consolidation Act. It is designed for employers to report on employees who have benefited from the Special Assignee Relief Programme (SARP). This program aims to attract skilled workers to Ireland by providing tax relief on certain income for assignees. The return covers the period from January first to December thirty-first and is crucial for ensuring compliance with tax regulations.

How to use the SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Special Assignee Relief Programme SARP Section 825C, Taxes Consolidation Act Revenue

Using the SARP Employer Return involves several steps to ensure accurate reporting. Employers must gather all relevant information regarding employees who availed of the SARP relief. This includes details such as the employee's name, tax identification number, and the amount of relief claimed. Once the information is compiled, it can be entered into the designated form, which may be submitted electronically or via traditional mail, depending on the employer's preference.

Steps to complete the SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Special Assignee Relief Programme SARP Section 825C, Taxes Consolidation Act Revenue

Completing the SARP Employer Return requires careful attention to detail. Here are the essential steps:

- Gather necessary employee information, including personal and tax details.

- Determine the total amount of relief each employee is eligible for under the SARP.

- Fill out the return form accurately, ensuring all fields are completed.

- Review the completed form for accuracy and compliance with tax regulations.

- Submit the return by the specified deadline, either online or by mail.

Legal use of the SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Special Assignee Relief Programme SARP Section 825C, Taxes Consolidation Act Revenue

The SARP Employer Return is legally binding when completed and submitted in accordance with the relevant tax laws. To ensure its legal validity, employers must adhere to the guidelines set forth by the tax authorities. This includes accurate reporting of all required information and maintaining compliance with any applicable regulations. Failure to comply can result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the SARP Employer Return to avoid penalties. Typically, the return must be submitted by a specific date following the end of the reporting period. It is essential to check the current tax year’s deadlines, as these can vary. Marking these dates on a calendar can help ensure timely submission.

Penalties for Non-Compliance

Non-compliance with the SARP Employer Return requirements can lead to significant penalties. These may include financial fines or additional scrutiny from tax authorities. Employers should take care to understand the consequences of late or inaccurate submissions to avoid these issues. Regular training and updates on tax regulations can help mitigate the risk of non-compliance.

Quick guide on how to complete sarp employer return for the period 1 january 2016 to 31 december 2016 return by employer of employees who availed of relief

Effortlessly Complete SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Spe on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and without interruptions. Manage SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Spe on any platform using airSlate SignNow applications for Android or iOS and simplify any document-related process today.

How to Modify and eSign SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Spe with Ease

- Obtain SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Spe and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, via email, SMS, an invitation link, or download it to your computer.

Forget the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing out new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Spe to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sarp employer return for the period 1 january 2016 to 31 december 2016 return by employer of employees who availed of relief

Create this form in 5 minutes!

How to create an eSignature for the sarp employer return for the period 1 january 2016 to 31 december 2016 return by employer of employees who availed of relief

The way to create an eSignature for a PDF document online

The way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Special Assignee Relief Programme?

The SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Special Assignee Relief Programme is a document that employers must submit to Revenue. It provides information on employees who benefited from the SARP, ensuring compliance with Section 825C of the Taxes Consolidation Act. Accurate submission is crucial to maintain proper tax records and relieve administrative burdens.

-

How can airSlate SignNow help with the SARP Employer Return process?

airSlate SignNow streamlines the SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Special Assignee Relief Programme by providing an intuitive platform to gather employee data and eSign necessary documents. With our easy-to-use interface, employers can efficiently complete and submit the required information to comply with tax regulations. This flexibility can enhance compliance and reduce risks associated with manual submissions.

-

What are the pricing options for using airSlate SignNow to manage SARP Employer Returns?

airSlate SignNow offers several pricing plans tailored to fit different business needs, making it accessible for companies managing SARP Employer Returns. Our plans include various features to enhance your document management experience, allowing you to choose the right level of functionality. Each plan provides a cost-effective solution to efficiently handle the SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Special Assignee Relief Programme.

-

What features does airSlate SignNow provide to facilitate the SARP Employer Return process?

airSlate SignNow provides a range of features to aid in the completion of the SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Special Assignee Relief Programme. Key features include document templates, real-time collaboration, and secure eSigning, which enable easy data collection and enhance workflow efficiency. These tools are designed to simplify the document preparation and submission process for employers.

-

What are the benefits of using airSlate SignNow for SARP Employer Returns?

Using airSlate SignNow for your SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Special Assignee Relief Programme can signNowly reduce administrative workload. By automating document workflows and ensuring compliance with legal requirements, employers can save time and resources. Furthermore, the digital platform increases accuracy and provides audit trails for better record-keeping.

-

Are there integrations available for managing SARP Employer Returns with airSlate SignNow?

Yes, airSlate SignNow offers seamless integrations with various business tools and applications, enhancing your ability to manage the SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Special Assignee Relief Programme. These integrations facilitate data synchronization and streamline workflows across platforms. Users can easily connect their existing tools to enhance overall efficiency and effectiveness.

-

Is training available for users new to airSlate SignNow for SARP Employer Returns?

Absolutely, airSlate SignNow provides resources and training materials to assist users in navigating the platform, particularly for completing the SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Special Assignee Relief Programme. Our customer support team also offers guidance to ensure users are fully confident in utilizing the software for their needs. Training ensures you maximize the platform’s capabilities.

Get more for SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Spe

- Mouse genetics gizmo answer key form

- Forensic science program college of science form

- Why become an erb member apply for erb membership form

- Information entered into the application while viewing it in a browser window cannot

- Checkout procedure example for laptops form

- This is a legal and binding agreement which when form

- Fillable outsourcing security assessment questionnaire form

- Veteran children and spouse tuition waiver form

Find out other SARP Employer Return For The Period 1 January To 31 December Return By Employer Of Employees Who Availed Of Relief Under The Spe

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast