Form No 20 2005-2026

What is Form No 20

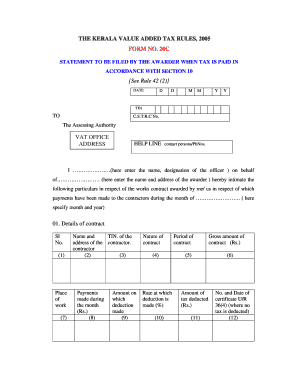

Form No 20 is a crucial document used in the context of value-added tax (VAT) in Kerala. This form serves as a declaration by the buyer to the seller, confirming that the goods purchased are for resale or for use in manufacturing. The completion of this form allows the buyer to claim input tax credit, which can significantly reduce the overall tax burden. Understanding the purpose and requirements of Form No 20 is essential for businesses operating in Kerala to ensure compliance with the state's tax regulations.

How to use Form No 20

Using Form No 20 involves several steps to ensure proper completion and submission. First, the buyer must accurately fill out the form with relevant details, including the seller's information, the nature of the goods, and the value of the transaction. Once completed, the form should be presented to the seller at the time of purchase. The seller retains this form for their records, which is essential for their own tax reporting. It is important for both parties to keep copies of the form for future reference and compliance audits.

Steps to complete Form No 20

Completing Form No 20 requires attention to detail. Here are the steps involved:

- Gather necessary information, including the seller's name, address, and GST registration number.

- Provide your own details, including your name, address, and GST registration number, if applicable.

- Clearly describe the goods being purchased, including quantities and values.

- Sign and date the form to validate the information provided.

- Submit the completed form to the seller during the transaction.

Legal use of Form No 20

Form No 20 holds legal significance in the context of VAT transactions in Kerala. It is a legally recognized document that supports the buyer's claim for input tax credit. To ensure its legal validity, the form must be completed accurately and retained by both the buyer and seller. In the event of an audit, having this form readily available can help demonstrate compliance with tax regulations and avoid potential penalties.

Key elements of Form No 20

Form No 20 includes several key elements that must be accurately filled out to ensure its validity. These elements include:

- The name and address of the seller.

- The GST registration number of the seller.

- The name and address of the buyer.

- The GST registration number of the buyer, if applicable.

- A detailed description of the goods purchased, including quantities and values.

- The signature of the buyer and the date of the transaction.

Required Documents

To complete Form No 20, certain documents may be required. These typically include:

- A valid GST registration certificate for both the buyer and seller.

- Invoices or receipts for the goods being purchased.

- Any additional documentation that supports the claim for input tax credit.

Quick guide on how to complete form no 20

Prepare Form No 20 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents rapidly without setbacks. Handle Form No 20 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to edit and eSign Form No 20 with ease

- Obtain Form No 20 and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize essential sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Form No 20 and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 20

The way to create an eSignature for your PDF document in the online mode

The way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What were the signNow events in 2005 in Kerala that impacted businesses?

In 2005 in Kerala, several signNow events influenced business operations, including the implementation of new trade policies and infrastructural developments. These changes created a conducive environment for growth, leading to increased investments in various sectors. Understanding these events is crucial for businesses looking to thrive in the current market.

-

How does airSlate SignNow benefit businesses in Kerala established in 2005?

For businesses established in 2005 in Kerala, airSlate SignNow provides an efficient way to manage documentation through digital signatures. This solution streamlines processes, reducing time and costs associated with physical paperwork. With ease of use, companies can enhance their productivity while ensuring legal compliance.

-

What features of airSlate SignNow are most beneficial for startups in Kerala post-2005?

Startups in Kerala that emerged post-2005 can greatly benefit from airSlate SignNow's features, such as customizable templates, secure cloud storage, and real-time collaboration. These features help streamline operations for new businesses, allowing them to focus on growth and customer satisfaction. Additionally, the user-friendly interface makes it easy for startups to adopt this solution without extensive training.

-

Is airSlate SignNow a cost-effective solution for businesses operating since 2005 in Kerala?

Absolutely! airSlate SignNow offers a cost-effective solution for businesses operating since 2005 in Kerala. With various pricing plans tailored to meet different needs, companies can choose a plan that fits their budget while taking advantage of essential features. This solution helps businesses save on overhead costs associated with traditional document management.

-

What integrations does airSlate SignNow provide for businesses in Kerala rooted in 2005?

airSlate SignNow seamlessly integrates with various popular applications that businesses in Kerala, rooted in 2005, commonly use. These integrations allow for efficient workflows by connecting with tools like Google Drive, Salesforce, and more. This ensures that businesses can maintain their existing processes while leveraging the eSigning capabilities of airSlate SignNow.

-

How does airSlate SignNow ensure compliance for documents signed in 2005 in Kerala?

To ensure compliance for documents signed in 2005 in Kerala, airSlate SignNow follows strict security protocols and industry standards. This includes maintaining an audit trail and using encryption to safeguard sensitive information. Businesses can rely on airSlate SignNow for ensuring that their eSigned documents meet legal requirements.

-

Can airSlate SignNow help enhance customer satisfaction for businesses in Kerala founded in 2005?

Yes, airSlate SignNow can signNowly enhance customer satisfaction for businesses in Kerala founded in 2005. By simplifying the signing process and reducing turnaround times, businesses can provide a better customer experience. Quick and efficient document handling helps build trust and improves relationships with clients.

Get more for Form No 20

Find out other Form No 20

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors