Bad Debt Write off Method Form

Understanding the Bad Debt Write Off Method

The bad debt write off method is a financial approach used by businesses to recognize and account for debts that are unlikely to be collected. This method allows companies to remove these uncollectible amounts from their accounts receivable, thereby providing a clearer picture of their financial health. By writing off bad debts, businesses can also reduce their taxable income, as these amounts can be deducted from their overall revenue.

Steps to Complete the Bad Debt Write Off Method

Completing the bad debt write off method involves several key steps:

- Identify uncollectible debts: Review accounts receivable to determine which debts are unlikely to be paid.

- Document attempts to collect: Keep records of all attempts made to collect the debt, including communications and payment plans.

- Prepare a write off letter: Draft a letter to formally document the decision to write off the debt.

- Update financial records: Adjust your accounting records to reflect the write-off, ensuring that the bad debt is removed from accounts receivable.

- Notify relevant parties: Inform stakeholders, such as accountants or tax advisors, about the write-off for proper reporting.

Legal Use of the Bad Debt Write Off Method

The legal use of the bad debt write off method is governed by various regulations and accounting principles. In the United States, businesses must comply with Generally Accepted Accounting Principles (GAAP) when writing off bad debts. This ensures that the write-off is appropriately documented and justified. Additionally, businesses should maintain thorough records to support their write-off claims in case of an audit by the Internal Revenue Service (IRS).

IRS Guidelines for Bad Debt Write Offs

The IRS provides specific guidelines regarding the treatment of bad debts for tax purposes. To qualify for a bad debt deduction, the debt must be a legitimate obligation that has become worthless. Businesses are required to demonstrate that they have made reasonable efforts to collect the debt before it can be written off. It's essential to consult IRS publications or a tax professional to ensure compliance with these guidelines and to understand the implications for your tax filings.

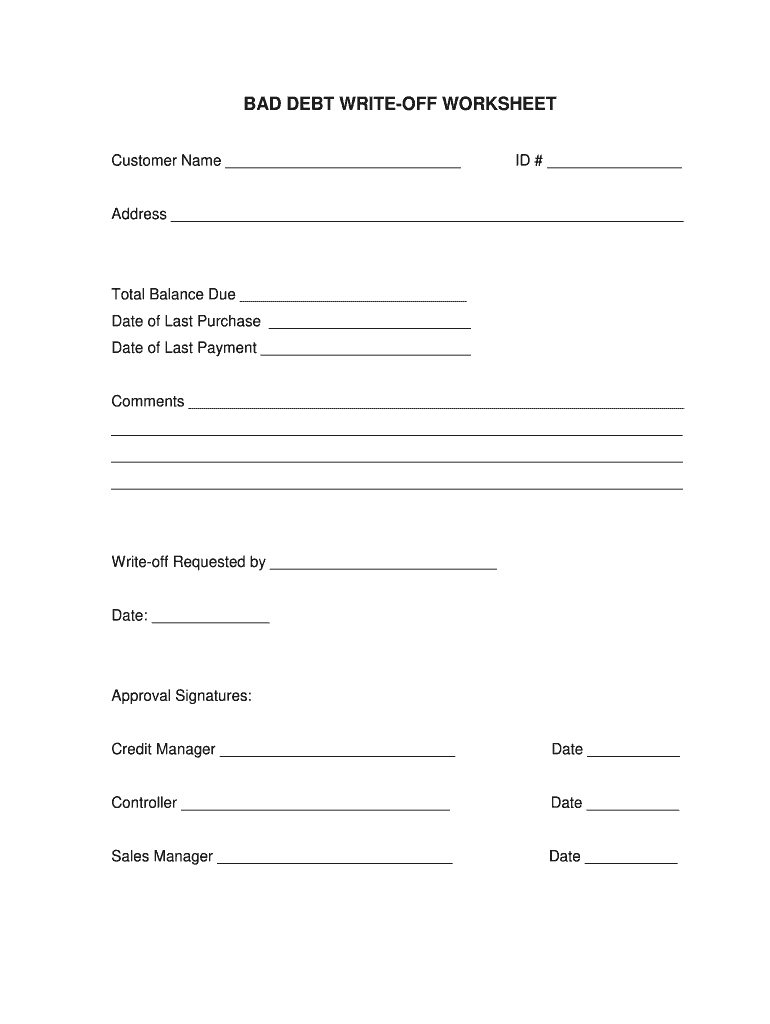

Required Documents for Bad Debt Write Off

To successfully execute a bad debt write off, certain documents are necessary:

- Accounts receivable records: Documentation showing the original debt and payment history.

- Collection attempts: Evidence of efforts made to collect the debt, such as emails, letters, or phone call logs.

- Write off letter: A formal letter stating the decision to write off the debt, including reasons and relevant details.

- Financial statements: Updated financial records reflecting the write-off for accurate reporting.

Examples of Using the Bad Debt Write Off Method

Here are some common scenarios where the bad debt write off method is applied:

- A small business that has exhausted all collection efforts for an unpaid invoice from a customer who has declared bankruptcy.

- A service provider who has provided services but has not received payment after multiple reminders and attempts to negotiate a payment plan.

- A retailer that has a long-standing account with a customer who has not made any payments for an extended period, leading to the decision to write off the balance.

Quick guide on how to complete bad debt write off method

Complete Bad Debt Write Off Method effortlessly on any device

Digital document management has become popular among both organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the right template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Bad Debt Write Off Method on any device using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Bad Debt Write Off Method with ease

- Obtain Bad Debt Write Off Method and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight important sections of the documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Decide how you want to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choice. Modify and eSign Bad Debt Write Off Method and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bad debt write off method

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is a bad debt write off approval letter format?

A bad debt write off approval letter format is a standardized document that organizations use to formally request the approval of writing off debts that are deemed uncollectible. This letter ensures that the process follows internal and regulatory compliance, facilitating smoother accounting practices.

-

How can airSlate SignNow help me create a bad debt write off approval letter?

With airSlate SignNow, you can easily create a bad debt write off approval letter format using customizable templates. Our platform allows you to fill in the necessary details and eSign the document, speeding up the approval process and ensuring accuracy.

-

Is airSlate SignNow suitable for businesses with large numbers of bad debt write off approvals?

Absolutely! airSlate SignNow is designed to handle high volumes of document management, making it ideal for businesses with extensive requests for bad debt write off approval letters. You can efficiently track and manage multiple approval requests in one unified platform.

-

What features does airSlate SignNow offer for managing bad debt documentation?

airSlate SignNow provides key features such as document templates, eSigning capabilities, and secure storage for your bad debt write off approval letters. Additionally, our platform supports real-time collaboration, ensuring that your team can work together seamlessly.

-

Can I integrate airSlate SignNow with other accounting software for bad debt management?

Yes, airSlate SignNow integrates smoothly with many popular accounting software solutions, which can streamline your bad debt write off approval letter format processes. This integration allows for better tracking and management of financial documents in one place.

-

What are the benefits of using airSlate SignNow for bad debt write off approval letters?

Using airSlate SignNow for your bad debt write off approval letters offers the benefit of speed, efficiency, and secure digital signature capabilities. The platform simplifies the process, reducing errors and enhancing compliance, which leads to improved cash flow management.

-

How does pricing work for airSlate SignNow when managing approval letters?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those focused on managing bad debt write off approval letters. You can select a plan that fits your budget and access various features that streamline document management.

Get more for Bad Debt Write Off Method

Find out other Bad Debt Write Off Method

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online