Spending Claim 2018-2026

What is the Spending Claim?

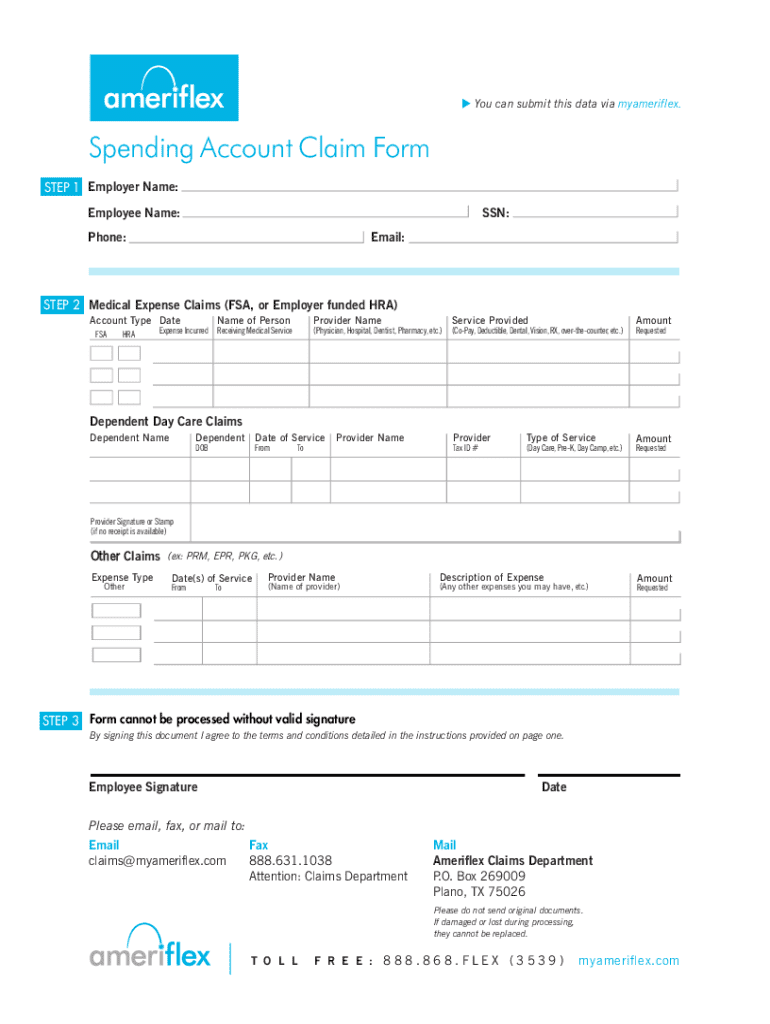

The ameriflex spending claim form is a document used by individuals to request reimbursement for eligible expenses incurred through their ameriflex spending account. This account allows employees to set aside pre-tax dollars for qualified medical expenses, dependent care, and other approved costs. Understanding the specifics of the spending claim is crucial for ensuring that all eligible expenses are accurately documented and reimbursed.

How to Use the Spending Claim

To effectively use the ameriflex spending claim form, gather all necessary documentation that supports your claim. This includes receipts, invoices, and any other relevant proof of payment. When filling out the form, clearly indicate the amount being claimed, the date of the expense, and a brief description of the service or item purchased. It is essential to ensure that all information is accurate to avoid delays in processing.

Steps to Complete the Spending Claim

Completing the ameriflex spending claim form involves several key steps:

- Gather all relevant documentation, including receipts and invoices.

- Fill out the claim form with accurate details, including your personal information and the specifics of the expenses.

- Attach the necessary documentation to support your claim.

- Review the completed form for accuracy and completeness.

- Submit the form according to the specified submission methods, which may include online, mail, or in-person options.

Legal Use of the Spending Claim

The ameriflex spending claim form must be filled out and submitted in compliance with applicable laws and regulations governing spending accounts. This includes adhering to IRS guidelines regarding eligible expenses and maintaining proper documentation to substantiate claims. Ensuring legal compliance helps protect against potential audits and ensures that reimbursements are processed smoothly.

Required Documents

When submitting the ameriflex spending claim form, it is important to include the following required documents:

- Receipts or invoices for all claimed expenses.

- A completed ameriflex spending claim form.

- Any additional documentation that may be required by your employer or plan administrator.

Form Submission Methods

The ameriflex spending claim form can typically be submitted through various methods, providing flexibility for users. Common submission methods include:

- Online submission through the designated ameriflex portal.

- Mailing a hard copy of the completed form to the designated address.

- In-person submission at designated locations, if applicable.

Eligibility Criteria

To utilize the ameriflex spending account and submit a claim, individuals must meet specific eligibility criteria. Generally, this includes being an employee of a participating employer and having access to a qualified spending account plan. Additionally, expenses must be for services or items that qualify under IRS regulations to ensure reimbursement.

Quick guide on how to complete spending claim

Effortlessly Prepare Spending Claim on Any Device

Managing documents online has gained popularity among organizations and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and without delays. Handle Spending Claim on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and Electronically Sign Spending Claim

- Find Spending Claim and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important parts of your documents or redact sensitive information with tools specifically designed for that purpose from airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Select your preferred method to share your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Spending Claim to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the spending claim

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is an Ameriflex account?

An Ameriflex account is a type of flexible spending account that allows you to set aside pre-tax dollars for eligible medical expenses. This account helps you save on taxes while managing healthcare costs effectively. With an Ameriflex account, you can use your funds to pay for a variety of qualified expenses, ensuring you maximize your benefits.

-

How can I set up an Ameriflex account?

To set up an Ameriflex account, you typically need to enroll during your employer's open enrollment period. Your employer will provide you with the necessary enrollment forms and details on how to contribute. Once your account is set up, you can start funding it with pre-tax income.

-

What are the benefits of using an Ameriflex account?

Using an Ameriflex account offers several benefits, including tax savings since contributions are deducted from your taxable income. It also allows you to manage healthcare expenses more effectively, giving you greater flexibility in using funds for eligible costs. This account can enhance your overall budgeting for medical expenses and increase your financial wellness.

-

What types of expenses can I pay for with my Ameriflex account?

You can use your Ameriflex account funds for a wide range of qualified medical expenses, such as copayments, prescription medications, and dental or vision care. It's important to keep track of your spending and save receipts for verification purposes. Checking Ameriflex guidelines helps ensure you're using the account correctly.

-

Are there annual limits on contributions to the Ameriflex account?

Yes, there are annual contribution limits for Ameriflex accounts, which can vary based on IRS regulations and your employer's plan. For the most current limits, it's advisable to consult your HR department or refer to Ameriflex’s guidelines. Staying informed about these limits can optimize your tax savings and budgeting.

-

How does the Ameriflex account integrate with airSlate SignNow?

The Ameriflex account can seamlessly integrate with airSlate SignNow, allowing you to efficiently manage documentation related to your account and expenses. With airSlate SignNow, you can electronically sign necessary forms and documents with ease, simplifying the management of your healthcare expenses. This integration enhances your overall experience by streamlining administrative tasks.

-

What are the fees associated with an Ameriflex account?

Typically, there may be administrative fees associated with maintaining an Ameriflex account, but these can vary by employer. Some plans may have no fees, while others could charge a small monthly or annual fee. It's important to clarify any potential fees with your employer to understand the total cost of using your Ameriflex account.

Get more for Spending Claim

Find out other Spending Claim

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online