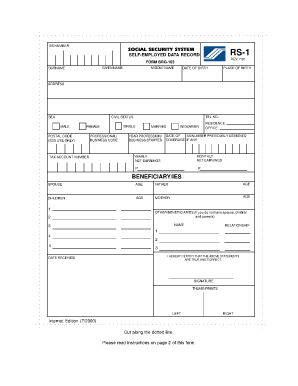

Sss Requirements for Self Employed Form

What are the SSS Requirements for Self-Employed Individuals?

The Social Security System (SSS) requirements for self-employed individuals in the United States focus on ensuring that these individuals contribute to their retirement and social security benefits. Self-employed individuals must register with the SSS and provide necessary documentation to establish their eligibility. Key requirements include proof of self-employment, such as business registration documents, tax identification numbers, and income statements. Additionally, self-employed individuals must select a contribution rate based on their declared income, which will affect their future benefits.

Steps to Complete the SSS Requirements for Self-Employed Individuals

Completing the SSS requirements involves several important steps:

- Registration: Self-employed individuals must register with the SSS by filling out the appropriate forms, which can be done online or in person.

- Documentation: Gather necessary documents, including proof of income, business registration, and tax identification.

- Contribution Selection: Determine the appropriate contribution rate based on income. This will impact future benefits.

- Payment: Make regular contributions to the SSS to maintain eligibility for benefits.

Legal Use of the SSS Requirements for Self-Employed Individuals

The legal framework surrounding the SSS requirements for self-employed individuals is designed to protect both the individual and the system. Compliance with these requirements ensures that self-employed individuals can access benefits such as retirement, disability, and health insurance. It is crucial to adhere to the guidelines set forth by the SSS to avoid penalties and ensure that contributions are recognized. Failure to comply can result in loss of benefits and potential legal consequences.

Required Documents for SSS Registration

To successfully register with the SSS as a self-employed individual, several documents are required:

- Business Registration: Proof of business registration or a license to operate.

- Tax Identification Number: A valid tax ID to confirm self-employment status.

- Income Statements: Documentation of income, such as tax returns or profit and loss statements.

- Identification: A government-issued ID for personal identification.

Form Submission Methods for SSS Requirements

Self-employed individuals can submit their SSS registration forms through various methods:

- Online: Registration and submission can be completed through the official SSS website, providing a convenient option for users.

- Mail: Forms can be printed, filled out, and mailed to the appropriate SSS office.

- In-Person: Individuals may also visit local SSS offices to submit their forms directly.

Penalties for Non-Compliance with SSS Requirements

Non-compliance with the SSS requirements can lead to significant penalties for self-employed individuals. These may include:

- Fines: Financial penalties for failing to register or make timely contributions.

- Loss of Benefits: Ineligibility for future benefits such as retirement or disability payments.

- Legal Action: Potential legal repercussions for failing to comply with established regulations.

Quick guide on how to complete sss requirements for self employed

Prepare Sss Requirements For Self Employed effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can easily find the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without any holdups. Handle Sss Requirements For Self Employed on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Sss Requirements For Self Employed with ease

- Locate Sss Requirements For Self Employed and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive details using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just moments and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Sss Requirements For Self Employed to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sss requirements for self employed

The way to make an e-signature for your PDF file online

The way to make an e-signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to 1 sss?

airSlate SignNow is a robust platform that enables businesses to send and eSign documents easily. The term '1 sss' refers to our one-stop solution for eSignature needs, ensuring a seamless process for document management.

-

What are the pricing plans available for airSlate SignNow related to 1 sss?

airSlate SignNow offers various pricing plans tailored to meet diverse business needs. Our '1 sss' plan provides a cost-effective solution that includes essential features for eSigning and document workflows.

-

What features does airSlate SignNow provide under the 1 sss solution?

The 1 sss solution boasts features such as template creation, real-time tracking, document sharing, and mobile access. These tools are designed to streamline your eSigning process and enhance productivity.

-

How can airSlate SignNow benefit my business with the 1 sss option?

Using the 1 sss option allows your business to save time and reduce costs associated with traditional document signing. This effective solution ensures quick turnaround times and improves customer satisfaction.

-

Can I integrate airSlate SignNow with other applications under the 1 sss plan?

Yes, airSlate SignNow supports integrations with various applications, enhancing your workflow under the 1 sss plan. This allows for seamless connectivity with your existing business tools for a more streamlined process.

-

Is airSlate SignNow secure for handling sensitive documents in the 1 sss service?

Absolutely! airSlate SignNow adheres to strict security protocols to ensure that your documents remain safe. When you use our 1 sss service, you can trust that sensitive information is protected with advanced encryption.

-

Are there any limits on document signing with the 1 sss plan?

The 1 sss plan is designed to offer generous limits on document signing, ensuring you can manage your workflow effectively. However, it's always good to check your specific plan details to understand any potential restrictions.

Get more for Sss Requirements For Self Employed

- Hawaii sublease form

- Hawaii landlord tenant form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable hawaii form

- Hi lease form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497304421 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement hawaii form

- Letter landlord rental form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants hawaii form

Find out other Sss Requirements For Self Employed

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors