Standard Deduction 40 Form

What is the Standard Deduction 40 Form

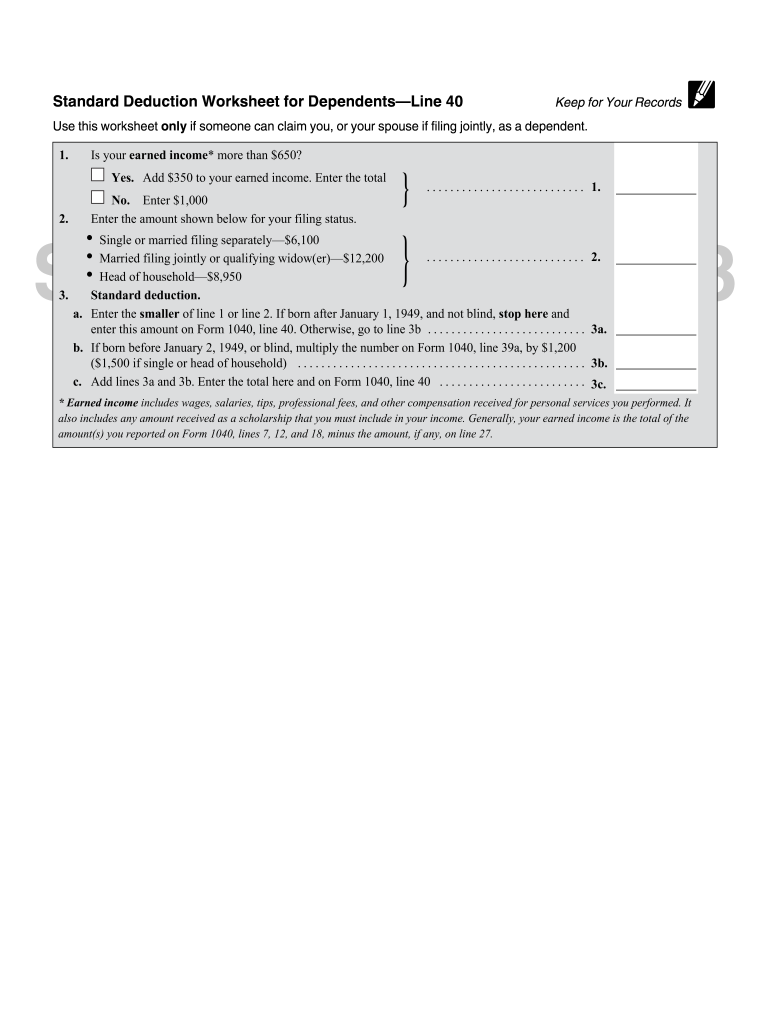

The Standard Deduction 40 Form is a tax document used by individuals in the United States to calculate their standard deduction for the tax year. This form simplifies the process of determining the amount that can be deducted from taxable income, thereby reducing the overall tax liability. For the 2024 tax year, the standard deduction amounts vary based on filing status, including single, married filing jointly, married filing separately, and head of household. Understanding this form is essential for taxpayers to maximize their deductions and ensure compliance with IRS regulations.

Steps to Complete the Standard Deduction 40 Form

Completing the Standard Deduction 40 Form involves several key steps that ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, identify your filing status, as this will determine the applicable standard deduction amount. Then, fill out the form by entering your personal information and calculating your total income. Finally, apply the standard deduction to your total income to determine your taxable income. It is crucial to review the completed form for any errors before submission.

IRS Guidelines

The IRS provides specific guidelines for using the Standard Deduction 40 Form. These guidelines outline the eligibility criteria for claiming the standard deduction, including income limits and filing status requirements. Taxpayers must ensure they are not itemizing deductions on their tax return if they choose to use this form. Additionally, the IRS updates the standard deduction amounts annually, so it is essential to refer to the latest guidelines for the 2024 tax year. Familiarity with these regulations can help prevent mistakes and potential penalties.

Required Documents

To successfully complete the Standard Deduction 40 Form, certain documents are necessary. Taxpayers should have their Social Security numbers, income statements such as W-2s or 1099s, and any prior year tax returns on hand. If claiming dependents, documentation proving their eligibility, such as birth certificates or Social Security cards, may also be required. Having these documents readily available can streamline the process and ensure that all information provided on the form is accurate and complete.

Form Submission Methods

The Standard Deduction 40 Form can be submitted through various methods, catering to different preferences. Taxpayers can choose to file electronically using tax preparation software, which often includes built-in features for completing the form. Alternatively, the form can be printed and mailed to the IRS. For those who prefer a personal touch, in-person submission at designated IRS offices is also an option. Each method has its advantages, and choosing the right one can depend on individual circumstances and preferences.

Eligibility Criteria

Eligibility for using the Standard Deduction 40 Form is determined by several factors. Taxpayers must meet specific income thresholds and filing status requirements set by the IRS. For instance, those who are married filing separately may have different eligibility criteria compared to single filers. Additionally, individuals who can be claimed as dependents on someone else's tax return may face limitations on their standard deduction. Understanding these criteria is vital for ensuring compliance and maximizing potential deductions.

Legal Use of the Standard Deduction 40 Form

The legal use of the Standard Deduction 40 Form hinges on compliance with IRS regulations. This form must be filled out accurately and submitted within the designated filing period to avoid penalties. Additionally, taxpayers should ensure that they are eligible to claim the standard deduction and that all information provided is truthful. Utilizing electronic signature solutions, such as airSlate SignNow, can enhance the legal validity of the form by ensuring secure and compliant submissions, particularly when filing electronically.

Quick guide on how to complete standard deduction 40 form

Complete Standard Deduction 40 Form effortlessly on any device

Managing documents online has gained signNow popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can access the correct version and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Standard Deduction 40 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Standard Deduction 40 Form with ease

- Locate Standard Deduction 40 Form and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Standard Deduction 40 Form and guarantee exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the standard deduction 40 form

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is the standard deduction line in relation to tax preparation?

The standard deduction line refers to the fixed amount that taxpayers can deduct from their taxable income, reducing their overall tax liability. Understanding where this line is situated in your tax documentation is crucial for maximizing your deductions and ensuring accurate filing.

-

How does airSlate SignNow streamline the eSigning process for tax documents?

airSlate SignNow simplifies the eSigning process for tax documents by allowing users to send and sign securely online. This way, you can quickly and efficiently handle documents that may include the standard deduction line and other essential tax features without delays.

-

What pricing plans does airSlate SignNow offer for businesses?

airSlate SignNow provides flexible pricing plans catering to various business sizes and needs. Each plan includes features designed to help manage documents, including those necessary for filing under the standard deduction line, making it an affordable choice for businesses.

-

Can I integrate airSlate SignNow with my accounting software?

Yes, airSlate SignNow offers seamless integration with popular accounting software solutions. This allows you to easily send tax forms and manage documents associated with the standard deduction line, enhancing your overall productivity.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents provides benefits such as improved efficiency, enhanced security, and ease of use. The platform helps you focus on critical tax aspects, like the standard deduction line, without the hassles of traditional paperwork.

-

Is airSlate SignNow suitable for freelancers and independent contractors?

Absolutely! Freelancers and independent contractors can greatly benefit from airSlate SignNow, especially when dealing with tax forms that involve the standard deduction line. The platform enables quick and secure document management, which is advantageous for individuals managing their taxes.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes document security with advanced encryption and robust authentication measures. This ensures that sensitive information, including details related to the standard deduction line, remains confidential and protected throughout the signing process.

Get more for Standard Deduction 40 Form

- About schedule r form 1040 credit for the elderly or

- Wwwirsgovforms pubsabout form 944about form 944 employers annual federal tax return

- 2021 form 1042 s foreign persons us source income subject to withholding

- 2021 form 1099 k payment card and third party network transactions

- Federal us income tax return for homeowners associations form

- 3903 form 3903 moving expenses department of the treasury

- W2g form 2021

- Fillioimportant notice how to apply for the energyfillable important notice how to apply for the energy state form

Find out other Standard Deduction 40 Form

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document