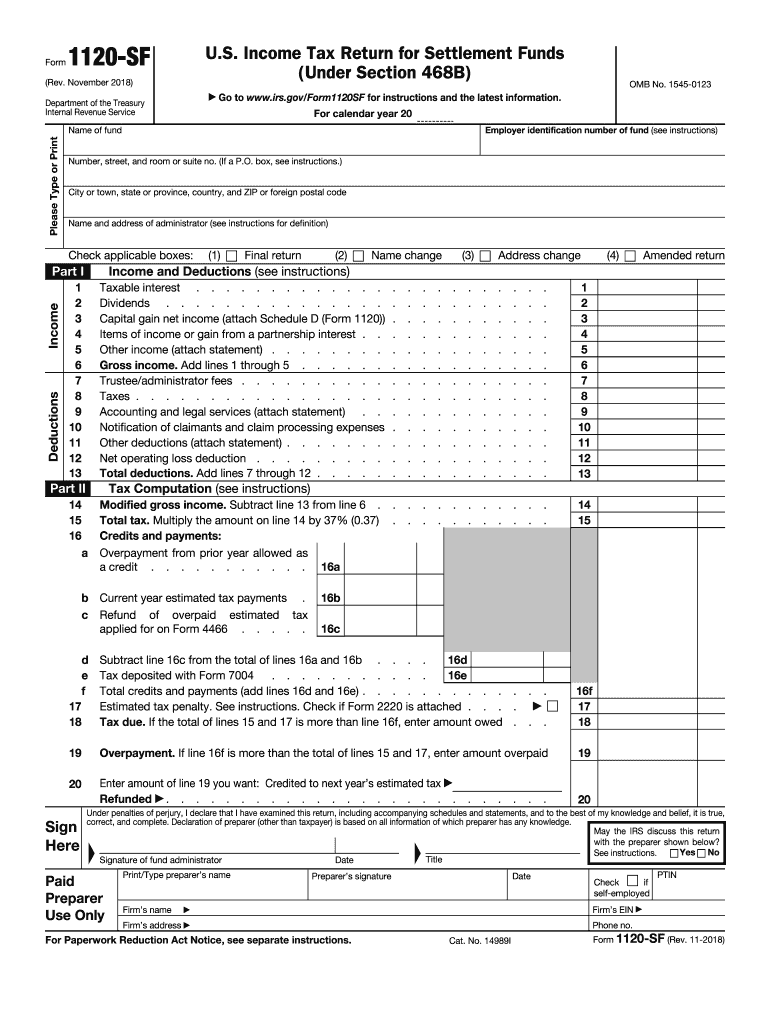

Form Sf Irs 2018-2026

What is the 1120S Form?

The 1120S form, also known as the IRS Form 1120S, is a tax return specifically designed for S corporations in the United States. This form allows S corporations to report their income, deductions, and credits to the Internal Revenue Service (IRS). Unlike traditional C corporations, S corporations pass their income directly to shareholders, who then report it on their personal tax returns. This tax structure helps avoid double taxation, making it a popular choice for small businesses.

Steps to Complete the 1120S Form

Completing the 1120S form involves several key steps to ensure accuracy and compliance with IRS regulations. Here’s a simplified guide:

- Gather necessary financial documents, including income statements, balance sheets, and records of deductions.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report income by detailing gross receipts or sales, as well as any other income sources.

- List allowable deductions, such as salaries, rent, and utilities, to calculate the corporation's taxable income.

- Complete the Schedule K, which summarizes the income, deductions, and credits that will be passed on to shareholders.

- Ensure all calculations are accurate and double-check for any missing information.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Filing deadlines for the 1120S form are crucial for compliance. Typically, the form must be filed by the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. If additional time is needed, S corporations can file for an extension, which provides an additional six months to submit the form. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties.

Legal Use of the 1120S Form

The 1120S form serves a legal purpose by ensuring that S corporations comply with federal tax laws. By accurately reporting income and deductions, corporations fulfill their obligations under the Internal Revenue Code. Furthermore, the form must be signed by an authorized officer of the corporation, affirming that the information provided is true and complete. This legal requirement helps maintain transparency and accountability in corporate financial reporting.

Required Documents

To successfully complete the 1120S form, several documents are required. These include:

- Financial statements, such as profit and loss statements and balance sheets.

- Records of all income sources, including sales and investment income.

- Documentation for all deductions claimed, such as receipts for expenses and payroll records.

- Prior year tax returns, if applicable, for reference and consistency.

Form Submission Methods

The 1120S form can be submitted through various methods. Corporations have the option to file electronically using IRS-approved software, which can streamline the process and reduce errors. Alternatively, the form can be printed and mailed to the appropriate IRS address. It is important to ensure that the form is sent to the correct location based on the corporation's principal business activity and location. In-person submissions are generally not an option for tax forms.

Quick guide on how to complete form sf irs

Prepare Form Sf Irs effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form Sf Irs on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

The simplest method to modify and eSign Form Sf Irs without stress

- Find Form Sf Irs and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose your method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Edit and eSign Form Sf Irs for seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form sf irs

Create this form in 5 minutes!

How to create an eSignature for the form sf irs

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the 1120 s form and whom does it apply to?

The 1120 s form is a tax return specifically designed for S corporations to report their income, deductions, and credits. It applies to any corporation that has elected to be taxed under Subchapter S of the Internal Revenue Code. Understanding the 1120 s form is crucial for small business owners to ensure compliance with federal tax regulations.

-

How can airSlate SignNow simplify the process of filing the 1120 s form?

airSlate SignNow streamlines the process of preparing and signing the 1120 s form by allowing you to collect necessary signatures electronically. This eliminates the hassle of printing, scanning, and mailing documents. With airSlate SignNow, you can efficiently manage your S corporation's tax filings from anywhere.

-

What are the costs associated with using airSlate SignNow for the 1120 s form?

airSlate SignNow offers competitive pricing tailored to different business needs, allowing you to choose a plan that suits your budget. The cost may vary based on features required, such as document storage or integrations. Investing in airSlate SignNow can save you time and resources associated with filing the 1120 s form.

-

What features does airSlate SignNow offer for handling the 1120 s form?

Key features of airSlate SignNow relevant to the 1120 s form include customizable templates, user-friendly document sharing options, and secure cloud storage. These tools are designed to help you efficiently prepare and manage your S corporation’s tax documents while ensuring data integrity and compliance with tax regulations.

-

How does airSlate SignNow ensure the security of my 1120 s form documents?

airSlate SignNow implements robust security measures, including end-to-end encryption, two-factor authentication, and secure data storage to protect your 1120 s form documents. These features ensure that your sensitive financial information is safeguarded against unauthorized access. You can trust airSlate SignNow to keep your data secure while you manage your S corporation’s paperwork.

-

Can I integrate airSlate SignNow with other software for my 1120 s form needs?

Yes, airSlate SignNow offers seamless integrations with popular accounting and tax preparation software, enhancing your workflow for handling the 1120 s form. This allows you to sync data across platforms, which minimizes errors and saves time. By integrating airSlate SignNow, you create a streamlined approach to managing your S corporation's tax filings.

-

What are the benefits of using airSlate SignNow for my S corporation's 1120 s form?

Using airSlate SignNow offers numerous benefits for your S corporation's 1120 s form process, including increased efficiency through digitally signed documents and simplified collaboration among team members. Additionally, this solution enhances your compliance efforts by keeping your documents organized and easily accessible. Overall, airSlate SignNow saves you time and reduces stress during tax season.

Get more for Form Sf Irs

- K to 12 grade 7 learning material in edukasyon sa form

- Remit 5 form

- Ohio secretary of state certificate of merger to be used when at least one constituent entity is an ohio entity form

- Meal attendance sheet mid michigan child care food program form

- Application for emergency variance form

- Telephone 304 558 6000 form

- Documents required for registration of a boat form

- Availability for employment in a position in new york state government form

Find out other Form Sf Irs

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online