Form 1120 SF Rev December Irs 2016

What is the Form 1120 SF Rev December IRS

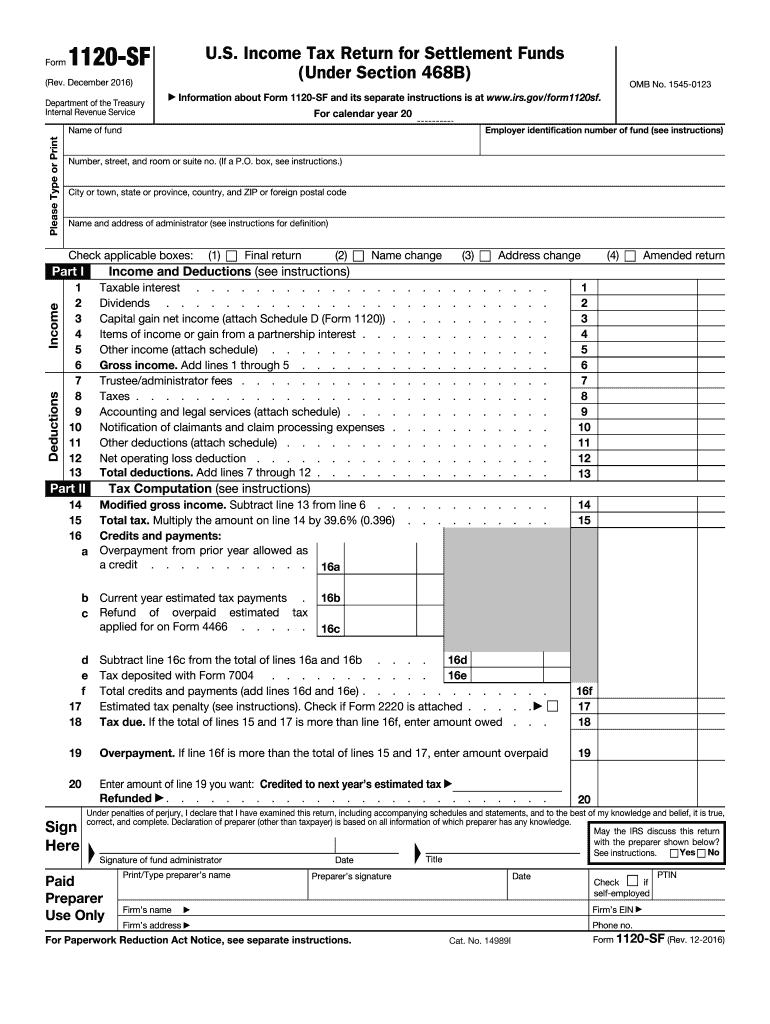

The Form 1120 SF Rev December IRS is a tax form specifically designed for S corporations in the United States. This form is used to report income, gains, losses, deductions, and credits, as well as to calculate the tax liability for S corporations. It is essential for S corporations to file this form annually to comply with federal tax regulations. The “SF” in the title stands for “Short Form,” indicating that it is a simplified version of the standard Form 1120, tailored for smaller S corporations with straightforward tax situations.

How to use the Form 1120 SF Rev December IRS

Using the Form 1120 SF Rev December IRS involves several steps. First, gather all necessary financial documents, such as income statements, expense reports, and previous tax returns. Next, accurately fill out the form, ensuring that all income and deductions are reported correctly. It is important to follow the instructions provided by the IRS to avoid errors. Once completed, the form can be submitted electronically or via mail, depending on the preferences and requirements of the corporation.

Steps to complete the Form 1120 SF Rev December IRS

Completing the Form 1120 SF Rev December IRS requires careful attention to detail. Here are the key steps:

- Begin by entering the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report total income in the designated section, including gross receipts and other income sources.

- List allowable deductions, such as salaries, cost of goods sold, and other business expenses.

- Calculate the taxable income by subtracting total deductions from total income.

- Complete the tax calculation section, applying the appropriate tax rate for S corporations.

- Sign and date the form, ensuring that it is submitted by the deadline.

Legal use of the Form 1120 SF Rev December IRS

The legal use of the Form 1120 SF Rev December IRS is crucial for maintaining compliance with federal tax laws. This form serves as an official document that reports the financial activities of an S corporation. Accurate completion and timely submission are necessary to avoid penalties and ensure that the corporation remains in good standing with the IRS. The form must be signed by an authorized officer of the corporation, which adds to its legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 SF Rev December IRS are important to adhere to in order to avoid late fees and penalties. Generally, the form is due on the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is typically due by March 15. Extensions may be available, but they must be requested in advance and submitted according to IRS guidelines.

Form Submission Methods (Online / Mail / In-Person)

The Form 1120 SF Rev December IRS can be submitted through various methods. Corporations have the option to file electronically using IRS-approved e-filing software, which can streamline the process and reduce the risk of errors. Alternatively, the form can be printed and mailed to the appropriate IRS address. In-person submissions are generally not accepted for this form. When filing by mail, it is advisable to use certified mail or another trackable service to ensure that the submission is received.

Quick guide on how to complete form 1120 sf rev december 2016 irs

Easily Prepare Form 1120 SF Rev December Irs on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly and without delays. Handle Form 1120 SF Rev December Irs across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Form 1120 SF Rev December Irs

- Obtain Form 1120 SF Rev December Irs and click Obtain Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Finish button to save your changes.

- Choose your preferred method of sending your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 1120 SF Rev December Irs to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 sf rev december 2016 irs

Create this form in 5 minutes!

How to create an eSignature for the form 1120 sf rev december 2016 irs

How to make an electronic signature for your Form 1120 Sf Rev December 2016 Irs in the online mode

How to generate an electronic signature for the Form 1120 Sf Rev December 2016 Irs in Google Chrome

How to make an electronic signature for signing the Form 1120 Sf Rev December 2016 Irs in Gmail

How to generate an electronic signature for the Form 1120 Sf Rev December 2016 Irs from your smartphone

How to generate an electronic signature for the Form 1120 Sf Rev December 2016 Irs on iOS devices

How to create an eSignature for the Form 1120 Sf Rev December 2016 Irs on Android OS

People also ask

-

What is Form 1120 SF Rev December Irs?

Form 1120 SF Rev December Irs is a specific tax form used by small corporations to report their income, gains, losses, deductions, and credits. It is essential for compliance with IRS regulations and helps businesses properly file their taxes in a timely manner.

-

How can airSlate SignNow assist with Form 1120 SF Rev December Irs?

airSlate SignNow provides a seamless solution for businesses to send, eSign, and manage their Form 1120 SF Rev December Irs electronically. This ensures a faster and more efficient filing process, reducing the risk of errors associated with traditional paper methods.

-

Is there a cost associated with using airSlate SignNow for Form 1120 SF Rev December Irs?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs at competitive rates. Each plan includes features that facilitate the electronic signing and management of documents like Form 1120 SF Rev December Irs, ensuring value for your investment.

-

What features does airSlate SignNow offer for handling Form 1120 SF Rev December Irs?

airSlate SignNow includes critical features like customizable templates, secure cloud storage, and tracking capabilities for documents like Form 1120 SF Rev December Irs. These features streamline the signing process and enhance document security, ensuring compliance and ease of use.

-

Are there integrations available with other software for Form 1120 SF Rev December Irs?

Absolutely, airSlate SignNow integrates with various popular software solutions, allowing you to manage Form 1120 SF Rev December Irs alongside your existing tools. Integrations with cloud storage, CRM systems, and accounting software enhance workflow and efficiency.

-

Can I access my Form 1120 SF Rev December Irs documents from anywhere?

Yes, with airSlate SignNow, you can access your Form 1120 SF Rev December Irs documents from any device with an internet connection. The platform’s cloud-based nature ensures that you can manage your documents anytime, making it convenient for busy professionals.

-

What are the benefits of using airSlate SignNow for Form 1120 SF Rev December Irs?

Using airSlate SignNow for Form 1120 SF Rev December Irs provides numerous benefits, including enhanced security, reduced turnaround times, and easy collaboration. The platform’s user-friendly interface makes it accessible for everyone, ensuring that your business file is processed smoothly.

Get more for Form 1120 SF Rev December Irs

Find out other Form 1120 SF Rev December Irs

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed