Form 1120 SF U S Income Tax Return for Settlement Funds Irs 2013

What is the Form 1120 SF U S Income Tax Return For Settlement Funds Irs

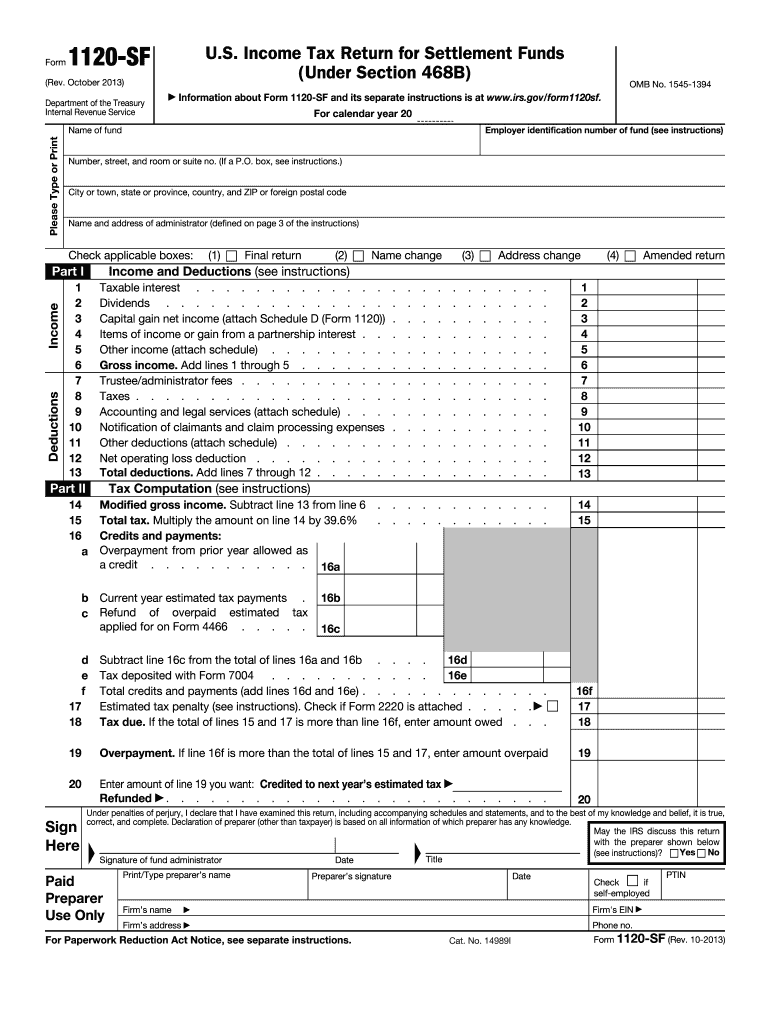

The Form 1120 SF U S Income Tax Return for Settlement Funds is a specialized tax return form utilized by certain entities, such as corporations, to report income, gains, losses, deductions, and credits associated with settlement funds. This form is particularly relevant for organizations that manage settlement funds on behalf of clients, ensuring compliance with IRS regulations. It is designed to capture the unique financial activities related to these funds, allowing entities to accurately report their tax obligations to the IRS.

How to use the Form 1120 SF U S Income Tax Return For Settlement Funds Irs

Utilizing the Form 1120 SF requires careful attention to detail to ensure accurate reporting. First, gather all necessary financial documents related to the settlement funds, including income statements and expense reports. Next, complete the form by entering relevant financial data in the appropriate sections, such as income, deductions, and credits. After filling out the form, review it thoroughly for accuracy before submitting it to the IRS. It is essential to keep a copy for your records and ensure compliance with any specific instructions provided by the IRS.

Steps to complete the Form 1120 SF U S Income Tax Return For Settlement Funds Irs

Completing the Form 1120 SF involves several key steps:

- Step 1: Gather all financial records related to the settlement funds.

- Step 2: Fill in the entity's name, address, and identification number at the top of the form.

- Step 3: Report total income from settlement funds in the designated section.

- Step 4: Enter any deductions or credits applicable to the settlement funds.

- Step 5: Review all entries for accuracy and completeness.

- Step 6: Sign and date the form before submission.

Legal use of the Form 1120 SF U S Income Tax Return For Settlement Funds Irs

The legal use of the Form 1120 SF is critical for compliance with U.S. tax laws. This form must be filed by entities managing settlement funds to report their financial activities accurately. Failure to file or inaccuracies in the form can lead to penalties or legal repercussions. It is essential to understand the legal implications of the information reported on this form and ensure that all data is truthful and complete to maintain compliance with IRS regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 SF are crucial for compliance. Generally, the form must be filed by the 15th day of the third month after the end of the tax year. For entities operating on a calendar year, this typically means a deadline of March 15. Extensions may be available, but it is important to file for an extension prior to the original deadline to avoid penalties. Keeping track of these dates ensures that entities remain compliant and avoid unnecessary fines.

Form Submission Methods (Online / Mail / In-Person)

The Form 1120 SF can be submitted through various methods, providing flexibility for filers. Entities may file electronically through the IRS e-file system, which is often the most efficient method. Alternatively, the form can be mailed to the appropriate IRS address designated for tax returns. In-person submissions are generally not available for this form, making electronic and mail submissions the primary options. Ensure that any electronic submissions receive confirmation to verify receipt by the IRS.

Quick guide on how to complete form 1120 sf us income tax return for settlement funds irs

Complete Form 1120 SF U S Income Tax Return For Settlement Funds Irs effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to retrieve the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Form 1120 SF U S Income Tax Return For Settlement Funds Irs on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Form 1120 SF U S Income Tax Return For Settlement Funds Irs with ease

- Obtain Form 1120 SF U S Income Tax Return For Settlement Funds Irs and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, the hassle of tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow addresses all your document management needs within a few clicks from any device you prefer. Modify and electronically sign Form 1120 SF U S Income Tax Return For Settlement Funds Irs and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 sf us income tax return for settlement funds irs

Create this form in 5 minutes!

How to create an eSignature for the form 1120 sf us income tax return for settlement funds irs

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF document on Android devices

People also ask

-

What is the Form 1120 SF U S Income Tax Return For Settlement Funds Irs?

The Form 1120 SF U S Income Tax Return For Settlement Funds Irs is a tax form specifically used by certain eligible entities to report their income, deductions, and credits for settlement funds. It's crucial for compliance with IRS regulations and helps businesses accurately assess their tax liabilities.

-

How can airSlate SignNow assist with completing the Form 1120 SF U S Income Tax Return For Settlement Funds Irs?

airSlate SignNow simplifies the process of completing the Form 1120 SF U S Income Tax Return For Settlement Funds Irs by providing an easy-to-use electronic platform for document creation, signing, and submission. Our tools ensure that your forms are filled out correctly and submitted on time.

-

What are the pricing options for airSlate SignNow when filing Form 1120 SF U S Income Tax Return For Settlement Funds Irs?

airSlate SignNow offers competitive pricing plans that cater to various business needs. We provide a cost-effective solution for easily managing and submitting your Form 1120 SF U S Income Tax Return For Settlement Funds Irs without hidden fees or complicated pricing structures.

-

Is it safe to use airSlate SignNow for sensitive tax documents like the Form 1120 SF U S Income Tax Return For Settlement Funds Irs?

Absolutely! airSlate SignNow employs industry-standard security protocols to ensure that your sensitive information, such as the Form 1120 SF U S Income Tax Return For Settlement Funds Irs, is protected. Our platform uses encryption and secure cloud storage to maintain the confidentiality and integrity of your documents.

-

Can I integrate airSlate SignNow with other accounting software for filing Form 1120 SF U S Income Tax Return For Settlement Funds Irs?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax preparation software. This allows you to streamline your workflow and effortlessly file the Form 1120 SF U S Income Tax Return For Settlement Funds Irs alongside your existing systems.

-

What benefits does airSlate SignNow offer when managing the Form 1120 SF U S Income Tax Return For Settlement Funds Irs?

Using airSlate SignNow for managing the Form 1120 SF U S Income Tax Return For Settlement Funds Irs provides numerous benefits, including increased efficiency, reduced errors, and faster turnaround times. Our platform enables you to focus on your core business activities while we handle the complexities of document management.

-

Is there customer support available for users filing the Form 1120 SF U S Income Tax Return For Settlement Funds Irs?

Yes, airSlate SignNow offers comprehensive customer support to assist users with their queries about the Form 1120 SF U S Income Tax Return For Settlement Funds Irs. Our support team is available to guide you through any challenges you may face during the filing process.

Get more for Form 1120 SF U S Income Tax Return For Settlement Funds Irs

- Georgia motion form

- Annulment for columbia county ga form

- Letter from landlord to tenant as notice of default on commercial lease georgia form

- Residential or rental lease extension agreement georgia form

- Georgia rental form

- Apartment lease rental application questionnaire georgia form

- Georgia residential application 497303849 form

- Salary verification form for potential lease georgia

Find out other Form 1120 SF U S Income Tax Return For Settlement Funds Irs

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format