Form 5309 2012-2026

What is the Form 5309

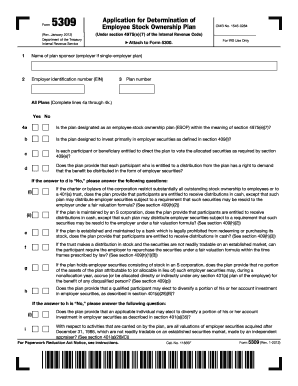

The Form 5309 is a federal tax form utilized by businesses and individuals to report specific information regarding stock ownership and transactions. This form is particularly relevant for those involved in stock ownership plans, as it provides crucial details necessary for compliance with IRS regulations. Understanding the purpose of the Form 5309 is essential for ensuring accurate reporting and avoiding potential penalties.

How to use the Form 5309

Using the Form 5309 involves several key steps. First, gather all necessary information related to stock ownership, including details about the stock, the owners, and any transactions that have occurred. Next, complete the form by accurately filling in each section, ensuring that all required fields are addressed. After completing the form, review it for accuracy before submitting it to the IRS or the relevant state authority, depending on your specific circumstances.

Steps to complete the Form 5309

Completing the Form 5309 requires careful attention to detail. Follow these steps:

- Collect all relevant documentation regarding stock ownership and transactions.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check entries for any errors or omissions.

- Sign and date the form where required.

- Submit the form via the appropriate method, whether online, by mail, or in person.

Legal use of the Form 5309

The legal use of the Form 5309 is governed by IRS regulations, which mandate that the information reported must be accurate and complete. Failure to comply with these regulations can result in penalties. It is important to ensure that the form is used for its intended purpose and that all necessary documentation is maintained for record-keeping and potential audits.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Form 5309. These guidelines outline the necessary information to be reported, deadlines for submission, and any additional documentation that may be required. Familiarizing oneself with these guidelines is crucial for ensuring compliance and avoiding any issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5309 can vary based on individual circumstances and the type of transactions reported. It is essential to be aware of these deadlines to ensure timely submission. Generally, forms must be filed by specific dates set by the IRS, and late submissions may incur penalties. Keeping track of these important dates can help avoid complications.

Required Documents

To complete the Form 5309, several documents may be required. These typically include proof of stock ownership, transaction records, and any other relevant financial documentation. Having these documents readily available can facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Quick guide on how to complete form 5309

Complete Form 5309 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a superb eco-conscious alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents promptly without interruptions. Manage Form 5309 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Form 5309 with ease

- Find Form 5309 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device of your choosing. Modify and electronically sign Form 5309 and ensure effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5309

Create this form in 5 minutes!

How to create an eSignature for the form 5309

The way to make an eSignature for your PDF in the online mode

The way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

How to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the 2012 form plan offered by airSlate SignNow?

The 2012 form plan from airSlate SignNow is designed to simplify document workflows and electronic signatures. This plan provides essential features that allow businesses to create, sign, and manage forms efficiently. It's a cost-effective solution for those who need to handle forms annually or project-based.

-

How much does the 2012 form plan cost?

The pricing for the 2012 form plan varies based on the number of users and features required. AirSlate SignNow offers competitive pricing structures that cater to businesses of all sizes. For specific pricing details, it’s best to visit our website or contact our sales team for customized quotes.

-

What features are included in the 2012 form plan?

The 2012 form plan includes features like document templates, customizable fields, and audit trails to track document interactions. Additionally, users can enjoy unlimited e-signatures and access to mobile apps for signing on-the-go. This plan is tailored to enhance productivity for form management.

-

What are the benefits of using the 2012 form plan?

Using the 2012 form plan allows businesses to reduce turnaround times and increase document security. You can streamline workflows, minimize paper usage, and improve the overall efficiency of document management. This makes it a valuable tool for both small businesses and enterprises.

-

Can I integrate the 2012 form plan with other applications?

Yes, the 2012 form plan can be easily integrated with various applications, making it versatile for business use. Whether you are using CRM systems, cloud storage services, or productivity suites, you can connect airSlate SignNow to enhance your document workflows. Our API supports seamless integration for a customized experience.

-

Is the 2012 form plan suitable for remote teams?

Absolutely, the 2012 form plan is perfect for remote teams as it enables users to send, sign, and manage documents from anywhere. The cloud-based platform ensures that your team can collaborate in real-time, making it easier to work together even when apart. This is essential for modern business operations.

-

What types of documents can be managed with the 2012 form plan?

The 2012 form plan allows you to manage a wide range of documents, including contracts, consent forms, and invoices. This flexibility is vital for businesses that require handling various document types for daily operations. You can tailor your document workflow according to your specific business needs.

Get more for Form 5309

Find out other Form 5309

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample