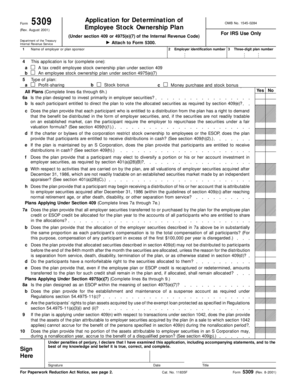

Form 5309 Rev August Application for Determination of Employee Stock Ownership Plan 2001

What is the Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan

The Form 5309 Rev August is an application used to determine whether an Employee Stock Ownership Plan (ESOP) qualifies under the Internal Revenue Code. This form is essential for businesses looking to establish an ESOP, as it provides the necessary documentation to the IRS for approval. By submitting this form, employers can ensure that their ESOP meets the legal requirements for tax benefits, which can significantly impact both the company and its employees. Properly completing this form is crucial for compliance and to avoid potential penalties.

How to use the Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan

Using the Form 5309 Rev August involves several key steps. First, gather all necessary information about the ESOP, including details about the company, the plan, and the participants. Ensure that the form is filled out accurately, as any errors may lead to delays or rejections. Once completed, the form must be submitted to the IRS along with any required supporting documents. It is advisable to keep copies of all submitted materials for your records. Utilizing digital tools can streamline this process, making it easier to fill out, sign, and submit the form securely.

Steps to complete the Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan

Completing the Form 5309 Rev August involves a systematic approach. Follow these steps to ensure accuracy:

- Begin by downloading the form from the IRS website or accessing it through a trusted digital platform.

- Fill in the basic information about the company, including its name, address, and Employer Identification Number (EIN).

- Provide detailed information about the ESOP, including its structure and the type of stock involved.

- Include information about the plan's participants and their rights under the ESOP.

- Review the form for completeness and accuracy before submission.

- Submit the form electronically or via mail, ensuring that you adhere to the IRS guidelines for submission.

Legal use of the Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan

The legal use of the Form 5309 Rev August is governed by IRS regulations that dictate how ESOPs must be structured and operated. To ensure compliance, it is important to understand the legal requirements associated with the form. This includes adhering to the Employee Retirement Income Security Act (ERISA) and ensuring that the ESOP is designed to benefit employees. Failure to comply with these regulations can result in penalties, including the disqualification of the plan and loss of tax benefits. Therefore, it is crucial to approach the completion and submission of this form with diligence and accuracy.

Eligibility Criteria

To qualify for the Employee Stock Ownership Plan as outlined in the Form 5309 Rev August, certain eligibility criteria must be met. These criteria typically include:

- The company must be a corporation or an S corporation.

- There must be a legitimate ESOP in place that meets the requirements set forth by the IRS.

- The plan must be designed to provide stock ownership to employees.

- All employees must be eligible to participate in the ESOP, subject to specific vesting and eligibility rules.

Understanding these criteria is essential for businesses to ensure that their ESOP is compliant and eligible for the desired tax benefits.

Form Submission Methods

The Form 5309 Rev August can be submitted to the IRS through various methods. Businesses have the option to file the form electronically, which is often the fastest method, or to submit it via traditional mail. When filing electronically, it is important to use a secure and compliant platform to ensure that the submission is processed efficiently. For those opting to mail the form, it is advisable to use certified mail to confirm delivery and maintain a record of submission. Regardless of the method chosen, ensure that all required documents accompany the form to avoid delays in processing.

Quick guide on how to complete form 5309 rev august 2001 application for determination of employee stock ownership plan

Complete Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan effortlessly on any device

Online document management has gained traction among organizations and individuals alike. It serves as a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan without hassle

- Obtain Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5309 rev august 2001 application for determination of employee stock ownership plan

Create this form in 5 minutes!

How to create an eSignature for the form 5309 rev august 2001 application for determination of employee stock ownership plan

The best way to create an eSignature for a PDF in the online mode

The best way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan?

The Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan is a crucial document used to request a determination from the IRS regarding the qualification of an Employee Stock Ownership Plan (ESOP). This form ensures that an ESOP meets all necessary regulatory requirements, allowing businesses to benefit from tax advantages and employee incentives.

-

How can airSlate SignNow help with the Form 5309 Rev August Application?

airSlate SignNow streamlines the process of preparing and signing the Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan. With our platform, users can easily upload, edit, and eSign the document, ensuring compliance and speeding up the submission process to the IRS.

-

What features does airSlate SignNow offer for managing the Form 5309 Rev August Application?

airSlate SignNow provides robust features such as template creation, document analytics, and real-time collaboration for managing the Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan. These features facilitate better organization and tracking of the application process, making it easier for businesses to stay compliant.

-

Is airSlate SignNow cost-effective for small businesses filing the Form 5309 Rev August Application?

Yes, airSlate SignNow offers competitive pricing plans designed to be cost-effective for small businesses looking to file the Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan. Our solution helps reduce paperwork and operational costs, making it an affordable option for companies of all sizes.

-

Does airSlate SignNow integrate with other platforms while preparing the Form 5309 Rev August Application?

Yes, airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Dropbox, and more, allowing for smooth management of documents needed for the Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan. This connectivity enhances workflow efficiency by enabling easy access and sharing of essential files.

-

What are the benefits of using airSlate SignNow for the Form 5309 Rev August Application?

Using airSlate SignNow for the Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan offers several benefits including faster document turnaround, enhanced security features, and professional templates. These advantages help businesses achieve compliance effectively while providing a more efficient process for their employees.

-

Can airSlate SignNow assist in tracking the status of the Form 5309 Rev August Application?

Absolutely! airSlate SignNow includes features that allow users to track the status of the Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan throughout its lifecycle. Users can receive notifications and updates, ensuring they are informed about any actions taken on the application, leading to better preparedness.

Get more for Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan

Find out other Form 5309 Rev August Application For Determination Of Employee Stock Ownership Plan

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors