Authorization Fair Credit Reporting Act 2015-2026

What is the Authorization Fair Credit Reporting Act

The Authorization Fair Credit Reporting Act (FCRA) is a federal law designed to promote accuracy, fairness, and privacy in the collection, dissemination, and use of consumer information. It regulates how consumer reporting agencies manage personal information and ensures that consumers have the right to access their credit reports and dispute inaccuracies. Under the FCRA, entities that use consumer reports must obtain authorization from consumers, providing transparency regarding how their information will be used.

Key elements of the Authorization Fair Credit Reporting Act

Several key elements define the Authorization Fair Credit Reporting Act, including:

- Consumer Consent: Entities must obtain written authorization from consumers before accessing their credit reports.

- Disclosure Requirements: Consumers must be informed about the purpose of the report and their rights under the FCRA.

- Accuracy and Privacy: Consumer reporting agencies are obligated to ensure the accuracy of the information they provide and to protect consumer privacy.

- Right to Dispute: Consumers have the right to dispute any inaccuracies in their credit reports, and agencies must investigate these disputes.

Steps to complete the Authorization Fair Credit Reporting Act

Completing the Authorization Fair Credit Reporting Act involves several important steps:

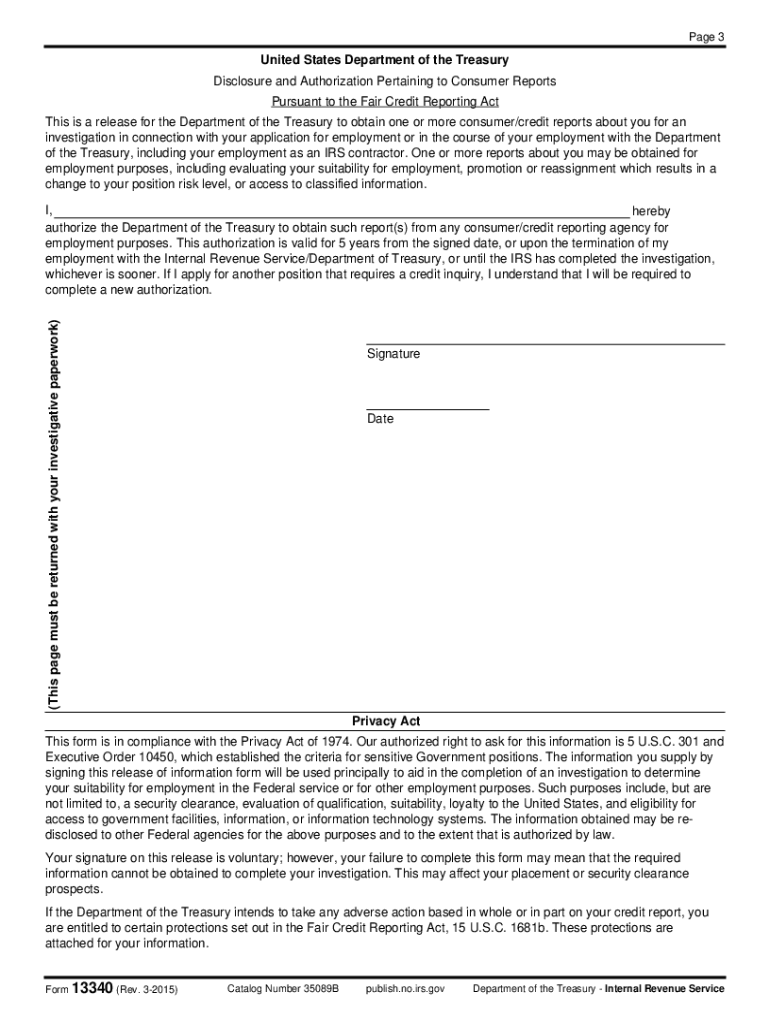

- Obtain the appropriate FCRA form: Ensure you have the correct form for authorization.

- Fill out the form: Provide accurate personal information, including your name, address, and Social Security number.

- Review the disclosure: Read the information regarding your rights and the purpose of the report.

- Sign and date the form: Your signature indicates your consent for the agency to access your credit report.

- Submit the form: Send the completed form to the requesting entity via the specified submission method.

Legal use of the Authorization Fair Credit Reporting Act

The Authorization Fair Credit Reporting Act is legally binding and must be adhered to by all parties involved. Entities that fail to comply with the FCRA may face penalties, including fines and legal action. It is crucial for businesses to understand the legal implications of using consumer reports and to ensure they obtain proper authorization before accessing personal information. Compliance with the FCRA not only protects consumers but also enhances the credibility of businesses in their operations.

Who Issues the Form

The Authorization Fair Credit Reporting Act form is typically issued by consumer reporting agencies, which are organizations that collect and provide consumer information. These agencies include major credit bureaus as well as specialized companies that focus on specific types of consumer data. It is important to ensure that the form you are using is from a reputable source to guarantee its validity and compliance with legal standards.

Disclosure Requirements

Disclosure requirements under the Authorization Fair Credit Reporting Act mandate that consumers be informed about the nature and purpose of the information being collected. This includes:

- The specific reasons for obtaining a consumer report.

- Information on the consumer's rights under the FCRA.

- Details on how to dispute inaccuracies in the report.

These disclosures must be clear and accessible, ensuring that consumers understand their rights and the implications of providing their information.

Quick guide on how to complete authorization fair credit reporting act

Complete Authorization Fair Credit Reporting Act seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Authorization Fair Credit Reporting Act on any device using airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The easiest way to alter and eSign Authorization Fair Credit Reporting Act effortlessly

- Locate Authorization Fair Credit Reporting Act and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your needs in document management with just a few clicks from any device of your preference. Alter and eSign Authorization Fair Credit Reporting Act and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct authorization fair credit reporting act

Create this form in 5 minutes!

How to create an eSignature for the authorization fair credit reporting act

The way to make an eSignature for your PDF file online

The way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is FCRA law and how does it relate to eSignatures?

FCRA law, or the Fair Credit Reporting Act, regulates how consumers' personal information can be used, especially in credit applications. In the context of eSignatures, adherence to FCRA law ensures that consumer consent is obtained transparently and securely, which is crucial for compliance.

-

How can airSlate SignNow help me comply with FCRA law?

AirSlate SignNow provides features that enable organizations to securely capture and store consent from users, ensuring compliance with FCRA law. By utilizing advanced encryption and audit trails, businesses can confidently manage their eSigning processes within the regulatory framework of the FCRA.

-

What are the pricing options for using airSlate SignNow?

AirSlate SignNow offers a variety of pricing plans to cater to different business needs. While pricing may vary based on features and user count, each plan emphasizes compliance with legislation such as FCRA law, ensuring that your signing processes are both affordable and lawful.

-

What features of airSlate SignNow support FCRA law requirements?

Key features of airSlate SignNow that support FCRA law compliance include secure eSigning, customizable templates, and real-time tracking of document statuses. These tools help ensure proper documentation and consent collection in line with regulatory mandates, giving you peace of mind.

-

Can airSlate SignNow integrate with other applications for FCRA law compliance?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow while ensuring compliance with FCRA law. Integrations with CRM systems and document management tools allow for streamlined processes while safeguarding consumer data.

-

What benefits does airSlate SignNow offer for businesses dealing with FCRA law?

Using airSlate SignNow allows businesses to minimize the risk of non-compliance with FCRA law, saving time and resources. The solution offers an easy-to-use platform for managing electronic signatures, which can lead to faster document turnaround and improved client satisfaction.

-

Is airSlate SignNow suitable for businesses in regulated industries regarding FCRA law?

Absolutely, airSlate SignNow is designed to cater to businesses in regulated industries, providing essential tools for FCRA law compliance. This ensures that all eSigning processes meet the stringent requirements necessary for industries such as finance and healthcare.

Get more for Authorization Fair Credit Reporting Act

Find out other Authorization Fair Credit Reporting Act

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form