Onett Computation Form

What is the Onett Computation?

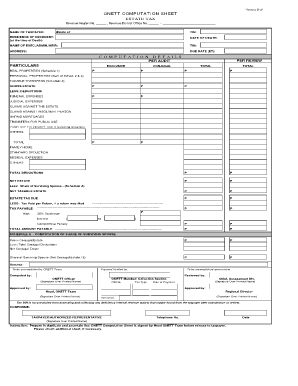

The Onett Computation is a specific form used for estate tax calculations in the Philippines. It serves as a crucial tool for individuals and businesses to determine the tax obligations related to estate transfers. This computation is essential for ensuring compliance with local tax regulations and helps in the accurate reporting of estate values. The Onett Computation includes various elements such as the valuation of assets, deductions, and applicable tax rates, making it a comprehensive resource for estate tax calculations.

Steps to Complete the Onett Computation

Completing the Onett Computation involves several systematic steps to ensure accuracy and compliance. Here are the key steps:

- Gather all necessary documents, including asset valuations and any relevant financial statements.

- List all assets and liabilities associated with the estate.

- Calculate the total value of the estate by subtracting liabilities from assets.

- Apply any allowable deductions as per the regulations.

- Determine the applicable estate tax rate based on the net estate value.

- Complete the computation form with the calculated figures.

Legal Use of the Onett Computation

The Onett Computation must adhere to specific legal guidelines to ensure its validity. In the United States, digital signatures are recognized under the ESIGN and UETA acts, which means that the completed Onett Computation can be submitted electronically if it meets certain criteria. It is important to ensure that all information is accurate and that the form is signed by the appropriate parties to avoid legal complications.

Required Documents for the Onett Computation

To complete the Onett Computation effectively, certain documents are required. These typically include:

- Death certificate of the deceased.

- List of assets and their valuations.

- Documentation of any debts or liabilities.

- Previous tax returns, if applicable.

- Legal documents related to the estate, such as wills or trusts.

Examples of Using the Onett Computation

Understanding how to apply the Onett Computation can be enhanced through practical examples. For instance, consider a scenario where an individual inherits a property valued at $300,000 and has liabilities amounting to $50,000. The net estate value would be calculated as $250,000. Based on the applicable estate tax rate, the individual can determine the tax amount owed. Such examples illustrate the real-world application of the Onett Computation in estate planning and tax preparation.

Filing Deadlines / Important Dates

Filing deadlines for the Onett Computation are critical to avoid penalties. Typically, the estate tax return must be filed within a specific time frame after the death of the individual. It is advisable to check local regulations to confirm the exact deadlines, as these can vary by state and may be subject to change. Missing these deadlines can result in additional fees and complications, making timely submission essential.

Quick guide on how to complete onett computation

Complete Onett Computation effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly and without delays. Manage Onett Computation on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest method to modify and eSign Onett Computation with ease

- Obtain Onett Computation and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate new document prints. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Onett Computation to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Philippine Onett B3 and how does it work?

The Philippine Onett B3 is an advanced e-signature solution designed to streamline document signing for businesses. With airSlate SignNow, users can easily create, send, and manage documents while ensuring compliance and security. Its intuitive interface allows for quick onboarding, making the e-signature process efficient and hassle-free.

-

What features does the Philippine Onett B3 offer?

The Philippine Onett B3 offers a wide array of features, including customizable templates, real-time tracking, and automated workflows. Users can also benefit from advanced authentication options and the ability to request multiple signatures. This comprehensive feature set ensures that businesses can manage their documents efficiently.

-

How much does the Philippine Onett B3 cost?

Pricing for the Philippine Onett B3 through airSlate SignNow is competitive and designed to fit various business budgets. There are several plans available, allowing businesses to choose the one that best meets their needs. To find the best option, visit our pricing page for detailed information.

-

What are the key benefits of using the Philippine Onett B3?

Using the Philippine Onett B3 with airSlate SignNow signNowly reduces the time spent on document management. It enhances productivity by allowing teams to collaborate seamlessly and ensures faster turnaround times for document approvals. Additionally, the platform's security measures protect sensitive information, giving users peace of mind.

-

Can the Philippine Onett B3 integrate with other tools?

Yes, the Philippine Onett B3 easily integrates with a variety of popular business tools, enhancing overall efficiency. These integrations allow users to streamline their workflows by connecting e-signature capabilities with applications like CRM systems, project management tools, and more. This versatility helps businesses maximize productivity.

-

Is the Philippine Onett B3 suitable for small businesses?

Absolutely! The Philippine Onett B3 is designed to cater to businesses of all sizes, including small enterprises. Its user-friendly interface and cost-effective pricing make it an ideal solution for small businesses looking to improve their document management processes without breaking the bank.

-

How secure is the Philippine Onett B3 for electronic signatures?

The Philippine Onett B3 ensures high levels of security for electronic signatures through robust encryption and compliance with global security standards. airSlate SignNow provides advanced authentication options to verify signers' identities, minimizing risks associated with document fraud. You can rest assured that your sensitive documents are well-protected.

Get more for Onett Computation

Find out other Onett Computation

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile