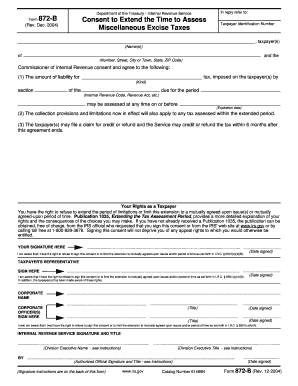

Form 872 B Rev 12 Consent to Extend the Time to Assess Employment Taxes 2004-2026

What is the Form 872 B Consent to Extend the Time to Assess Employment Taxes

The IRS Form 872 B is a legal document used to extend the time for the Internal Revenue Service to assess employment taxes. This form is particularly relevant for employers who may need additional time to address tax liabilities related to employee wages and withholdings. By signing this form, an employer grants the IRS permission to extend the assessment period, which can help in resolving any discrepancies or issues that may arise during tax time.

How to Use the Form 872 B Consent to Extend the Time to Assess Employment Taxes

To effectively use the Form 872 B, an employer must complete the form accurately and submit it to the IRS. The form requires essential information, including the taxpayer's name, address, and identification number. Once filled out, it should be signed by an authorized person, ensuring that the consent is legally binding. This form can be beneficial in situations where an employer anticipates needing more time to clarify tax matters or gather necessary documentation.

Steps to Complete the Form 872 B Consent to Extend the Time to Assess Employment Taxes

Completing the Form 872 B involves several steps:

- Begin by entering the taxpayer's name and address in the designated fields.

- Provide the taxpayer identification number, which is crucial for IRS processing.

- Indicate the type of tax being extended, specifically employment taxes.

- Specify the new assessment period, detailing how long the extension is requested.

- Ensure that the form is signed by an authorized individual, which may include a business owner or a designated representative.

- Review the completed form for accuracy before submission.

Legal Use of the Form 872 B Consent to Extend the Time to Assess Employment Taxes

The legal use of Form 872 B is governed by IRS regulations. When properly executed, this form serves to extend the statute of limitations for the IRS to assess employment taxes. It is essential that the form is completed in accordance with IRS guidelines to ensure its validity. Failure to comply with the legal requirements may result in the form being rejected, which could lead to complications in tax assessments.

Filing Deadlines / Important Dates

Filing deadlines for the Form 872 B are critical to ensure compliance with IRS regulations. Typically, the form should be filed before the original assessment period expires. Employers should be aware of the specific dates related to their tax obligations, as missing a deadline can result in penalties or loss of the extension. It is advisable to track these dates closely to avoid any issues during tax filing.

Penalties for Non-Compliance

Failure to file Form 872 B or to comply with its terms can lead to significant penalties. The IRS may impose fines for late assessments or for not adhering to the extended timeline agreed upon in the form. Additionally, employers may face increased scrutiny during audits if they do not follow proper procedures. Understanding these potential penalties can help employers make informed decisions regarding their tax obligations.

Quick guide on how to complete form 872 b rev 12 2004 consent to extend the time to assess employment taxes

Effortlessly prepare Form 872 B Rev 12 Consent To Extend The Time To Assess Employment Taxes on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without any hold-ups. Handle Form 872 B Rev 12 Consent To Extend The Time To Assess Employment Taxes on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest method to edit and electronically sign Form 872 B Rev 12 Consent To Extend The Time To Assess Employment Taxes smoothly

- Locate Form 872 B Rev 12 Consent To Extend The Time To Assess Employment Taxes and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which only takes a few seconds and carries the same legal authority as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or downloading it to your computer.

No more concerns about lost or mislaid files, tedious form searching, or errors that require printing new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 872 B Rev 12 Consent To Extend The Time To Assess Employment Taxes to ensure seamless communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 872 b rev 12 2004 consent to extend the time to assess employment taxes

Create this form in 5 minutes!

How to create an eSignature for the form 872 b rev 12 2004 consent to extend the time to assess employment taxes

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is IRS Form 872 B and why is it important?

IRS Form 872 B is a consent form that allows the IRS to extend the assessment period for tax liabilities. Understanding and utilizing IRS Form 872 B correctly is crucial for businesses to manage their tax obligations effectively. By leveraging tools like airSlate SignNow, you can efficiently eSign and manage this important document.

-

How can airSlate SignNow help with IRS Form 872 B?

AirSlate SignNow provides an easy-to-use platform for businesses to eSign and send IRS Form 872 B securely. With streamlined workflows, businesses can ensure timely completion and submission of the form, making tax compliance hassle-free. Our solution also supports document tracking to maintain compliance.

-

What are the pricing options for using airSlate SignNow for IRS Form 872 B?

AirSlate SignNow offers flexible pricing plans designed to fit any business size. Our plans include features specifically suited for handling important documents like IRS Form 872 B, ensuring that you can access necessary tools without breaking the bank. Check our website for the most current pricing tiers.

-

Is it safe to eSign IRS Form 872 B using airSlate SignNow?

Yes, airSlate SignNow employs top-level security measures to protect your documents, including IRS Form 872 B, during the eSigning process. Our platform complies with industry standards and regulations, ensuring that your sensitive tax information is kept safe and confidential. You can sign with confidence using our secure solution.

-

Can I integrate airSlate SignNow with other tools for IRS Form 872 B?

Absolutely! AirSlate SignNow integrates seamlessly with various third-party applications, enhancing your workflow when dealing with IRS Form 872 B. Whether you're using CRM systems or cloud storage solutions, our integrations help streamline document management and ensure you have all tools in one place.

-

What are the benefits of using airSlate SignNow for IRS Form 872 B?

Using airSlate SignNow for IRS Form 872 B simplifies the eSigning process and accelerates document turnaround times. The platform’s user-friendly interface reduces administrative burdens, allowing businesses to focus on more critical tasks while ensuring compliance with tax requirements. Enjoy greater efficiency and convenience with our solution.

-

Can I track the status of IRS Form 872 B once sent for eSignature?

Yes, airSlate SignNow allows you to track the status of your documents, including IRS Form 872 B in real-time. You can see when recipients receive, view, and sign the document, which helps ensure that all parties stay informed throughout the process. This feature enhances accountability and streamlines communication.

Get more for Form 872 B Rev 12 Consent To Extend The Time To Assess Employment Taxes

- Pakistan visa indian form

- Visa application form for indian national phclondon

- Pakistan power attorney form

- Application police character certificate form

- Protection status applicant s pakistanorgau form

- Postal order of rs 100 form

- Ilovepdf pdf editor amp reader mod v1310 form

- Home department government of jammu ampamp kashmir form

Find out other Form 872 B Rev 12 Consent To Extend The Time To Assess Employment Taxes

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document