CT 1065CT 1120SI EXT, Application for Extension of Time to File Connecticut Composite Income Tax Return Application for Extensio 2009-2026

Understanding the CT 1065CT 1120SI EXT

The CT 1065CT 1120SI EXT is an application for an extension of time to file the Connecticut Composite Income Tax Return. This form is essential for businesses and partnerships that need additional time to prepare their tax returns. By submitting this application, taxpayers can receive an automatic extension, allowing them to file their returns without facing immediate penalties for late submission. It is important to note that while this extension provides extra time to file, it does not extend the time to pay any taxes owed.

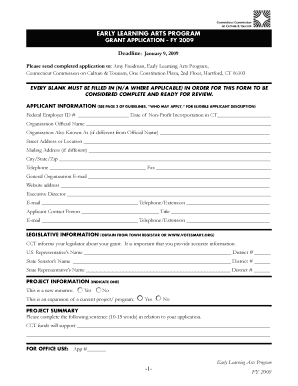

Steps to Complete the CT 1065CT 1120SI EXT

Completing the CT 1065CT 1120SI EXT involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form with accurate information regarding the entity's name, address, and tax identification number. It is crucial to indicate the desired extension period and ensure that all calculations are correct. After completing the form, review it for any errors before submission. Finally, submit the form either electronically or by mail, depending on your preference.

Filing Deadlines and Important Dates

Understanding the filing deadlines for the CT 1065CT 1120SI EXT is vital for compliance. Generally, the application must be submitted by the original due date of the tax return to qualify for the extension. For most entities, this date falls on the fifteenth day of the fourth month following the end of the tax year. For example, if the tax year ends on December 31, the application would be due by April 15 of the following year. Be mindful of these dates to avoid penalties and ensure timely filing.

Form Submission Methods

The CT 1065CT 1120SI EXT can be submitted through various methods, catering to different preferences. Taxpayers have the option to file the form electronically via the Connecticut Department of Revenue Services website, which is often the fastest method. Alternatively, the form can be mailed to the appropriate address provided by the state. In-person submissions may also be possible at designated state offices, although this option is less common. Choosing the right submission method can help streamline the filing process.

Eligibility Criteria for Filing the CT 1065CT 1120SI EXT

Eligibility for filing the CT 1065CT 1120SI EXT generally applies to partnerships and certain business entities that are required to file a composite income tax return in Connecticut. To qualify, the entity must be registered in Connecticut and have a tax obligation. It is essential to review the specific requirements outlined by the Connecticut Department of Revenue Services to ensure that your entity meets all necessary criteria before submitting the application.

Penalties for Non-Compliance

Failing to file the CT 1065CT 1120SI EXT by the deadline can result in significant penalties. If the application is not submitted on time, the entity may face late fees and interest on any unpaid taxes. Additionally, the inability to file the tax return on time can lead to further complications, including increased scrutiny from tax authorities. Understanding these penalties emphasizes the importance of timely submission and compliance with state tax regulations.

Quick guide on how to complete ct 1065ct 1120si ext application for extension of time to file connecticut composite income tax return application for

Complete CT 1065CT 1120SI EXT, Application For Extension Of Time To File Connecticut Composite Income Tax Return Application For Extensio effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-conscious substitute for conventional printed and signed paperwork, enabling you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage CT 1065CT 1120SI EXT, Application For Extension Of Time To File Connecticut Composite Income Tax Return Application For Extensio on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The easiest way to edit and eSign CT 1065CT 1120SI EXT, Application For Extension Of Time To File Connecticut Composite Income Tax Return Application For Extensio without hassle

- Obtain CT 1065CT 1120SI EXT, Application For Extension Of Time To File Connecticut Composite Income Tax Return Application For Extensio and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Mark relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign CT 1065CT 1120SI EXT, Application For Extension Of Time To File Connecticut Composite Income Tax Return Application For Extensio and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 1065ct 1120si ext application for extension of time to file connecticut composite income tax return application for

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

Can I file form CT 1065 CT 1120SI paper using airSlate SignNow?

Yes, you can file form CT 1065 CT 1120SI paper through airSlate SignNow. Our platform allows you to upload, eSign, and send important documents securely and efficiently. With our user-friendly interface, managing your forms becomes hassle-free.

-

What features does airSlate SignNow offer for filing documents?

airSlate SignNow provides a range of features for filing documents, including customizable templates, bulk sending, and real-time tracking. You can easily manage your form submissions, including form CT 1065 CT 1120SI paper, ensuring that everything is organized and accessible in one place.

-

Is airSlate SignNow cost-effective for small businesses?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans cater to small businesses, allowing them to efficiently manage documents, including filing form CT 1065 CT 1120SI paper, without breaking the budget.

-

How secure is the document signing process with airSlate SignNow?

The security of your documents is our top priority at airSlate SignNow. We employ advanced encryption and security protocols to safeguard your data, ensuring that when you file form CT 1065 CT 1120SI paper, your information remains confidential and protected.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers seamless integrations with various applications like Google Drive, Dropbox, and CRM systems. This makes it easy for you to manage your documents, including form CT 1065 CT 1120SI paper, alongside your existing workflows.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including faster turnaround times, reduced paper usage, and improved document tracking. This ensures that when you need to file form CT 1065 CT 1120SI paper, you can do so quickly and efficiently.

-

Is there customer support available if I have questions about my documents?

Yes, airSlate SignNow offers dedicated customer support to assist you with any questions or issues you may encounter, including those related to filing form CT 1065 CT 1120SI paper. Our team is ready to help you navigate the platform and ensure your experience is smooth.

Get more for CT 1065CT 1120SI EXT, Application For Extension Of Time To File Connecticut Composite Income Tax Return Application For Extensio

Find out other CT 1065CT 1120SI EXT, Application For Extension Of Time To File Connecticut Composite Income Tax Return Application For Extensio

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed