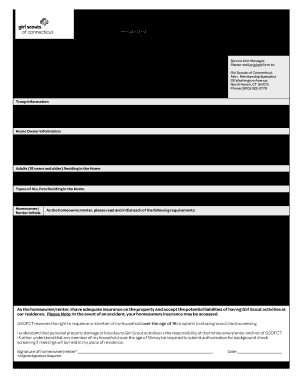

TroopGroup # 2017-2026

Understanding the Connecticut Annual Form

The Connecticut annual form is a crucial document for residents and businesses in Connecticut, often used for tax reporting and compliance purposes. This form plays a significant role in ensuring that individuals and entities meet their annual obligations to the state. Understanding its purpose and requirements is essential for accurate and timely submission.

Steps to Complete the Connecticut Annual Form

Completing the Connecticut annual form involves several steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with accurate information, paying close attention to details such as your Social Security number and any relevant deductions. Once completed, review the form for errors before submission. This careful process helps prevent delays and potential penalties.

Filing Deadlines and Important Dates

Timely filing of the Connecticut annual form is essential to avoid penalties. Typically, the deadline for submission is April fifteenth, aligning with federal tax deadlines. However, it is important to check for any updates or changes to these dates each year. Mark your calendar to ensure you submit your form on time, as late filings can result in additional fees and interest on unpaid taxes.

Required Documents for Submission

When preparing to submit the Connecticut annual form, certain documents are necessary to support your claims. These may include W-2 forms, 1099 forms, and any documentation related to deductions or credits you plan to claim. Having these documents organized and ready will streamline the filing process and help ensure that your form is complete and accurate.

Legal Use of the Connecticut Annual Form

The Connecticut annual form must be used in accordance with state regulations to ensure its legal standing. This includes adhering to guidelines set forth by the Connecticut Department of Revenue Services. Proper use of the form not only fulfills your legal obligations but also protects you from potential audits or disputes regarding your tax filings.

Examples of Using the Connecticut Annual Form

Residents and businesses may encounter various scenarios where the Connecticut annual form is applicable. For instance, an individual filing as a self-employed person will report income differently than a corporation. Understanding these examples can help clarify how to accurately complete the form based on your specific situation, ensuring compliance with state tax laws.

Quick guide on how to complete troopgroup

Effortlessly Prepare TroopGroup # on Any Device

Digital document management has gained traction among enterprises and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage TroopGroup # on any platform using airSlate SignNow's Android or iOS applications and simplify any document-oriented process today.

How to Edit and eSign TroopGroup # with Ease

- Find TroopGroup # and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant portions of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose how you would like to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign TroopGroup # to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct troopgroup

Create this form in 5 minutes!

How to create an eSignature for the troopgroup

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to Connecticut forms?

airSlate SignNow is an electronic signature solution that empowers businesses to send and eSign documents, including various Connecticut forms. The platform streamlines the process of handling essential paperwork, ensuring compliance and quick turnaround times. With airSlate SignNow, you can efficiently manage your Connecticut forms from anywhere, reducing time and enhancing productivity.

-

Are there any specific features that simplify the signing of Connecticut forms?

Yes, airSlate SignNow offers features tailored to simplify the signing of Connecticut forms. Users have access to templates that ensure document consistency and compliance with state requirements. Additionally, features like in-app notifications and reminders keep all parties informed, allowing smooth collaboration on Connecticut forms.

-

How does airSlate SignNow ensure the security of Connecticut forms?

airSlate SignNow prioritizes the security of your Connecticut forms by implementing advanced encryption and compliance with industry standards like ISO 27001. All documents are securely stored and transmitted, ensuring that sensitive information remains protected from unauthorized access. This commitment to security allows you to confidently manage important Connecticut forms.

-

What is the pricing structure for using airSlate SignNow for Connecticut forms?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including options for businesses that frequently utilize Connecticut forms. Pricing typically varies based on features and the number of users, ensuring you only pay for what you need. A free trial is also available, allowing you to explore the platform’s capabilities before committing to a subscription.

-

Can I integrate airSlate SignNow with other applications for managing Connecticut forms?

Yes, airSlate SignNow seamlessly integrates with various applications that can help you manage Connecticut forms more effectively. Popular integrations include CRM systems, cloud storage services, and project management tools. This flexibility allows you to streamline workflows and maintain efficiency while handling Connecticut forms alongside your existing software.

-

What are the benefits of using airSlate SignNow for Connecticut forms?

Using airSlate SignNow for Connecticut forms comes with numerous benefits, including increased efficiency, cost savings, and enhanced user experience. Businesses can accelerate their document processes signNowly, reducing turnaround times and improving overall productivity. Additionally, the platform ensures compliance with legal requirements, making it a reliable choice for your Connecticut forms.

-

Is there customer support available for assistance with Connecticut forms?

Absolutely! airSlate SignNow provides comprehensive customer support to assist users with any questions or issues related to Connecticut forms. Support is available through multiple channels, including live chat, email, and an extensive knowledge base. Our dedicated team is here to ensure you have all the help you need when working with Connecticut forms.

Get more for TroopGroup #

- Access to dmv records is highly restricted form

- 31336 epmf account numbersinternal revenue service form

- How to apply for ifta virginia department of motor vehicles form

- In accordance with texas transportation code 501 form

- Illinois secretary of state rules of the road schedule form

- South carolina department of motor vehicles fr 50 request for form

- Dmv 5 tr form

- Salvage title application packet form

Find out other TroopGroup #

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement