Form 1194 2000-2026

What is the Form 1194

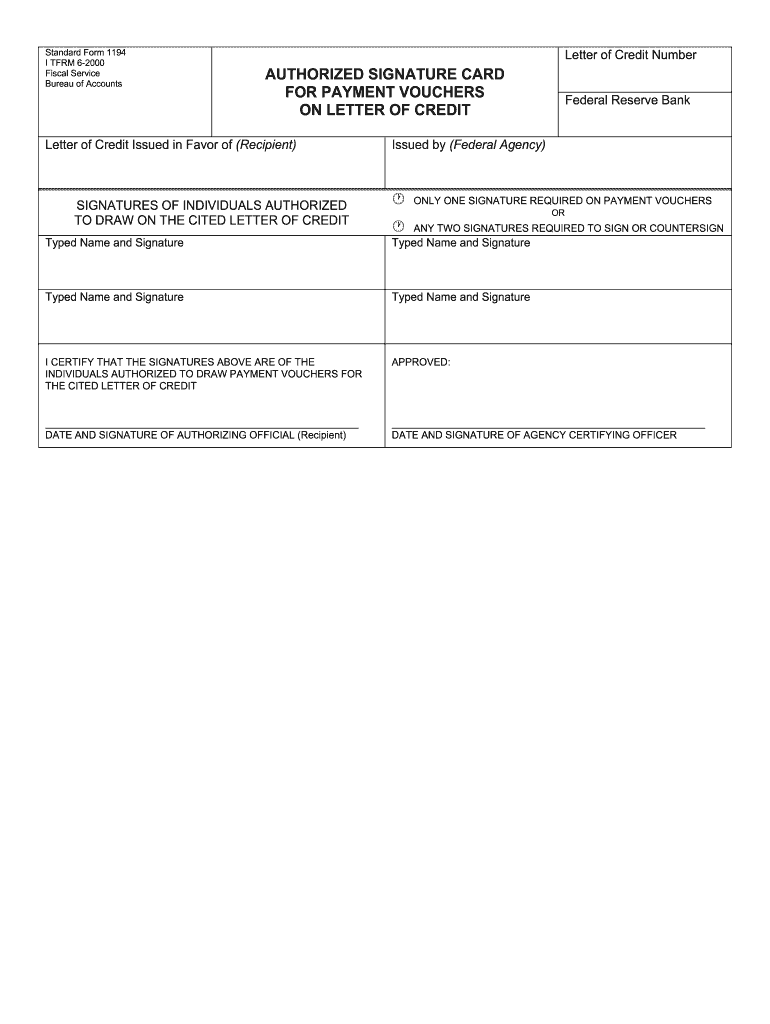

The Form 1194 is a document utilized primarily for reporting and compliance purposes within various business and tax contexts. This form is essential for organizations that need to provide specific information to the IRS regarding their tax-exempt status or other financial disclosures. Understanding the purpose of the Form 1194 is crucial for ensuring accurate reporting and compliance with federal regulations.

How to use the Form 1194

Using the Form 1194 involves several key steps. First, gather all necessary information related to your organization's financial activities. This may include income statements, balance sheets, and details about tax-exempt activities. Next, accurately fill out the form, ensuring that all required fields are completed. Once the form is filled out, review it for accuracy before submission. Utilizing digital tools can streamline this process, making it easier to complete and sign the form electronically.

Steps to complete the Form 1194

Completing the Form 1194 requires careful attention to detail. Follow these steps for a smooth process:

- Gather Information: Collect all relevant financial documents and data.

- Fill Out the Form: Enter the required information accurately in each section.

- Review: Double-check all entries for correctness and completeness.

- Sign: Ensure the form is signed electronically or physically as required.

- Submit: Send the completed form to the appropriate IRS office or agency.

Legal use of the Form 1194

The legal use of the Form 1194 is governed by specific IRS guidelines and regulations. It is crucial to ensure that the form is completed in compliance with applicable laws to avoid penalties or issues with tax reporting. Using electronic signatures through a compliant platform can enhance the legal validity of the form, making it easier to meet the requirements set forth by the IRS.

Key elements of the Form 1194

The Form 1194 contains several key elements that must be addressed for proper completion. These include:

- Organization Information: Name, address, and tax identification number.

- Financial Data: Detailed reporting of income, expenses, and other financial activities.

- Tax-Exempt Status: Information regarding the organization's eligibility for tax-exempt status.

- Signature Section: Where authorized representatives must sign the form.

Form Submission Methods

The Form 1194 can be submitted through various methods, including:

- Online Submission: Many organizations opt for electronic submission for efficiency and ease of tracking.

- Mail: The form can be printed and mailed to the appropriate IRS office.

- In-Person: Some may choose to deliver the form directly to an IRS office, ensuring immediate receipt.

Quick guide on how to complete form 1194

Prepare Form 1194 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without complications. Manage Form 1194 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest way to edit and eSign Form 1194 seamlessly

- Locate Form 1194 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 1194 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1194

The best way to make an electronic signature for a PDF online

The best way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the 1194 form and its purpose?

The 1194 form is a specific type of document used for electronic signatures in various business transactions. It verifies the authenticity of electronic documents and is vital for ensuring compliance with legal requirements. By utilizing the 1194 form, businesses can accelerate their workflow while maintaining security.

-

How can airSlate SignNow help with the 1194 form?

AirSlate SignNow simplifies the process of managing the 1194 form by providing an intuitive platform for eSigning and document management. With its user-friendly interface, you can easily upload, send, and sign the 1194 form electronically. This streamlines your workflow, saving time and reducing paperwork.

-

What are the pricing options for using airSlate SignNow for the 1194 form?

AirSlate SignNow offers various pricing plans tailored to fit different business needs. You can choose from monthly or annual subscriptions, often with the first trial period being free. Each plan provides full access to eSign documents like the 1194 form, enhancing your business efficiency.

-

Are there any specific features in airSlate SignNow that cater to the 1194 form?

Yes, airSlate SignNow includes features designed specifically for handling the 1194 form. These features encompass customizable templates, automated reminders, and secure cloud storage. Additionally, electronic audit trails provide assurance that the signing process remains compliant and streamlined.

-

What benefits does airSlate SignNow offer for eSigning the 1194 form?

Using airSlate SignNow for eSigning the 1194 form offers numerous benefits, including reduced turnaround time and enhanced security. You can sign documents from anywhere, facilitating remote work while ensuring that all signatures are legally binding. This automated process also minimizes the risk of errors and missed deadlines.

-

Can airSlate SignNow integrate with other software for managing the 1194 form?

Absolutely! AirSlate SignNow integrates seamlessly with various software applications, allowing you to manage the 1194 form alongside your other business tools. This integration capability enhances productivity and ensures that your workflow remains synchronized across platforms.

-

Is it secure to use airSlate SignNow for the 1194 form?

Yes, security is a top priority for airSlate SignNow when handling the 1194 form. The platform employs robust encryption and compliance with industry standards to protect your sensitive information. You can confidently eSign and manage documents knowing that your data is fully secured.

Get more for Form 1194

- Form i 601a application for provisional unlawful presence waiver instructions for application for provisional unlawful presence

- Application for advance processing of an orphan petition i 600a instructions for application for advance processing of an form

- Citizenship immigration services naturalization 606228964 form

- Instructions examination form

- Fillable online form i 942 instructions instructions for

- Homeland security employment authorization form

- Tax topic bulletin git12 estates and trusts revised december 2016 tax topic bulletin git12 estates and trusts revised december form

- 2020 new jersey income form

Find out other Form 1194

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form