Receipt of in Kind Gift to Society of St Vincent De Paul Atlanta Svdpatl Form

What is the St Vincent de Paul tax receipt?

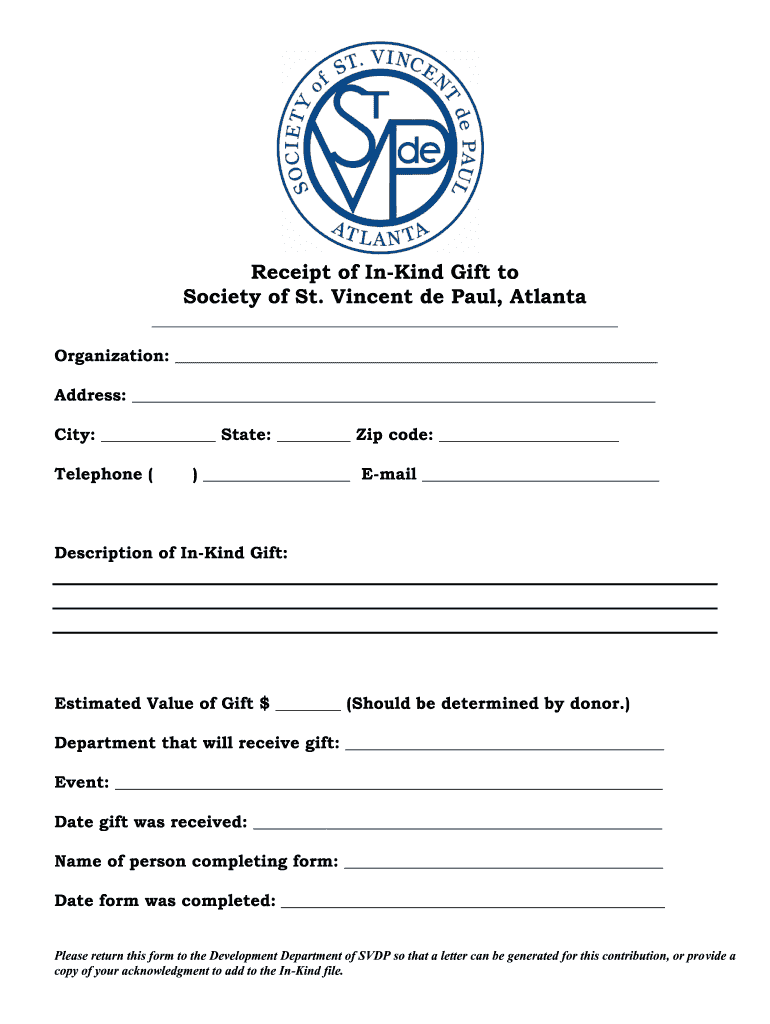

The St Vincent de Paul tax receipt is a formal document provided to donors who contribute in-kind gifts to the Society of St Vincent de Paul. This receipt serves as proof of the donation for tax purposes. It typically includes details such as the donor's name, the date of the donation, a description of the items donated, and their estimated value. This documentation is essential for individuals seeking to claim tax deductions for charitable contributions on their federal income tax returns.

How to use the St Vincent de Paul tax receipt

Using the St Vincent de Paul tax receipt involves several important steps. Donors should keep the receipt in a safe place, as it will be required when filing taxes. When preparing tax returns, individuals can refer to the receipt to accurately report their charitable contributions. It is advisable to maintain a copy of the receipt along with other relevant tax documents to ensure compliance with IRS regulations.

Steps to complete the St Vincent de Paul tax receipt

Completing the St Vincent de Paul tax receipt involves a straightforward process. First, gather all necessary information, including the donor's name, address, and contact information. Next, provide a detailed description of the items donated, including their condition and estimated value. Finally, sign and date the receipt to validate the donation. If completing the receipt electronically, ensure that all information is accurate and legible before submission.

Key elements of the St Vincent de Paul tax receipt

Key elements of the St Vincent de Paul tax receipt include the donor's full name and address, the date of the donation, a description of the donated items, and their estimated fair market value. Additionally, the receipt should indicate whether any goods or services were received in return for the donation, as this affects the deductible amount. Including a statement that no goods or services were provided in exchange for the donation is also important for compliance purposes.

IRS Guidelines for St Vincent de Paul tax receipts

The IRS has specific guidelines regarding the documentation required for charitable contributions. For in-kind donations, the IRS requires that donors maintain a written acknowledgment from the charity, such as the St Vincent de Paul tax receipt, especially for contributions exceeding a certain value. Donors should ensure that the receipt includes all necessary information to substantiate their claims on their tax returns, as inadequate documentation may lead to disallowed deductions during an audit.

Legal use of the St Vincent de Paul tax receipt

The legal use of the St Vincent de Paul tax receipt is primarily for tax deduction purposes. Donors can present this receipt to the IRS as evidence of their charitable contributions. It is crucial that the receipt is completed accurately and retained for at least three years, as the IRS may request documentation to verify claims. Failure to provide proper receipts can result in penalties or disallowed deductions, making it essential for donors to understand the legal implications of their charitable giving.

Quick guide on how to complete receipt of in kind gift to society of st vincent de paul atlanta svdpatl

Manage Receipt Of In Kind Gift To Society Of St Vincent De Paul Atlanta Svdpatl effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without any hold-ups. Handle Receipt Of In Kind Gift To Society Of St Vincent De Paul Atlanta Svdpatl on any device using the airSlate SignNow apps for Android or iOS, and simplify your document-oriented processes today.

How to modify and eSign Receipt Of In Kind Gift To Society Of St Vincent De Paul Atlanta Svdpatl with ease

- Obtain Receipt Of In Kind Gift To Society Of St Vincent De Paul Atlanta Svdpatl and click Get Form to begin.

- Utilize the tools available to complete your form.

- Mark important sections of your documents or redact sensitive information with specialized tools provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form retrieval, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from your chosen device. Modify and eSign Receipt Of In Kind Gift To Society Of St Vincent De Paul Atlanta Svdpatl and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the receipt of in kind gift to society of st vincent de paul atlanta svdpatl

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is a St Vincent De Paul tax receipt?

A St Vincent De Paul tax receipt is a document issued by the organization to acknowledge charitable donations. This receipt can be used for tax deduction purposes, allowing donors to claim contributions made to St Vincent De Paul during the tax year.

-

How can I obtain a St Vincent De Paul tax receipt?

To obtain a St Vincent De Paul tax receipt, you can request one at the time of your donation. If you have not received it, you can contact the organization directly or use their online platform to access past donation receipts.

-

Are St Vincent De Paul tax receipts available for all types of donations?

Yes, St Vincent De Paul tax receipts are typically available for various forms of donations, including cash, goods, and services. It's important to keep your donation records for accurate receipt issuance.

-

How can airSlate SignNow assist with managing St Vincent De Paul tax receipts?

airSlate SignNow can help you streamline the process of sending and signing St Vincent De Paul tax receipts electronically. This ensures that the receipt distribution is quick and efficient, benefiting both the organization and the donors.

-

What are the benefits of using airSlate SignNow for tax receipts?

Using airSlate SignNow for tax receipts offers ease of use, cost-effectiveness, and secure document management. With its user-friendly interface, you can easily create, send, and track St Vincent De Paul tax receipts for your donors.

-

Can airSlate SignNow integrate with existing donation platforms for tax receipts?

Yes, airSlate SignNow can integrate with various donation platforms to facilitate the management of St Vincent De Paul tax receipts. This integration streamlines data transfer and improves efficiency in handling donation records.

-

Is there a cost associated with using airSlate SignNow for sending tax receipts?

airSlate SignNow offers a variety of pricing plans, making it a cost-effective solution for sending St Vincent De Paul tax receipts. You can choose a plan that fits your organization’s needs and budget while enjoying the benefits of electronic signatures.

Get more for Receipt Of In Kind Gift To Society Of St Vincent De Paul Atlanta Svdpatl

Find out other Receipt Of In Kind Gift To Society Of St Vincent De Paul Atlanta Svdpatl

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure