Ir742 2018-2026

What is the IR742?

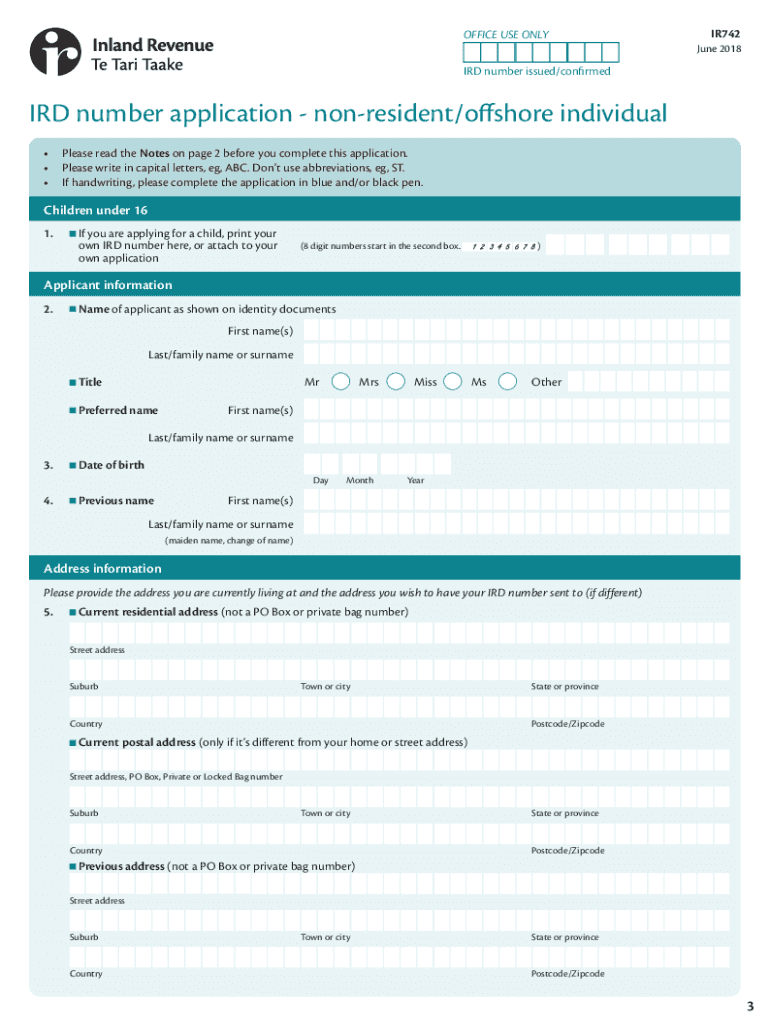

The IR742 form is an essential document used for the IRD number application for non-resident offshore individuals. This form is specifically designed for individuals who are not residents of New Zealand but require an IRD number for tax purposes. The IRD number is crucial for anyone engaging in business or financial activities in New Zealand, as it helps the tax authorities track income and ensure compliance with tax regulations.

How to Obtain the IR742

To obtain the IR742 form, individuals can visit the official website of the New Zealand Inland Revenue Department. The form is available for download in a PDF format, allowing users to fill it out digitally or print it for manual completion. It is important to ensure that all required information is accurately provided to avoid delays in processing.

Steps to Complete the IR742

Completing the IR742 form involves several key steps:

- Download the IR742 form from the Inland Revenue Department website.

- Fill in personal details, including full name, date of birth, and contact information.

- Provide details regarding your residency status and the reason for applying for an IRD number.

- Sign and date the form to validate your application.

- Submit the completed form either online or by mailing it to the designated address provided by the Inland Revenue Department.

Legal Use of the IR742

The IR742 form is legally recognized as a valid application for obtaining an IRD number. When completed correctly, it meets the requirements set forth by New Zealand tax law. It is essential for applicants to provide truthful and accurate information, as any discrepancies may lead to legal consequences or delays in processing.

Required Documents

When submitting the IR742 form, applicants must include specific supporting documents to verify their identity and residency status. These documents typically include:

- A valid passport or national identification card.

- Proof of address, such as a utility bill or bank statement.

- Any additional documentation requested by the Inland Revenue Department.

Form Submission Methods

The IR742 form can be submitted through various methods to accommodate different preferences:

- Online Submission: Fill out the form digitally and submit it through the Inland Revenue Department's secure online portal.

- Mail Submission: Print the completed form and send it to the designated address via postal service.

- In-Person Submission: Visit a local Inland Revenue office to submit the form directly.

Quick guide on how to complete ir742

Complete Ir742 effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as a stellar eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Engage with Ir742 on any device through airSlate SignNow Android or iOS applications and simplify any document-related processes today.

The simplest way to modify and electronically sign Ir742 without hassle

- Access Ir742 and click Get Form to commence.

- Leverage the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure confidential information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validation as a traditional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Choose your preferred method for submitting your form, via email, text message (SMS), or invitation link, or download it onto your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Edit and electronically sign Ir742 and ensure effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ir742

Create this form in 5 minutes!

How to create an eSignature for the ir742

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What are IRD forms IR742 and how do they work?

IRD forms IR742 are specific tax forms required in New Zealand for requesting a formal assessment of income. Utilizing airSlate SignNow can simplify the process of completing and submitting these forms electronically, ensuring accuracy and compliance. Our platform streamlines the electronic signing process, making it easy to manage IRD forms IR742 efficiently.

-

How can airSlate SignNow help with IRD forms IR742?

With airSlate SignNow, you can easily complete, sign, and send IRD forms IR742 from anywhere, at any time. The platform's user-friendly interface allows users to quickly fill out the necessary sections of the forms and securely eSign them. This not only saves time but also reduces the risk of errors in tax submissions.

-

Is there a cost associated with using airSlate SignNow for IRD forms IR742?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs when handling documents like IRD forms IR742. The cost varies based on the features and number of users, but we aim to provide a cost-effective solution for all users. You can choose a plan that fits your budget while still benefiting from our comprehensive eSigning features.

-

What features does airSlate SignNow offer for managing IRD forms IR742?

airSlate SignNow provides several features tailored for handling IRD forms IR742, including secure electronic signing, customizable templates, and real-time tracking of document status. Additionally, our platform allows for automated reminders and notifications to ensure that your forms are submitted on time. All these features make it easier to manage your tax obligations effectively.

-

Can I integrate airSlate SignNow with other applications for handling IRD forms IR742?

Yes, airSlate SignNow offers integrations with a variety of applications that can enhance your workflow for IRD forms IR742. You can connect with popular tools such as Google Drive, Dropbox, and other business applications. This interoperability allows for seamless document management and easy access to your forms and templates.

-

What benefits do businesses gain from using airSlate SignNow for IRD forms IR742?

Businesses benefit from using airSlate SignNow for IRD forms IR742 through increased efficiency, reduced paperwork, and enhanced compliance. By automating the signing process, companies can save time and focus on core activities, while ensuring all tax forms are completed accurately. This streamlined approach also helps mitigate risks associated with manual errors.

-

Is it secure to eSign IRD forms IR742 with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security by employing industry-standard encryption to protect all documents, including IRD forms IR742. Your data is safeguarded throughout the signing process, ensuring that sensitive tax information remains confidential. With our compliance to regulations, you can trust that your eSignatures are legally binding.

Get more for Ir742

- Notice to landlord improper rent increase form

- In the event you do not accept the increase be form

- I will be having the repairs made in the near form

- In response to the increased rent notice you served on me this notice is provided to you in form

- This letter is to inform you that you are in violation of the terms and conditions of our lease

- Re contracts ch 10 possession and temporary lease forms

- 14 printable letter to tenant for eviction forms and

- The specific deductions are itemized as follows form

Find out other Ir742

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe