Tax Return 2017-2026

What is the Tax Return

A tax return is a formal document that individuals and businesses, including those structured as a Shelby LLC, file with the Internal Revenue Service (IRS) to report income, expenses, and other tax-related information. This document is crucial for determining the amount of tax owed or the refund due. For Shelby LLCs, the tax return may differ based on how the entity is classified for tax purposes, such as a sole proprietorship, partnership, or corporation.

Steps to Complete the Tax Return

Completing a tax return involves several key steps:

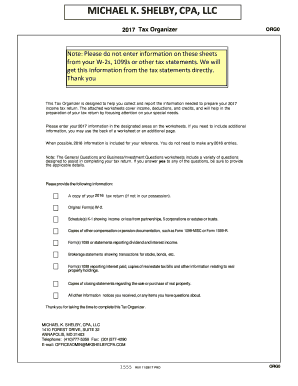

- Gather necessary documents, including W-2s, 1099s, and any relevant expense receipts.

- Select the appropriate tax form based on your business structure and income type.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Review the completed return for errors and ensure all calculations are correct.

- Sign and date the return before submission.

Legal Use of the Tax Return

The tax return serves as a legal document that must be filed in accordance with IRS regulations. For a Shelby LLC, it is important to understand that accurate reporting is essential to avoid penalties and ensure compliance with federal and state tax laws. The return must be submitted by the designated deadline to maintain its legal standing.

Filing Deadlines / Important Dates

Filing deadlines for tax returns can vary based on the type of entity and the tax year. Generally, individual tax returns are due on April fifteenth of each year. However, if a Shelby LLC operates on a fiscal year, the deadline may differ. It is crucial to stay informed about these dates to avoid late penalties.

Required Documents

To complete a tax return for a Shelby LLC, several documents are typically required:

- Income statements, such as W-2s and 1099s.

- Expense documentation, including receipts and invoices.

- Previous year's tax return for reference.

- Records of any estimated tax payments made throughout the year.

IRS Guidelines

The IRS provides comprehensive guidelines for completing tax returns. For a Shelby LLC, it is essential to follow these guidelines closely to ensure compliance. This includes understanding allowable deductions, credits, and the correct classification of income. Familiarizing oneself with IRS publications can provide valuable insights into the tax filing process.

Quick guide on how to complete tax return 2018

Complete Tax Return effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage Tax Return on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to edit and electronically sign Tax Return with ease

- Find Tax Return and then click Get Form to begin.

- Make use of the tools available to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Verify all the information and then click on the Done button to store your modifications.

- Choose how you wish to send your form, whether via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and electronically sign Tax Return and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax return 2018

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the pricing structure for airSlate SignNow for Shelby LLC?

airSlate SignNow offers flexible pricing plans designed to meet the needs of businesses like Shelby LLC. Whether you require basic eSigning functionalities or advanced features, you can choose a plan that aligns with your budget. Our competitive rates ensure that Shelby LLC can access premium services without overspending.

-

What features does airSlate SignNow provide for Shelby LLC users?

airSlate SignNow equips Shelby LLC with robust features such as document templating, in-person signing, and secure cloud storage. These tools help businesses streamline their document workflows and improve efficiency. Additionally, Shelby LLC can customize their experience to fit unique business needs.

-

How can airSlate SignNow benefit Shelby LLC in document management?

By utilizing airSlate SignNow, Shelby LLC can enhance document management through automated workflows and easy retrieval of signed documents. This efficiency reduces time spent on paperwork, allowing your team to focus on more critical tasks. Ultimately, airSlate SignNow simplifies the entire signing process for Shelby LLC.

-

Can Shelby LLC integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integration with a variety of software tools that Shelby LLC may already be using. This includes CRM systems, project management tools, and email platforms, among others. By integrating these systems, Shelby LLC can create a more cohesive workflow and improve overall productivity.

-

Is airSlate SignNow secure for Shelby LLC's sensitive documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to safeguard Shelby LLC's sensitive documents. With features like audit trails and user permissions, you can trust that your data remains protected during the signing process.

-

How user-friendly is the interface of airSlate SignNow for Shelby LLC staff?

The interface of airSlate SignNow is designed with user-friendliness in mind, making it easy for Shelby LLC staff to navigate and utilize its features effectively. Even those who may not be tech-savvy will find the platform intuitive. This ease of use facilitates quick onboarding and minimizes the learning curve for your team.

-

What kind of customer support does airSlate SignNow offer for Shelby LLC?

airSlate SignNow provides comprehensive customer support tailored to meet the needs of Shelby LLC. Our dedicated team is available through various channels, including email, chat, and phone, to assist with any inquiries or technical issues. We strive to ensure that you have a positive experience with our services at all times.

Get more for Tax Return

Find out other Tax Return

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy