Costco Tax Exempt 2006-2026

What is the Costco Tax Exempt

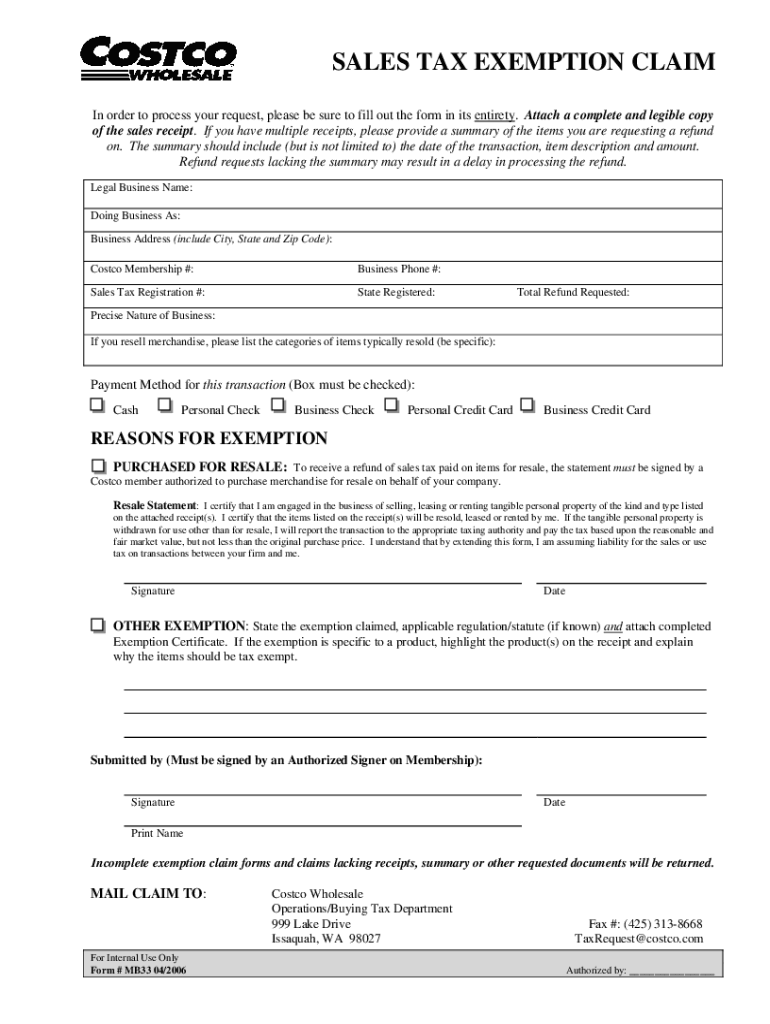

The Costco tax exempt form is a document that allows eligible organizations, such as nonprofits and government entities, to make tax-exempt purchases at Costco locations. This form is essential for businesses and organizations that qualify under state and federal tax regulations, enabling them to avoid paying sales tax on eligible items. The tax exemption applies to purchases made for official business purposes, ensuring that funds are used efficiently and effectively.

How to use the Costco Tax Exempt

Using the Costco tax exempt form involves presenting the completed document at the time of purchase. Once the form is filled out accurately, it should be submitted to the cashier or included with the payment method. It is crucial to ensure that the purchases align with the tax-exempt status, as personal items or non-qualifying purchases may still incur sales tax. Keeping a copy of the submitted form for your records is advisable in case of any inquiries.

Steps to complete the Costco Tax Exempt

To complete the Costco tax exempt form, follow these steps:

- Download the Costco tax exemption form from the official Costco website or obtain a physical copy at a Costco location.

- Fill in the required information, including the organization’s name, address, and tax identification number.

- Specify the purpose of the purchase and ensure that it aligns with tax-exempt criteria.

- Sign and date the form to validate it.

- Submit the completed form at the point of sale or include it with the payment method.

Eligibility Criteria

Eligibility for the Costco tax exempt status typically includes organizations that are recognized as tax-exempt under IRS regulations or state laws. Common qualifying entities include:

- Nonprofit organizations

- Government agencies

- Educational institutions

- Religious organizations

It is important to verify that your organization meets the specific criteria set by your state, as requirements may vary.

Required Documents

When applying for tax-exempt status at Costco, certain documents are typically required. These may include:

- A completed Costco tax exemption form

- A copy of the organization's IRS determination letter

- State-issued tax exemption certificate

- Identification of the individual making the purchase

Having these documents ready can streamline the process and ensure compliance with tax regulations.

Legal use of the Costco Tax Exempt

The legal use of the Costco tax exempt form is governed by state and federal laws regarding tax exemption. Organizations must ensure that purchases made with the tax-exempt form are strictly for official use. Misuse of the form, such as using it for personal purchases, can result in penalties, including fines or loss of tax-exempt status. It is essential to maintain accurate records of all tax-exempt purchases to support compliance with tax laws.

Quick guide on how to complete costco tax exempt

Effortlessly Prepare Costco Tax Exempt on Any Device

Managing documents online has gained traction among both businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed materials, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents swiftly, without any delays. Manage Costco Tax Exempt on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related task today.

The Easiest Way to Modify and eSign Costco Tax Exempt Effortlessly

- Locate Costco Tax Exempt and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive details using the tools that airSlate SignNow makes available specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your adjustments.

- Choose how you prefer to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Costco Tax Exempt and ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the costco tax exempt

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the process to become Costco tax exempt?

To become Costco tax exempt, businesses must provide a valid tax-exempt certificate to their local Costco store. It's important to ensure that the certificate is completely filled out and signed. Once your tax exempt status is verified, you can make tax-exempt purchases for your business needs.

-

How does airSlate SignNow support Costco tax exempt transactions?

airSlate SignNow allows businesses to easily eSign documents related to Costco tax exempt purchases. By using our platform, you can securely send and sign the required tax-exempt documentation without any hassle. This streamlines your purchasing process while ensuring compliance with tax regulations.

-

Are there any fees associated with Costco tax exempt purchases?

No, purchases made with Costco tax exempt status do not incur sales tax; however, there may be associated membership fees with Costco itself. It's crucial to review your membership plan to ensure you are maximizing your benefits. Using airSlate SignNow, the ease of managing tax-exempt documents can help minimize any hidden costs.

-

Can I use airSlate SignNow for recurring Costco tax exempt orders?

Yes, airSlate SignNow can manage recurring Costco tax exempt orders efficiently. You can create templates for your routine tax-exempt transactions, saving you time and ensuring consistency in documentation. This makes it simple to handle your ongoing business needs.

-

What features does airSlate SignNow offer for businesses seeking Costco tax exempt services?

airSlate SignNow offers a variety of features such as document templates, automated workflows, and secure cloud storage specifically designed to support businesses with their Costco tax exempt needs. Our platform ensures that all documents are legally binding and can be accessed anytime, anywhere. This enhances your business's efficiency and compliance.

-

How can I track my Costco tax exempt orders with airSlate SignNow?

With airSlate SignNow, you can track and manage your Costco tax exempt orders through our user-friendly dashboard. The platform allows you to see the status of your documents in real-time, ensuring that you remain informed throughout the signing process. This transparency helps you manage purchases effectively.

-

Does airSlate SignNow integrate with other business tools for Costco tax exempt purchasing?

Yes, airSlate SignNow seamlessly integrates with various business tools, enhancing your ability to manage Costco tax exempt purchases. Whether you use accounting software or CRM systems, our platform offers integrations that support your workflow. This allows for smooth record-keeping and financial management.

Get more for Costco Tax Exempt

- Gre vocab 2 flashcardsquizlet form

- Offer in compromiseinternal revenue service form

- I represent the heirs of name and in that regard i will be opening an estate on their behalf form

- In accordance with our telephone conversation today i am enclosing herewith a check in the form

- Enclosed is documentation which i will be filing to close the estate form

- In the matter of the estate of name cause no form

- Enclosed an original complaint to close estate which you will both need to execute before a form

- Enclosed please find a copy of the judgment closing estate which was entered with the form

Find out other Costco Tax Exempt

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter

- How To Sign Hawaii Military Leave Policy