Personal Umbrella Liability Insurance Application the 2017-2026

Understanding the Personal Umbrella Liability Insurance Application

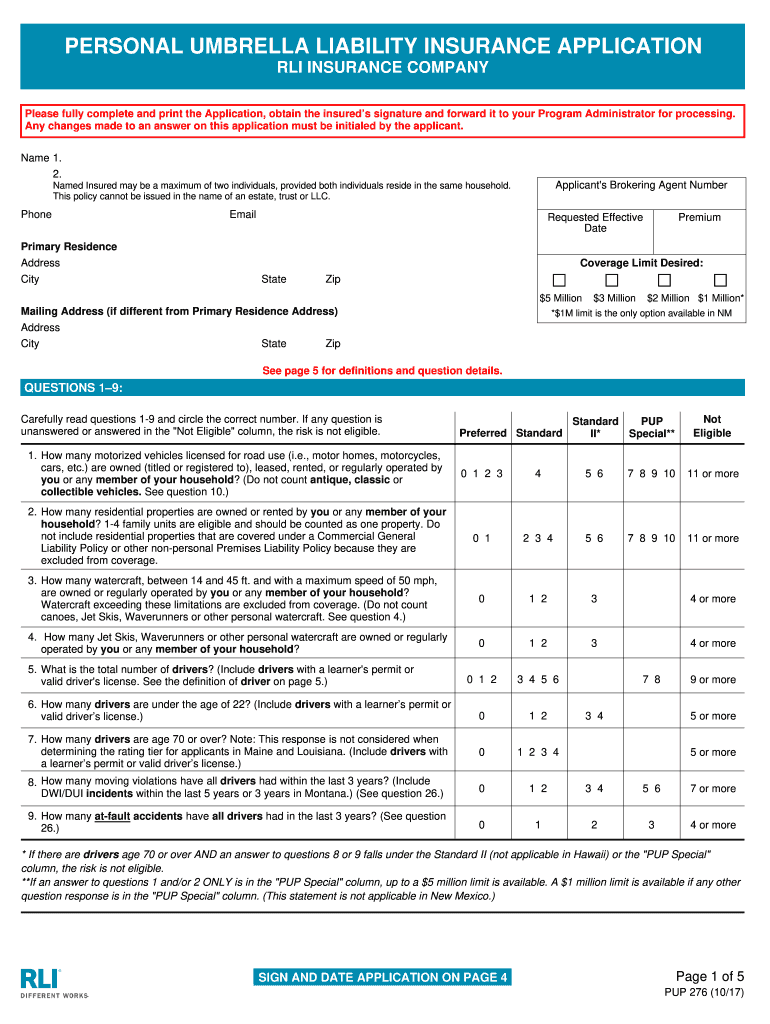

The personal umbrella liability insurance application is a crucial document for individuals seeking additional liability coverage beyond their standard home and auto insurance policies. This type of insurance provides an extra layer of protection against potential claims that could exceed the limits of your existing policies. By completing the application, you can secure coverage that helps safeguard your assets in the event of lawsuits, accidents, or other unforeseen incidents.

Steps to Complete the Personal Umbrella Liability Insurance Application

Completing the personal umbrella liability insurance application involves several key steps. First, gather all necessary information, including details about your current insurance policies, personal assets, and any prior claims. Next, accurately fill out the application form, ensuring that all information is complete and truthful. After submitting the application, the insurance provider may require additional documentation or clarification before processing your request. Finally, review the policy terms and conditions once approved, to ensure you fully understand your coverage.

Key Elements of the Personal Umbrella Liability Insurance Application

When filling out the personal umbrella liability insurance application, certain key elements must be included. These typically encompass personal information such as your name, address, and contact details, as well as information about your existing liability coverage limits. Additionally, you may need to disclose any high-value assets, such as properties or vehicles, and provide details about your lifestyle, including any activities that may increase your risk of liability claims. This information helps insurers assess your risk profile and determine appropriate coverage limits.

Legal Use of the Personal Umbrella Liability Insurance Application

The legal use of the personal umbrella liability insurance application is governed by various insurance regulations and guidelines. It is essential to ensure that the information provided is accurate and complies with state-specific insurance laws. Misrepresentation or omission of critical details can lead to denial of coverage or claims in the future. Understanding the legal implications of the application process can help you navigate the complexities of insurance compliance and secure the protection you need.

Eligibility Criteria for Personal Umbrella Liability Insurance

Eligibility for personal umbrella liability insurance typically depends on several factors, including your existing liability coverage limits, the types of assets you own, and your overall risk profile. Insurers often require applicants to have a minimum amount of underlying liability coverage on their home and auto insurance policies. Additionally, your claims history and lifestyle choices may influence your eligibility. Meeting these criteria is essential to obtaining the desired coverage.

How to Obtain the Personal Umbrella Liability Insurance Application

Obtaining the personal umbrella liability insurance application can be done through various channels. Most insurance providers offer the application directly on their websites, allowing you to download and complete it online. Alternatively, you can contact your insurance agent or broker to request the application. They can also provide guidance on the information needed and assist you throughout the application process, ensuring you submit a complete and accurate form.

Quick guide on how to complete personal umbrella liability insurance application the

Prepare Personal Umbrella Liability Insurance Application The effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without complications. Manage Personal Umbrella Liability Insurance Application The on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Personal Umbrella Liability Insurance Application The with ease

- Locate Personal Umbrella Liability Insurance Application The and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from whichever device you prefer. Edit and eSign Personal Umbrella Liability Insurance Application The and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct personal umbrella liability insurance application the

Create this form in 5 minutes!

How to create an eSignature for the personal umbrella liability insurance application the

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is RLI umbrella insurance?

RLI umbrella insurance is a type of personal liability coverage that provides extra protection beyond your existing policies. It helps safeguard your assets against large claims or lawsuits, making it essential for those wanting additional peace of mind. With RLI umbrella insurance, you can protect your financial future from unforeseen events.

-

What are the benefits of RLI umbrella insurance?

The benefits of RLI umbrella insurance include increased liability coverage, protection against signNow claims, and safeguarding your assets. This insurance offers broader coverage than typical home or auto policies, ensuring you're well-protected. It also typically has a low premium relative to the coverage amount provided, making it a cost-effective choice.

-

How much does RLI umbrella insurance cost?

The cost of RLI umbrella insurance can vary based on several factors, including your location, coverage limits, and risk profile. On average, premiums range from $150 to $300 per year for $1 million in coverage. Investing in RLI umbrella insurance is often viewed as a smart financial decision for homeowners and high-net-worth individuals.

-

How does RLI umbrella insurance differ from other types of insurance?

RLI umbrella insurance differs from other types of insurance by offering extra liability coverage that extends beyond your standard policies, such as home and auto. It is designed to kick in when your other policy limits are exhausted, providing an additional layer of protection. This makes it particularly valuable for those at higher risk of liability claims.

-

What types of incidents does RLI umbrella insurance cover?

RLI umbrella insurance covers a wide range of incidents, including bodily injury claims, property damage, and lawsuits resulting from personal actions. It also protects you against claims of defamation and invasion of privacy. Generally, if you are found liable for injuries or damages, RLI umbrella insurance can provide the necessary coverage.

-

Can RLI umbrella insurance be added to existing policies?

Yes, RLI umbrella insurance can often be added to your existing homeowner's or auto insurance policies. Many insurance providers offer discounts for bundling these policies together, making it even more cost-effective. This integration allows for seamless management of your insurance needs while enhancing your overall coverage.

-

Is RLI umbrella insurance worth it for renters?

Absolutely! Renters can also benefit from RLI umbrella insurance, which provides additional liability coverage that is not typically included in a renter's policy. It protects against unexpected events that could lead to costly claims, giving renters added peace of mind. Investing in RLI umbrella insurance can be a wise choice for anyone concerned about liability risks.

Get more for Personal Umbrella Liability Insurance Application The

- I am the petitioner co petitionerrespondent form

- Parenting time disputes form

- Of the petitioner co petitionerrespondent to enforce the parenting time order entered by form

- District court county colorado court address respondent form

- Justia consent for search pursuant to colorado form

- The petitioner and co petitionerrespondent stipulate and form

- Order re modificationrestriction of parenting time form

- Order re pleading affidavit for grandparent visitation justia form

Find out other Personal Umbrella Liability Insurance Application The

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word