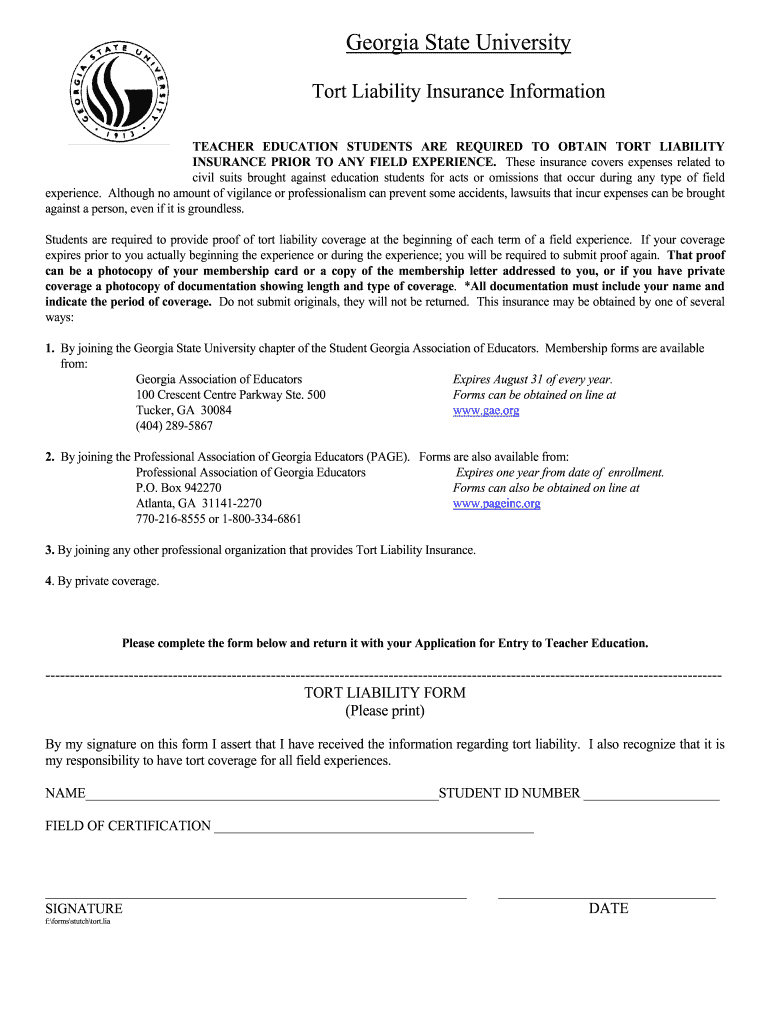

Tort Liability Insurance Gsu Form

What is the Tort Liability Insurance GSU

The Tort Liability Insurance GSU is a specific insurance policy designed to protect Georgia State University and its affiliates from legal claims arising from torts, which are wrongful acts leading to injury or damage. This insurance covers various liabilities that may occur during university operations, including incidents involving students, faculty, staff, and visitors. It ensures that the university can manage financial risks associated with potential lawsuits, safeguarding its resources and reputation.

How to use the Tort Liability Insurance GSU

Utilizing the Tort Liability Insurance GSU involves understanding its coverage and limitations. When an incident occurs that may lead to a claim, it is essential to report the event to the university's risk management office promptly. This office will guide you through the claims process, ensuring that all necessary documentation is collected. Proper use of this insurance can help mitigate the financial impact of legal claims against the university.

Steps to complete the Tort Liability Insurance GSU

Completing the Tort Liability Insurance GSU form requires several key steps:

- Gather necessary information, including details of the incident and involved parties.

- Fill out the tort liability insurance form accurately, ensuring all sections are completed.

- Submit the form to the appropriate university department, typically the risk management office.

- Keep a copy of the submitted form for your records.

Following these steps helps ensure that your submission is processed efficiently and that you receive the coverage needed.

Key elements of the Tort Liability Insurance GSU

The key elements of the Tort Liability Insurance GSU include coverage for bodily injury, property damage, and personal injury claims. It also outlines the conditions under which claims can be made, such as the requirement for timely reporting of incidents. Additionally, the policy details any exclusions or limitations, which are crucial for understanding what is not covered. Familiarizing yourself with these elements is essential for effective risk management.

Required Documents

To complete the Tort Liability Insurance GSU form, certain documents are typically required:

- Incident report detailing the circumstances of the claim.

- Contact information for all parties involved.

- Any relevant photographs or evidence supporting the claim.

- Documentation of any medical treatment or repairs needed as a result of the incident.

Having these documents ready can streamline the claims process and ensure that all necessary information is submitted.

Legal use of the Tort Liability Insurance GSU

The legal use of the Tort Liability Insurance GSU is governed by state laws and university policies. It is essential to ensure that all claims are made in accordance with these regulations to maintain the validity of the insurance coverage. This includes adhering to deadlines for reporting incidents and submitting claims. Understanding the legal framework surrounding this insurance helps protect both the university and individuals involved in potential claims.

Quick guide on how to complete tort liability insurance gsu

Easily prepare Tort Liability Insurance Gsu on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly and efficiently. Manage Tort Liability Insurance Gsu on any operating system with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and electronically sign Tort Liability Insurance Gsu effortlessly

- Find Tort Liability Insurance Gsu and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive details with the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information thoroughly and then click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting form searches, and mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Tort Liability Insurance Gsu to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tort liability insurance gsu

The best way to make an eSignature for your PDF file in the online mode

The best way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is tort liability insurance gsu?

Tort liability insurance gsu is designed to provide coverage for businesses against claims resulting from negligent actions that cause injury or damage. This type of insurance can protect your assets and ensure financial stability should legal claims arise. Understanding tort liability insurance gsu is crucial for risk management in any organization.

-

How can tort liability insurance gsu benefit my business?

Tort liability insurance gsu offers essential protection by covering legal costs and settlements related to tort claims. This coverage can help safeguard your business's finances, giving you peace of mind to focus on growth. Moreover, it reinforces consumer confidence in your business when they know you are properly insured.

-

What factors influence the pricing of tort liability insurance gsu?

The pricing of tort liability insurance gsu is influenced by various factors, including the size of your business, industry risk level, and claims history. Insurance providers will assess these factors to determine the premium you will pay. It's important to shop around and compare quotes to find affordable coverage that meets your needs.

-

Does airSlate SignNow integrate with tort liability insurance gsu providers?

Yes, airSlate SignNow can integrate with various tort liability insurance gsu providers to streamline your documentation process. This integration allows for seamless management of insurance contracts and claims directly through our platform. You can easily send and eSign important insurance documents without hassle.

-

What features should I look for in a tort liability insurance gsu policy?

When selecting a tort liability insurance gsu policy, it's crucial to look for features such as comprehensive coverage limits, protection against various claim types, and the ability to add endorsements. Additionally, consider the responsiveness of the insurer in case you need to file a claim, as this can greatly impact your experience. Choosing the right features can enhance your overall protection.

-

How does tort liability insurance gsu differ from other types of insurance?

Tort liability insurance gsu specifically protects against claims arising from negligent acts, while other insurance types may cover different areas, such as property damage or employee injuries. It is crucial to understand these differences to select the right coverage for your business needs. Properly integrating tort liability insurance gsu can complement existing policies and provide overall risk coverage.

-

Can I customize my tort liability insurance gsu coverage?

Yes, many providers allow for customization of tort liability insurance gsu coverage to fit the specific needs of your business. This may include adding additional coverage limits, optional endorsements, or tailored risk management services. Customization ensures you receive the most appropriate protection based on your unique operational risks.

Get more for Tort Liability Insurance Gsu

- Commonwealth of massachusetts boston housing form

- If unemployed form

- Form 21 sample execution masslegalhelp

- Fill free fillable ma sunset clause pdf form

- Commonwealth of massachusetts ss housing court department form

- Housing court finding and order for approval of attachment form

- To the sheriffs of our several counties or their deputies form

- Release and satisfaction of judgment form first boston software

Find out other Tort Liability Insurance Gsu

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile