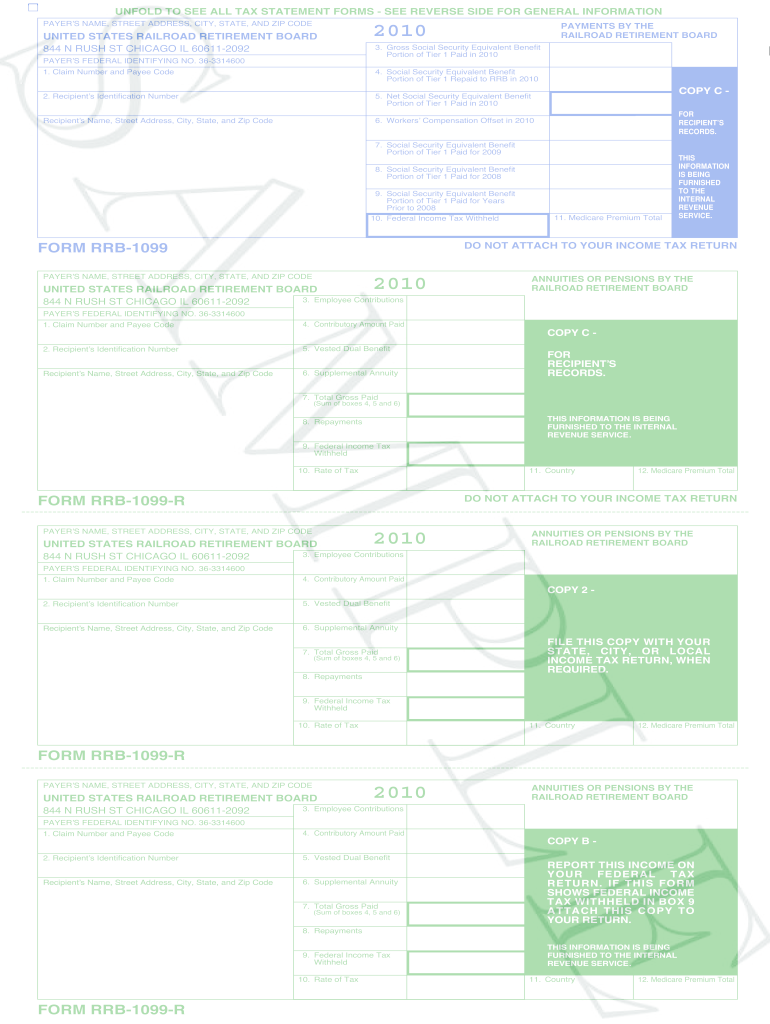

Form Rrb 1099 R Images

What is the Form RRB 1099?

The RRB 1099 form, officially known as the "Statement of Annuity Paid," is a tax document issued by the Railroad Retirement Board (RRB) to report annuity payments made to individuals. This form is essential for recipients of railroad retirement benefits, as it provides the necessary information for reporting income on federal tax returns. The RRB 1099 includes details such as the total amount of annuity received, any taxable amounts, and the recipient's identifying information. Understanding this form is crucial for accurate tax filing and compliance with IRS regulations.

Steps to Complete the Form RRB 1099

Completing the RRB 1099 form involves several key steps to ensure accuracy and compliance. First, gather all relevant information, including your Social Security number and details of your annuity payments. Next, carefully fill out the form, ensuring that all amounts are reported correctly. Pay special attention to the taxable amount, as this will affect your overall tax liability. After completing the form, review it for any errors or omissions before submitting it to the IRS. Keeping a copy for your records is also advisable for future reference.

Who Issues the Form RRB 1099?

The Railroad Retirement Board (RRB) is responsible for issuing the RRB 1099 form. This federal agency administers retirement and disability benefits for railroad workers and their families. Each year, the RRB sends out this form to eligible recipients who have received annuity payments during the tax year. It is important for recipients to ensure that their personal information is up-to-date with the RRB to receive the correct form in a timely manner.

IRS Guidelines for the Form RRB 1099

The IRS has specific guidelines regarding the use of the RRB 1099 form for tax reporting purposes. Recipients must include the information from this form when filing their federal income tax returns. The IRS requires that all income, including annuity payments reported on the RRB 1099, be accurately reported to ensure compliance with tax laws. Failure to report this income can result in penalties or audits, making it essential for recipients to understand their obligations regarding this form.

Filing Deadlines for the Form RRB 1099

Filing deadlines for the RRB 1099 form align with standard tax filing dates in the United States. Typically, recipients must report their annuity income by April fifteenth of the following tax year. However, if April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for recipients to be aware of these deadlines to avoid late filing penalties and ensure timely processing of their tax returns.

Legal Use of the Form RRB 1099

The RRB 1099 form serves as a legal document for reporting income received from annuity payments. It is recognized by the IRS as an official statement of income, and its accuracy is vital for compliance with tax regulations. Recipients must use this form to report their annuity income on their federal tax returns, and any discrepancies can lead to legal implications, including audits or penalties. Understanding the legal significance of the RRB 1099 is essential for all recipients to maintain compliance with tax laws.

Quick guide on how to complete sample tax form rrb 1099 rrb

Effortlessly Prepare Form Rrb 1099 R Images on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow provides all the necessary tools for you to create, edit, and electronically sign your documents swiftly without delays. Manage Form Rrb 1099 R Images on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Form Rrb 1099 R Images with Ease

- Find Form Rrb 1099 R Images and click Get Form to begin.

- Utilize the tools available to complete your form.

- Mark important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes just a few seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form Rrb 1099 R Images while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How many candidates applied for IBPS RRB 2018?

Fill rti you will come to know.

-

What is the last date to fill out the form of a technician post RRB?

Railway Recruitment Board invites online applications for the technical posts in Indian Railway.The Board has announced the notification for ALP & Technician posts.This notification has been released on 3 November 2018.Candidates can check the complete information for this notification from here – RRB ALP 2018.The last date to complete your registration is 31 March 2018.There are 26502 posts for RRB ALP & Technicians.So hurry up and fill the registration form.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Can I fill an RRB JE form from two different zones by filling out two forms?

No, submission of multiple numbers of forms can get your candidature rejected Therefore go through the vacancy table properly and based on your comfort zone select the region and apply.You can get complete details of RRB JE Recruitment 2018-19 Application Form: Apply Online for Railway Junior Engineer 13,487 VacancyMake sure that you check all the regions previous cut off and other details. On the basis of that, follow the instructions are fill in the application form.Kindly Note that the last date to submit the application form is 31st January 2019All The Best!

-

Can I fill out the IBPS RRB Scale 1 form twice due to a mistake the first time?

Today I've done a mistake. Uploaded Right Thumb Impression instead of left.Everybody said that this is a very little mistake but I'm considering it a huge one and I'll fill my form again tomorrow.What you need is:new Email ID.A phone number that you have not used in previous registrations.You'll have to pay the fee again (I hope you know this already).So, YES! Go for it.NOTE: I’M TALKING ABOUT IBPS BANK FORM, IN BANKS YOU REQUIRE NEW EMAIL ID TO FILL ANOTHER FORM IF YOU MADE A MISTAKE IN YOUR PREVIOUS FORM. HOWEVER, IN RRB YOU MAY NOT NEED TO HAVE ANOTHER EMAIL ID BUT HAVING IT IS ALWAYS BETTER THAN TO NOT HAVE IT BECAUSE HAVING A NEW EMAIL ID IS UNIVERSAL CORRECTION PROCEDURE.

Create this form in 5 minutes!

How to create an eSignature for the sample tax form rrb 1099 rrb

How to make an electronic signature for your Sample Tax Form Rrb 1099 Rrb online

How to generate an electronic signature for the Sample Tax Form Rrb 1099 Rrb in Chrome

How to make an eSignature for signing the Sample Tax Form Rrb 1099 Rrb in Gmail

How to generate an eSignature for the Sample Tax Form Rrb 1099 Rrb right from your smartphone

How to create an electronic signature for the Sample Tax Form Rrb 1099 Rrb on iOS

How to make an eSignature for the Sample Tax Form Rrb 1099 Rrb on Android devices

People also ask

-

What is a form RRB 1099 sample?

A form RRB 1099 sample is a tax document issued by the Railroad Retirement Board to report retirement benefits. It provides key information for recipients to complete their tax returns accurately. Understanding the structure of a form RRB 1099 sample is crucial for effective tax filing.

-

How can airSlate SignNow help with form RRB 1099 samples?

airSlate SignNow streamlines the process of sending and signing documents, including form RRB 1099 samples. Our platform allows you to easily eSign and manage the workflow for these important tax documents. By using airSlate SignNow, you can ensure that your form RRB 1099 samples are handled efficiently and securely.

-

What features does airSlate SignNow offer for managing form RRB 1099 samples?

airSlate SignNow offers features like customizable templates, real-time tracking, and secure eSigning for form RRB 1099 samples. With our intuitive interface, users can quickly create, send, and receive completed documents. These features enhance the overall efficiency when dealing with important tax documentation.

-

Is there a cost associated with using airSlate SignNow for form RRB 1099 samples?

Yes, there are costs associated with using airSlate SignNow, but our pricing plans are designed to be cost-effective for businesses of all sizes. By investing in our services, you get access to invaluable features that simplify the management of form RRB 1099 samples. The savings in time and improved efficiency can far outweigh the subscription cost.

-

Can I integrate airSlate SignNow with other applications for handling form RRB 1099 samples?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, making it easier to manage form RRB 1099 samples within your existing workflows. Whether you use CRM systems, cloud storage, or other document management tools, airSlate SignNow can enhance your document handling processes.

-

What are the benefits of using airSlate SignNow for my form RRB 1099 samples?

Using airSlate SignNow for your form RRB 1099 samples offers numerous benefits, including improved efficiency, time savings, and enhanced security. The platform allows you to keep all documents organized and provides an easy way to track signatures. This helps ensure that your tax documents are filed correctly and on time.

-

How secure is the transmission of form RRB 1099 samples with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption technologies to ensure that the transmission of form RRB 1099 samples is secure and protected from unauthorized access. You can trust that your sensitive information remains confidential while using our platform.

Get more for Form Rrb 1099 R Images

- Mass residential lease agreement pdf form

- Declaration of homestead norfolk county ma norfolkdeeds form

- 27 printable rental inspection checklist forms and templates

- Fillable online mbhp hcvp family certification form mtw

- Hcvp family certification form mtw mbhp

- Blumberg form a55

- Generic condo rental agreement 1996 form

- Nycha lease renewal form

Find out other Form Rrb 1099 R Images

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document