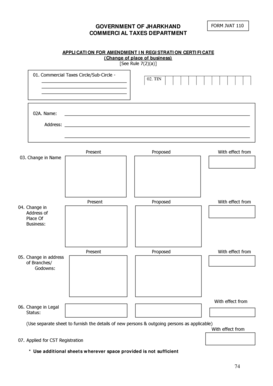

GOVERNMENT of JHARKHAND COMMERCIAL TAXES DEPARTMENT FORM JVAT 110 APPLICATION for AMENDMENT in REGISTRATION CERTIFICATE Change O

Understanding the IGL Partner Change PDF Format

The IGL Partner Change PDF format is a specific document used for amending partnership details within the framework of business operations. This form is essential for ensuring that all changes in partnership status, such as the addition or removal of partners, are formally recognized. Proper completion of this document is crucial for maintaining compliance with legal and tax obligations.

Steps to Complete the IGL Partner Change PDF Format

Completing the IGL Partner Change PDF format involves several key steps:

- Gather necessary information about the partnership, including names, addresses, and identification numbers of all partners.

- Clearly indicate the changes being made, specifying which partners are being added or removed.

- Ensure all current partners review and sign the document to validate the changes.

- Submit the completed form to the appropriate authority, following any specific submission guidelines.

Legal Use of the IGL Partner Change PDF Format

The IGL Partner Change PDF format serves a legal purpose by documenting changes in partnership agreements. This documentation is critical for tax reporting and legal accountability. It is necessary to ensure that all changes comply with local and federal regulations to avoid potential disputes or penalties.

Required Documents for the IGL Partner Change PDF Format

When preparing to submit the IGL Partner Change PDF format, certain documents may be required:

- Current partnership agreement.

- Identification documents for all partners involved.

- Any previous amendments or changes to the partnership.

Form Submission Methods for the IGL Partner Change PDF Format

The IGL Partner Change PDF format can typically be submitted through various methods, including:

- Online submission via a designated portal.

- Mailing the completed form to the relevant authority.

- In-person submission at local business offices.

Penalties for Non-Compliance with the IGL Partner Change PDF Format

Failure to properly complete and submit the IGL Partner Change PDF format can result in several penalties, including:

- Fines imposed by regulatory authorities.

- Inability to enforce partnership agreements legally.

- Potential tax liabilities for unreported changes.

Quick guide on how to complete government of jharkhand commercial taxes department form jvat 110 application for amendment in registration certificate change

Complete GOVERNMENT OF JHARKHAND COMMERCIAL TAXES DEPARTMENT FORM JVAT 110 APPLICATION FOR AMENDMENT IN REGISTRATION CERTIFICATE Change O effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly without delays. Manage GOVERNMENT OF JHARKHAND COMMERCIAL TAXES DEPARTMENT FORM JVAT 110 APPLICATION FOR AMENDMENT IN REGISTRATION CERTIFICATE Change O on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to edit and eSign GOVERNMENT OF JHARKHAND COMMERCIAL TAXES DEPARTMENT FORM JVAT 110 APPLICATION FOR AMENDMENT IN REGISTRATION CERTIFICATE Change O without hassle

- Locate GOVERNMENT OF JHARKHAND COMMERCIAL TAXES DEPARTMENT FORM JVAT 110 APPLICATION FOR AMENDMENT IN REGISTRATION CERTIFICATE Change O and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for sending your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign GOVERNMENT OF JHARKHAND COMMERCIAL TAXES DEPARTMENT FORM JVAT 110 APPLICATION FOR AMENDMENT IN REGISTRATION CERTIFICATE Change O and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the government of jharkhand commercial taxes department form jvat 110 application for amendment in registration certificate change

How to generate an eSignature for a PDF online

How to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is the igl parter change pdf format and why is it important?

The igl parter change pdf format is crucial for businesses that need secure and compliant document management. It allows users to easily convert and modify documents while retaining their integrity. This format also ensures that all changes are tracked, making it perfect for collaboration.

-

How does airSlate SignNow facilitate converting to the igl parter change pdf format?

With airSlate SignNow, users can effortlessly convert their documents to the igl parter change pdf format. The platform offers intuitive tools that allow you to upload and transform any document with just a few clicks. This efficiency helps streamline workflows and enhances productivity.

-

Is there a cost associated with using airSlate SignNow for igl parter change pdf format?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs when utilizing the igl parter change pdf format. Our plans are cost-effective, providing value for features like eSigning and document management. Additionally, you can choose a plan that best suits your budget and requirements.

-

Can I integrate airSlate SignNow with other tools while using the igl parter change pdf format?

Absolutely! airSlate SignNow seamlessly integrates with various business applications, enhancing the workflow of documents in the igl parter change pdf format. Whether you use CRM systems, cloud storage, or productivity tools, integration is simple and increases overall efficiency.

-

What are the benefits of using airSlate SignNow with the igl parter change pdf format?

Using airSlate SignNow with the igl parter change pdf format offers several benefits, including enhanced document security, easy tracking of changes, and improved collaboration. It allows businesses to manage their documents more effectively and reduces the risk of errors. This leads to quicker decision-making and smoother operational processes.

-

Is it easy to eSign documents in the igl parter change pdf format using airSlate SignNow?

Yes, eSigning documents in the igl parter change pdf format using airSlate SignNow is incredibly user-friendly. The platform allows you to sign documents digitally in just a few steps. This ease of use ensures that your document processes are quick and efficient, saving you valuable time.

-

What types of documents can I convert to the igl parter change pdf format?

You can convert a variety of document types to the igl parter change pdf format using airSlate SignNow, including Word documents, Excel spreadsheets, and presentations. This flexibility means you can manage all your important files in a consistent format. It ensures that your documents remain professional and easy to share.

Get more for GOVERNMENT OF JHARKHAND COMMERCIAL TAXES DEPARTMENT FORM JVAT 110 APPLICATION FOR AMENDMENT IN REGISTRATION CERTIFICATE Change O

Find out other GOVERNMENT OF JHARKHAND COMMERCIAL TAXES DEPARTMENT FORM JVAT 110 APPLICATION FOR AMENDMENT IN REGISTRATION CERTIFICATE Change O

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast