Notification Suspected Form

What is the notification suspected?

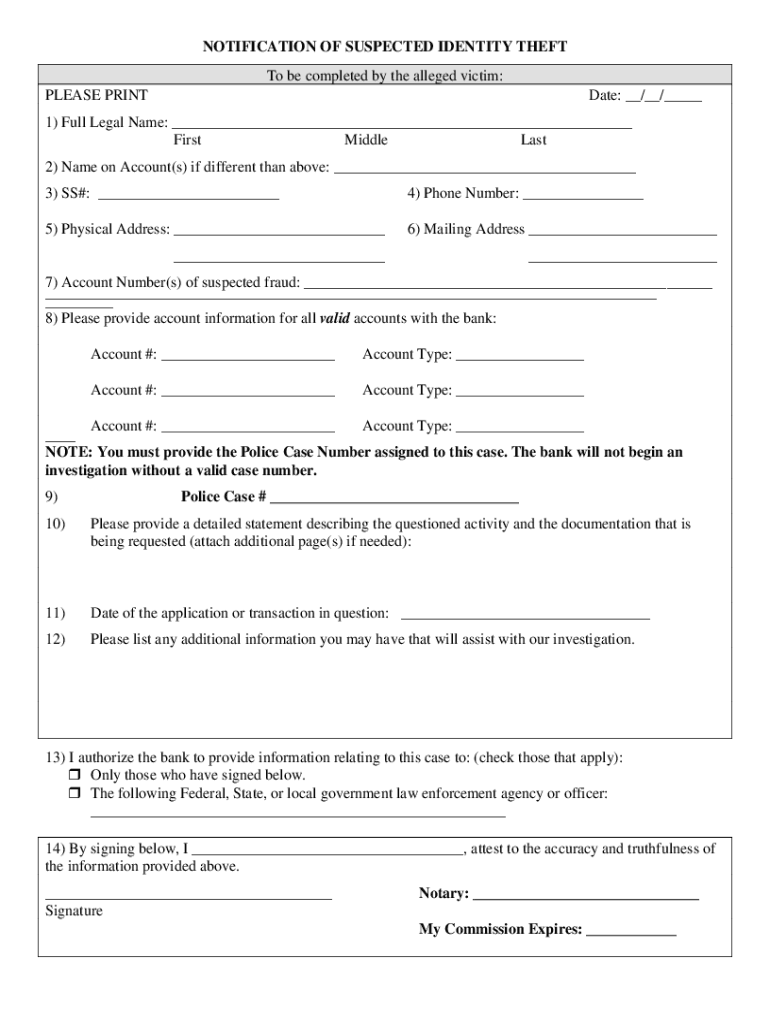

The notification suspected refers to a formal document used to report potential identity theft to relevant authorities, particularly the IRS. This form is essential for individuals who believe their personal information has been compromised and is being used fraudulently. By submitting this notification, taxpayers can initiate the process of protecting their identity and rectifying any fraudulent activities linked to their name or Social Security number.

How to use the notification suspected

To effectively utilize the notification suspected, individuals should first gather all pertinent information regarding the suspected identity theft. This includes any suspicious transactions, communications, or changes in their financial accounts. Once the information is compiled, the individual can fill out the notification form, ensuring all details are accurate and comprehensive. After completing the form, it should be submitted to the IRS or the appropriate state authority, depending on the nature of the suspected identity theft.

Steps to complete the notification suspected

Completing the notification suspected involves several key steps:

- Gather necessary documentation, including personal identification and evidence of identity theft.

- Fill out the notification suspected form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or via mail to the appropriate agency.

- Keep a copy of the submitted form and any correspondence for your records.

Legal use of the notification suspected

The legal use of the notification suspected is grounded in the need to protect individuals from identity theft. By filing this form, taxpayers can formally notify the IRS of potential fraudulent activities, which is crucial for legal protection. The submission of this notification can help establish a timeline of events and provide evidence if further legal action is necessary. Compliance with legal requirements surrounding identity theft reporting is essential for safeguarding one's rights.

IRS guidelines

The IRS provides specific guidelines regarding the notification suspected. Taxpayers should ensure they are using the most current version of the form and adhere to all instructions outlined by the IRS. This includes understanding the timelines for reporting suspected identity theft and the necessary documentation required for a complete submission. Familiarity with these guidelines can streamline the process and enhance the effectiveness of the notification.

Required documents

When completing the notification suspected, several documents may be required to support the claim. These can include:

- A copy of the taxpayer's identification, such as a driver's license or Social Security card.

- Evidence of identity theft, which may include bank statements, credit reports, or correspondence from creditors.

- Any police reports filed regarding the identity theft.

Providing these documents can help substantiate the claim and facilitate a more efficient resolution.

Form submission methods

The notification suspected can be submitted through various methods, depending on the preferences of the individual and the requirements of the IRS. Common submission methods include:

- Online submission through the IRS website, if applicable.

- Mailing the completed form to the designated IRS address.

- In-person submission at local IRS offices, where available.

Choosing the right submission method can impact the processing time and the overall experience of reporting identity theft.

Quick guide on how to complete notification suspected

Seamlessly complete Notification Suspected on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Handle Notification Suspected on any platform with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to modify and eSign Notification Suspected with ease

- Find Notification Suspected and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive data using tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to finalize your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign Notification Suspected and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the notification suspected

How to create an eSignature for your PDF document online

How to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What does 'notification suspected' mean in the context of airSlate SignNow?

In the context of airSlate SignNow, 'notification suspected' refers to alerts related to the status of your documents during the eSigning process. This indicates that there may be issues with receiving or processing notifications about document actions. Understanding this can help users ensure timely completions of their signing processes.

-

How does airSlate SignNow handle notifications if a notification is suspected?

If a notification is suspected in airSlate SignNow, our platform automatically generates alerts that inform users about potential issues. This proactive approach helps ensure that users can quickly address any inconsistencies and keep their document workflows moving smoothly, maintaining overall efficiency.

-

Are there any additional costs associated with notifications suspected in airSlate SignNow?

No, there are no additional costs for handling 'notification suspected' alerts within airSlate SignNow. Our eSigning solution is designed to provide comprehensive functionalities without hidden fees, allowing businesses to focus on their signing processes without concern for extra charges related to notifications.

-

What features help in reducing instances of notification suspected?

airSlate SignNow offers robust tracking features that minimize the chances of 'notification suspected' issues. Automated reminders, document status updates, and real-time notifications ensure that all parties stay informed throughout the signing process, reducing confusion and enhancing user experience.

-

Can I integrate airSlate SignNow with other platforms to manage notifications better?

Yes, airSlate SignNow seamlessly integrates with various platforms, allowing users to enhance their document management processes. By using these integrations, you can streamline notifications and minimize the occurrence of 'notification suspected' alerts, making your eSigning experience more efficient.

-

What benefits does airSlate SignNow offer regarding eSigning notifications?

airSlate SignNow provides signNow benefits related to eSigning notifications, including real-time updates and comprehensive tracking. By ensuring proper communication and alerting users when a 'notification suspected' situation arises, it helps maintain transparency and trust throughout document transactions.

-

How can I troubleshoot if I receive a notification suspected error?

If you encounter a 'notification suspected' error, start by checking your internet connection and the recipient details in your airSlate SignNow account. Additionally, verifying the document's status and ensuring that all email addresses are entered correctly can help resolve the issue swiftly. Our support team is also available to assist with any persistent concerns.

Get more for Notification Suspected

- Employment agreement form 481378257

- Not compete contract form

- Easements real estate form

- Release of judgment lien full release form

- Partial release of judgment lien form

- Transfer stock form

- Utah statutory declaration for mental health treatment form

- Utah special or limited power of attorney for real estate sales transaction by seller 481378289 form

Find out other Notification Suspected

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy